By Senior Analyst, Global Research & Design

On April 20, 2020, the S&P Eurozone LargeMidCap Paris-Aligned Climate Index (S&P Eurozone PA Climate Index) was launched (see press release). This index has been designed to align with recommendations from the Task Force on Climate-related Financial Disclosures and follow the new minimum standards for EU Paris-Aligned Benchmarks proposed by the EU, [1] while remaining as close as possible to its benchmark index, the S&P Eurozone LargeMidCap.

The current market conditions have put the effectiveness of the index methodology to the test. One of the main requirements of the regulation is that the carbon intensity of the index adheres to a strict trajectory of 7% reduction year-on-year.

In this short piece, we will analyze the impact of the recent market movements on the carbon intensity of the S&P Eurozone PA Climate Index and whether this has impeded the index’s ability to meet its 7% decarbonization goal.

First, we need to ask ourselves: why does market movement affect the index’s carbon intensity?

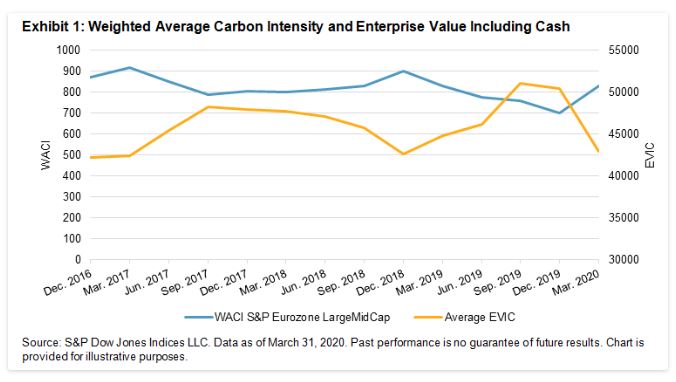

There are several approaches to measure the “carbon intensity” of a portfolio. The EU regulation stipulates that the carbon intensity of a company should be measured by dividing its Greenhouse Gas (GHG) emissions by its Enterprise Value Including Cash (EVIC). The index carbon intensity is the weighted-average carbon intensity (WACI) of its constituents. Therefore, when the EVIC of the index portfolio increases, the index WACI decreases and vice versa. Since the market capitalization of equities contributes substantially to EVIC, it is reasonable to assume that when the index level goes down, the carbon intensity of the index goes up.

In the first quarter of 2020, the S&P Eurozone LargeMidCap’s WACI (including Scope 3 emissions) increased by 18%. However, the chart shows that the main driver of this change was the 14% decrease in the average EVIC of its constituents (see Exhibit 1). Put simply, the recent market drop has made the carbon intensity of the index appear worse even without any companies necessarily increasing their GHG emissions.

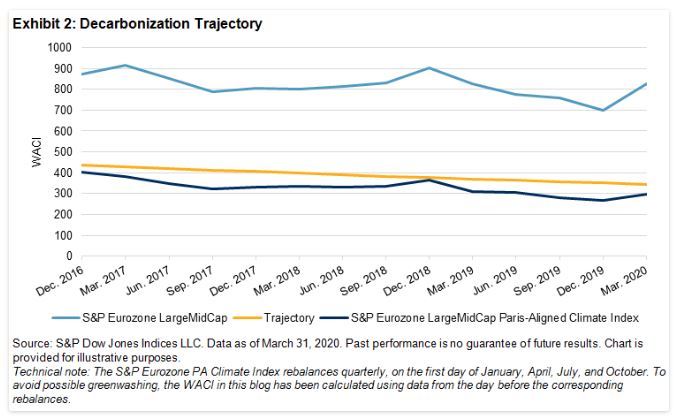

The question remains: has the S&P Eurozone PA Climate Index remained below its decarbonization trajectory during this period? The answer is a resounding yes (see Exhibit 2).

The yellow line indicates the 7% decarbonization trajectory required for the S&P Eurozone PA Climate Index. The index has remained below its allocated trajectory for every quarter since its inception. We can see that in the two periods (December 2018 and March 2020) when the EVIC suffered substantial decreases (see Exhibit 1) the S&P Eurozone PA Climate Index’s WACI moved closer to its required trajectory, but never exceeded it.

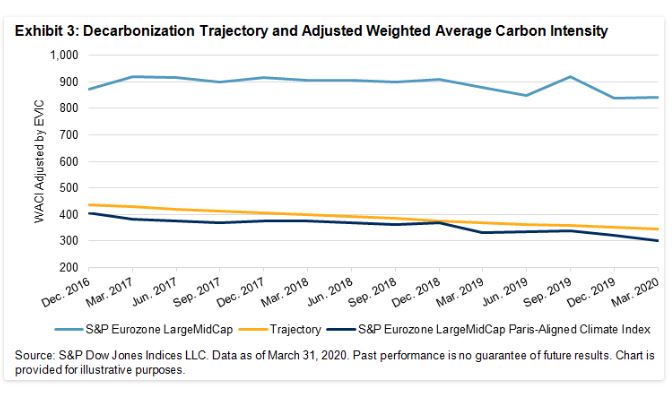

The dependency of EVIC on WACI was already noted by the Technical Expert Group (TEG) recommendations. To ensure that GHG emissions change is the main driver of the decarbonization of any climate benchmark, the TEG proposed adjusting the WACI by the average index-level EVIC increase/decrease (see Exhibit 3).

Exhibit 3 shows that the S&P Eurozone PA Climate Index’s adjusted-WACI tracks the required trajectory closely. This is because the WACI adjustment for index-level EVIC changes is an integral part of the methodology (see page 12 of the methodology).

In short, since the S&P Eurozone PA Climate Index targets decarbonization using the adjusted-WACI approach, we can rest assured that significant changes in the benchmark index level will have little impact on it meeting its climate objectives.

Exhibit 3 also shows that S&P Eurozone LargeMidCap-adjusted WACI has only reduced 3.4% since December 2016, while the S&P Eurozone PA Climate Index has reduced its WACI by 25.7%, well below the 21.0% required by the trajectory for the same period, without overshooting the required trajectory.

In summary, the current market conditions have provided an excellent opportunity to test the robustness of the methodology behind the S&P Paris-Aligned Climate Indices. The S&P Eurozone PA Climate Index passed with flying colors and successfully maintained its climate objectives. Now, back to business as usual.