Introduction

Welcome to the fall issue of Hidden Value Stocks.

In this issue, we have our usual fund interviews as well as their four value stock ideas. On top of our regular content, we also have an investment idea from Papyrus Capital: A deeply undervalued Hawaii/Maui real estate play with a potential upside of 250%.

Over the past two years, Hidden Value Stocks has grown rapidly and earlier this year we made the decision to incorporate the business as a standalone entity. This move should allow us to provide better service to readers, and more content. Unfortunately, it also means that, due to the higher costs of operating as an independent business, Hidden Value Stocks is increasing in price from $399 to $449 at the end of September.

If you’re an existing subscriber, you have nothing to worry about. We pledge to all our members to grandfather you in at the current rate for perpetuity if you renew. And for a limited time we’re offering a special deal for existing subscriber referrals. You can refer a friend and for each member (who completes the 5-day trial) you both get 10% off your membership price (new members will still receive the $399 price). We offer further reductions for multiple subscriptions.

You can refer a friend and for each member (who completes the 5-day trial) you both get 10% off your membership price (new members will still receive the $399 price). We offer further reductions for multiple subscriptions. So, if you enjoy Hidden Value Stocks please spread the word and help us grow the community.

We hope you enjoy the fall issue of Hidden Value Stocks and as always, if you have any questions or comments please do get in touch.

Sincerely,

Rupert Hargreaves

Jacob Wolinsky

Fund Updates

Update from Choice Equities on Reed’s Inc (profiled in the June issue of Hidden Value Stocks):

From Choice’s Q2 letter to investors:

Reed’s Inc. is a company that has had its ups and downs. You may know it as a market leading manufacturer of ginger beer and a pioneer in the small but rapidly growing craft consumer beverage segment. As the only leading player making ginger beer that actually has ginger in it, the company is well positioned to expand on its lead in the space and capture much of the growth in this category. But it was not always this way.

Chris Reed, the company’s founder, essentially brought the category mainstream and grew this company from scratch to an organization with multiple brands together doing near $50 million of sales per year. He should be commended for building such a well-regarded brand, an effort he initiated largely on his own. But the company had its share of missteps. The most costly one was an ill-fated and strategically questionable foray into expanding its manufacturing operations with a major investment in a new plant in 2015. This move diverted capital away from marketing spending and brand building initiatives and brought operational execution risk into the picture. Later that year the company began having problems fulfilling its commitments to customers, and the company was hurt by increased distribution costs and lost sales. Further troubles soon followed which ultimately led to the installation of a new board and management team last summer.

The new Chairman of the Board is John Bello, founder of Sobe and former Chairman of Izze. A year ago he tapped a new CEO, Val Stalowir, who I had the pleasure of meeting for lunch in Greenwich, CT a few months ago at a restaurant named, quite appropriately, The Ginger Man. He likewise has impressive experience within the industry with prior leadership and operational experience. The new team is appropriately transitioning the company to an asset-light strategy. The intended sale of its L.A. based plant will finalize the move away from the capital-intensive manufacturing operations and the company will devote the lion’s share of its resources towards marketing and brand building going forward. The focus will be on only their most visible and best-positioned brands, Virgil’s and Reed’s, as these two brands hold leadership positions in categories that are growing at mid-single digits and mid-teens levels annually, respectively. The new team looks intent on developing the brands and potentially positioning them for a sale to a larger player, a common play in the consumer beverage playbook.

This position resides as a smallish for one us as shares are up ~40% from our initial purchase levels earlier this summer. Unfortunately, while we were doing our due diligence, the price moved quickly. Choosing discipline over chasing the stock, we have held steady at a low to mid-single-digit size position. Still, if they are able to execute successfully on this plan, it seems shares could double or better from recent levels over some two to three-year horizon.

Update from Livermore Partners on Jadestone Energy (profiled in the June issue of Hidden Value Stocks):

From Livermore’s Q2 letter to investors:

With Jadestone (JSE), our thesis continues to manifest along with very strong returns for this exciting and growing oil producer. Jadestone successfully IPO’d in London in August. Jadestone executed a $200 million transformational Australian asset acquisition from Thailand giant, PTTEP. We hold a seat on the Board of Directors of Jadestone, added to the equity position on the raise, and continue to focus hard on its growth trajectory.

Jadestone has a chance to be a true small cap champion and the potential to be a $1 billion company in the face of Brent’s uplift near $75 a barrel. Adding to this are the strong free cash flows from the new Montara acquisition, which on a proforma basis, will allow $100 million of annual FCF for a company today trading at a large discount (1.5X EV/EBITDA for 2019) to any peers. We continue to feel Jadestone is in a great position to prosper in the years ahead thru both acquisition and organic growth and reflects the strength of an excellent management team. My hats off to CEO Paul Blakeley and his team!

