Allianz expanded its suite of next-generation risk management solutions with the launch of two new buffered outcome ETFs on Wednesday.

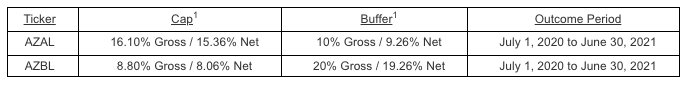

Allianz Investment Management LLC (AllianzIM), a wholly owned subsidiary of Allianz Life Insurance Company of North America (Allianz Life®), launched the AllianzIM U.S. Large Cap Buffer10 Jul ETF (NYSE Arca: AZAL) and the AllianzIM U.S. Large Cap Buffer20 Jul ETF (NYSE Arca: AZBL) today on the New York Stock Exchange.

AllianzIM Buffered Outcome ETFs are designed to expand the risk management strategies available to investors as prevailing market dynamics and declining appetite for risk create new challenges. Now offering low-cost buffered outcome ETFs, the AllianzIM ETFs seek to match the returns of the S&P 500 Price Return Index up to a stated Cap, while providing downside risk mitigation through a Buffer against the first 10% and 20% of S&P 500 Price Return Index losses for AZAL and AZBL, respectively over the 12-month outcome period.

“Following the launch of AllianzIM Buffered Outcome ETFs in June, the rollout of the July series marks the first opportunity to remain invested for the entire 12-month outcome period,” notes Brian Muench, president of AllianzIM. “Amid the uncertainty created by the coronavirus pandemic, the defined outcome period allows investors a buffer against downside risk, while still participating in the upside potential of the equity market.”

AllianzIM’s Buffered Outcome ETFs are offered at an expense ratio of 0.74% with portfolio management conducted in-house by AllianzIM. AllianzIM listed its inaugural U.S. Large Cap Buffered Outcome ETFs, AZAA and AZBA, on June 1, 2020.

Accessible to retail investors via the New York Stock Exchange, AllianzIM Buffered Outcome ETFs are also available to investment professionals through Halo Investing, Inc.’s (Halo) global technology platform. Halo’s technology is first in the market to help investors track and analyze this relatively new type of ETF utilizing many of the same analytics and portfolio tracking tools used under Halo’s core structured note platform.

“Building a technology platform for more informed investment decisions is our goal,” says Halo co-founder and President Jason Barsema. “With buffered outcome ETFs, there are new key variables that financial professionals can track and manage including cap and buffer levels with real-time market data to fully understand the product. Halo has built these portfolio tools so clients can more confidently invest with this new outcome-oriented ETF strategy.”

AllianzIM Buffered Outcome ETFs leverage AllianzIM’s core strengths, which include risk management experience and in-house hedging capabilities. Managing over $145 billion in hedged assets, AllianzIM serves as a bridge between insurance and capital markets. Offering a new way to help investors seek to mitigate risk and reduce volatility, these new ETFs complement Allianz Life’s suite of annuity and life insurance products.

For more information on AllianzIM Buffered Outcome ETFs, visit www.allianzIM.com.

[1] Gross reflects the Cap and Buffer prior to taking into account the 0.74% expense ratio of the ETF while Net accounts for the expense ratio, but does not include brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses. The Cap and Buffer experienced by investors may be different than the stated numbers. The funds’ website, at www.allianzIM.com, provides important fund information as well as information relating to the potential outcomes of an investment in the Fund on a daily basis.