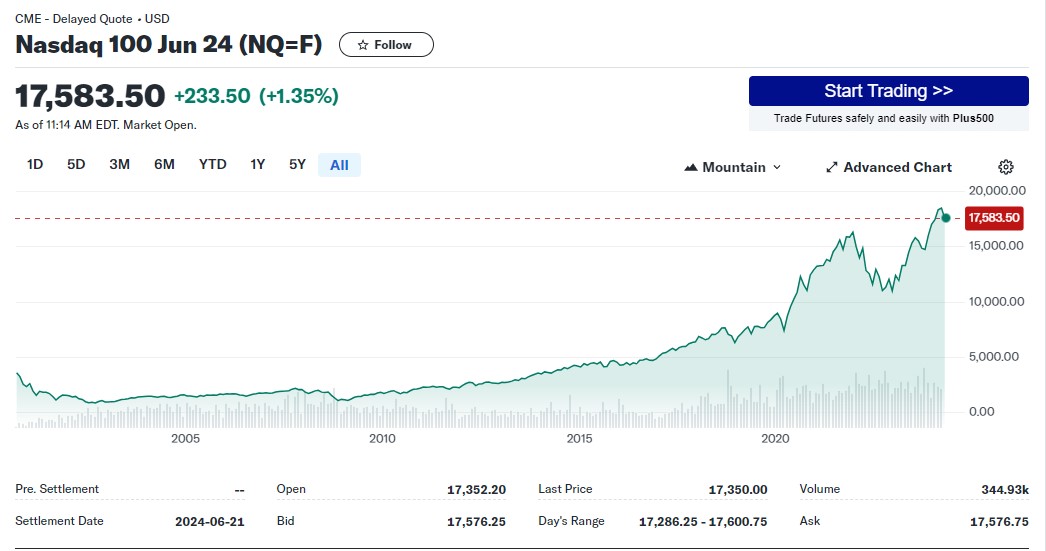

The Nasdaq-100® has performed well in recent days, reaching a new all-time high last month. While the economy is not signaling a slowdown anytime soon, interest rates appear to be higher for longer as the latest CPI data indicates that consumer inflation is stickier than the Federal Reserve anticipated, forestalling the prospect of any rate cuts in the near term.

Yahoo!Finance as of April 23, 2024

In markets like these, investors need to think differently about their equity exposure. They need to ask how they can remain in the market while mitigating risk. Calamos offers a strategy that provides uncapped upside to the largest and most recognized Nasdaq companies while also providing the income and diversification potential of bonds.

Blended Exposure for Nasdaq

The Calamos Alternative Nasdaq & Bond ETF (CANQ) is actively managed and aims to invest in both equity and fixed income securities. For equity exposure, the fund utilizes both LEAPS® and FLEX® Options to gain access to Nasdaq-100 performers.

To diversify investment and provide risk mitigation and monthly income, CANQ blends equity investment with fixed income assets. For bond exposure, CANQ primarily seeks investment in bonds and fixed income ETFs. The fund’s hybrid approach leverages robust Nasdaq-100 exposure with the versatility of bonds. This combination could prove effective, heading into potential interest rate cuts this year.

Throughout the year, bonds have remained a valuable option for investors and traders to capture value. The asset class historically performed well amid interest rate cuts, helping to mitigate investor risk.

Launching on February 13, 2024, CANQ’s unique strategy is already showing positive signs of results. The fund has seen returns of roughly 1.2% with a distribution yield of 4.90% as of March 31, 2024, based on the current market price. This one-two punch combination of uncapped market potential and monthly distributed income makes CANQ a unique Nasdaq equity exposure.

For more news, information, and analysis, visit the Alternatives Channel.

Disclosure Information

Before investing, carefully consider the fund’s investment objectives, risks, charges and expenses. Please see the prospectus and summary prospectus containing this and other information which can be obtained by calling 1-866-363-9219. Read it carefully before investing.

An investment in the Fund(s) is subject to risks, and you could lose money on your investment in the Fund(s). There can be no assurance that the Fund(s) will achieve its investment objective. Your investment in the Fund(s) is not a deposit in a bank. There is no assurance or guarantee by the Federal Deposit Insurance Corporation (FDIC) or any other government agency. The risks associated with an investment in the Fund(s) can increase during times of significant market volatility. The Fund(s) also has specific principal risks, which are described below. More detailed information regarding these risks can be found in the Fund’s prospectus.

Risks of investing in the Calamos Alternative Nasdaq & Bond ETF include risks associated with:

Authorized Participant Concentration Risk — Only an Authorized Participant may engage in creation or redemption transactions directly with the Fund, and there is no obligation for those Authorized Participants to engage in creation and/or redemption transactions.

Debt Securities Risk — Debt securities are subject to various risks, including interest rate risk, credit risk and default risk.

Equity Securities Risk — The securities markets are volatile, and the market prices of the Fund’s securities may decline generally.

FLEX Options Risk — The Fund may invest in FLEX Options issued and guaranteed for settlement by The Options Clearing Corporation (“OCC”). FLEX Options are customized option contracts that trade on an exchange but provide investors with the ability to customize key contract terms like strike price, style and expiration date while achieving price discovery in competitive, transparent auctions markets and avoiding the counterparty exposure of over-the-counter options positions.

High Yield Risk — High yield securities and unrated securities of similar credit quality (commonly known as “junk bonds”) are subject to greater levels of credit and liquidity risks.

LEAPS Options Risk — The Fund’s investments in options contracts may include long-term equity anticipation securities known as LEAPS Options. LEAPS Options are long-term exchange-traded call options that allow holders the opportunity to participate in the underlying securities’ appreciation in excess of a specified strike price without receiving payments equivalent to any cash dividends declared on the underlying securities.

Liquidity Risk – FLEX Options — In the event that trading in the underlying FLEX Options is limited or absent, the value of the Fund’s FLEX Options may decrease.

Liquidity Risk – LEAPS Options — In the event that trading in the underlying LEAPS Options is limited or absent, the value of the Fund’s LEAPS Options may decrease.

Market Maker Risk — If the Fund has lower average daily trading volumes, it may rely on a small number of third-party market makers to provide a market for the purchase and sale of Fund Shares.

Market Risk—The risk that the securities markets will increase or decrease in value is considered market risk and applies to any security.

New Fund Risk — The Fund is a recently organized investment company with a limited operating history.

Non-Diversification Risk — The Fund is classified as “non-diversified” under the 1940 Act.

Options Risk—The Fund’s ability to close out its position as a purchaser or seller of an over-the-counter or exchange-listed put or call option is dependent, in part, upon the liquidity of the option market.

Other Investment Companies (including ETFs) Risk — The Fund may invest in the securities of other investment companies to the extent that such investments are consistent with the Fund’s investment objective and the policies are permissible under the 1940 Act.

Nasdaq® and Nasdaq-100, are registered trademarks of Nasdaq, Inc. (which with its affiliates is referred to as the “Corporations”) and are licensed for use by Calamos Advisors LLC. The Fund has not been passed on by the Corporations as to their legality or suitability. The Fund is not issued, endorsed, sold, or promoted by the Corporations. The Corporations make no warranties and bear no liability with respect to the Fund(s).

Calamos Financial Services LLC, Distributor

NOT FDIC INSURED | MAY LOSE VALUE | NO BANK GUARANTEE

Calamos Financial Services LLC

2020 Calamos Court | Naperville, IL 60563

866.363.9219 | www.calamos.com | [email protected]

2024 Calamos Investments LLC. All Rights Reserved.

Calamos and Calamos Investments are registered trademarks of Calamos LLC.