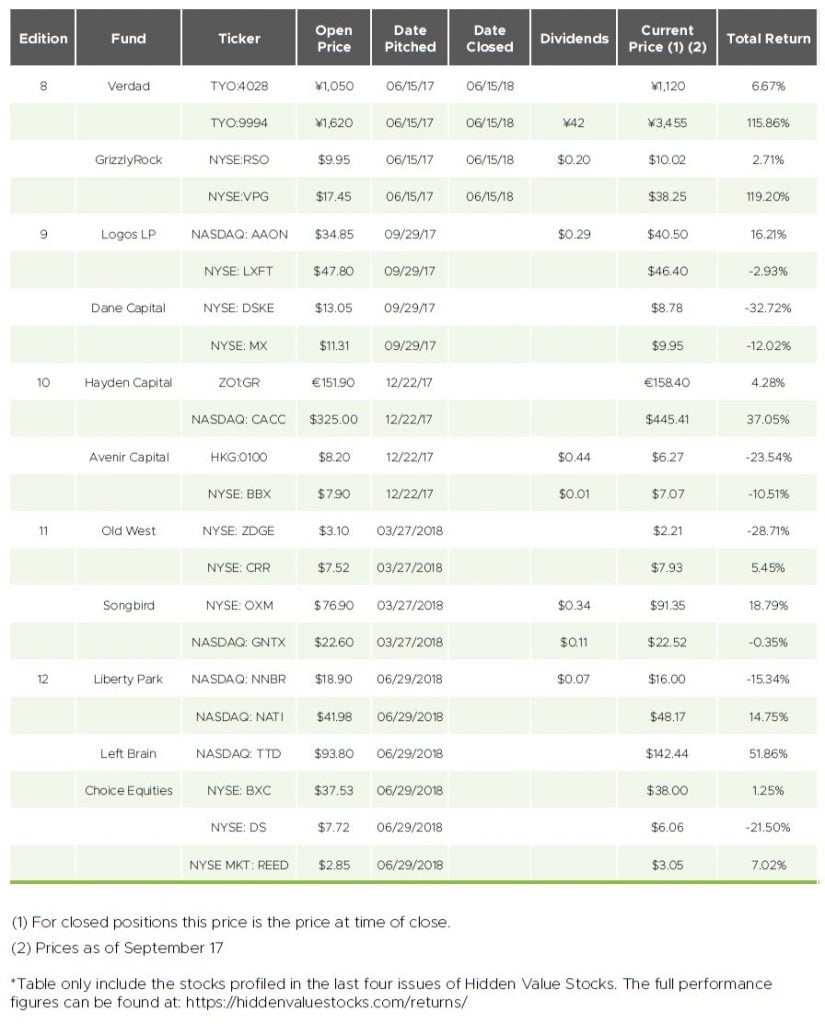

Returns

Quim Abril – Global Quality Edge Fund

Mr. Quim Abril, served as Head of Equity Funds within BMN Asset Management from July 2004 to January 2015, where he developed the Earnings Quality framework analysis and Forensic Accounting. His flagship fund´s 5-year performance ranked Top 5 in the Spanish Equity Funds category, while also pushing Mr. Abril to the #429 (2° in Spain) among the top 1000 equity PMs in the world, according to Citywire. In addition, Mr. Abril has had active participation within the Spanish economic press, also appearing as a guest speaker in leading asset management conferences.

Can you tell our readers a bit about your background and the Global Quality Edge Fund?

Sure, in the last 15 years I’ve been working at different asset management firms in Spain; primarily investment arms within banking. Looking back, it was a great experience but I reached a point where the l realized I needed to set up my own investment vehicle and break away from the limitations that come with working in a bank. It has now been two years since I made that difficult decision of giving up the comfortable lifestyle I had in banking to create my own hedge fund.

Before all this happened, my background had mostly been in finance, particularly in accounting and auditing while also (more importantly) analyzing businesses from a qualitative and strategic perspective. Above all, though, what has really helped me out the most has been the experience I acquired from one-to-one conference calls with senior managers at companies in which we analyze and invest at the fund. My daily contact with other people within the same sector, their vast experience in strategic analysis has also been incredibly helpful. While I will not mention names, they know who they are!

Global Quality Edge Fund was officially launched in June 2017 with €1.5 million of AUM from a single investor. Today, we have grown the fund to €6 million from 15 investors and we hope to achieve the €10 million milestones by the end of this year.

The fund invests mostly in extraordinary companies with solid and sustainable long term competitive advantages, who are leaders in their niche markets, face low or null competition, have low broker analyst coverage, sound capital management, high ROIC across the business cycle, low correlation to equity market indices and visible interest alignment between shareholders and company management.

We generally invest in small and midcap size businesses. Our preference0 for this size range can be explained in 10 points:

- 80% of the investable universe is made up of listed companies with less than €2.5 billion euros in market cap.

- Their underlying businesses are easier to understand and study.

- They focus on niche segments within their respective markets.

- Their senior management is more accessible to contact and exchange insight.

- They offer higher earnings growth potential and longer-term return, not always having to compromise on the increased volatility.

- Low analyst coverage.

- Lower correlation to market indices.

- A higher percentage of insider ownership.

- Higher chances of receiving take-over offers.

- If in the U.S., favorably benefiting from the recent tax reform.

Whenever we feel the likelihood of a recession increasing, we apply tail-risk hedging strategies and protect our fund from significant losses, like those seen in 2000 and 2008.

You’re looking only for “extraordinary companies.” How would you define extraordinary? What qualities are you looking for in a business?

I think an extraordinary company is one that has very low or no competition thanks to one or more competitive advantages (structural characteristics attributable to their business), which translate into higher return on capital and margin.

For example, Victrex (VCT), a British Specialty Chemicals company and a global leader in engineering thermoplastics. Their signature polymer solution, PEEK, component for a number of industries. It has a 65% market share with only two direct competitors. Acerinox (ACX), on the other hand, a Spanish listed steel company, competes in price against a multitude of players globally where the only possible moat is to be the lowest cost structure.

Although both companies’ products are key materials for other businesses, Victrex has a 4x higher return when compared to Acerinox. Is it reasonable to think that both companies will have qualified top senior management teams leading them; however, the main difference is the competitive advantage of Victrex, and the balance that exists between supply and demand, which is why Global Quality Edge Fund will and is always seeking markets where supply cannot always keep up with demand.

Another critical feature an extraordinary company must have is that they must cater to a niche market, where size matters in relative, not in absolute terms. If we take Holland Colours (HC), their total revenues were €84 million in 2017 within a potential global market of €11 billion in the coloring system business. However, if we study Holland Colours in greater detail, they actually have a 30% market share in a sub-segment of the colouring system business of €300 million. Is Holland Colours, then, a small or large company?

We try to understand the company from the perspective of the customers, as generally speaking the quality of their customers can also determine the quality of a company.

Happy customers also allow for better forecasting in future earnings. We could then ask ourselves, how dependent is the customer or client to the products or services offered by our case study company? What is their client retention rate? Is it easy to convince them to buy the products and services? Does the company in question have customer concentration? Tessi SA (TES), for example, is a market leader in document processing and payment services for the financial sector in France. In the last few years, they’ve achieved a 90% client retention rate. Similarly, Espey (ESP), a British manufacturing company that serves the military market and is largely protected by competition from its patents; has more than 50% of its sales come from its top 10 clients. If we look at Victrex again, it manufactures a polymer that is a critical supply material within the industrial sector, and its customers would not tolerate any error or settle for anything of lesser quality. To some extent, they’re captive clients and switching costs to another competitor are incredibly high.

Lastly, we must ask ourselves the following: Is growth in earnings and profitability consistent or erratic? In the commodities space, for example, companies have no control on the pricing of the products they’re selling, as the raw material it involves is directly linked to the cycle of the economy, there is exposure to price deflation and most of the companies destroy value for their shareholders. If we now think of software companies like Microsoft, where the user pays an average price and upfront fee of $100 for Office 365, generating a positive impact in working capital, visible and recurring earnings from their licensing, room for potential price increases and knowing switching costs are very high.

And another key part of your strategy is finding companies with a “low probability that an accounting problem could reduce the profit or cash flow.” Can you tell us some more about this goal?

In the last 25 years, there have been many accounting fraud cases where senior management misled investors. Enron, Health South and Valeant in the U.S. and Gowex and Pescanova in Spain, to quote a few examples.

Most of the time, these situations are remote and hard to spot but what think are far easier to detect are the possible accounting practices that may put future earnings and cash flow generation at risk: accounting ‘red flags’.

While it is always imperative to understand the business model of a company, their competitive position and their capital management, it is equally relevant to look for these ‘red flags’; something we dedicate a lot of time in doing for our Global Quality Edge Fund.

To avoid falling victim to these mistakes we read annual filings in detail. These documents are not always easy to read and will change over time to reflect new accounting rules and guidelines; which is why a strong knowledge in accounting is necessary to understand them fully.

If we put these ‘red flags’ in context, I can maybe start off by saying – without running too big a risk – that the US economy is almost reaching its final economic stage and companies will begin to feel the strain to maintain or continue growing their earnings. In answer to that challenge, some senior management teams may start applying aggressive accounting practices to keep earnings growth, stable cash flow generation and a clean balance sheet. In the last 10 years, we have spent our time listing and classifying red flags according to their type which then help us identify possible accounting risks and understand how senior

management think and act around them.