With equity valuations stretched, core fixed income yields near zero, and cross asset-class correlations increasing, traditional portfolio management and diversification methods are presenting investors and allocators with critical challenges. How do you keep portfolios exposed to risk assets while navigating these challenges?

In the upcoming webcast, Adding Convexity To Your Core Equity Portfolio, Paul Kim, CEO and Co-Founder, Simplify; David Berns, CIO and Co-Founder, Simplify; Corey Hoffstein, Co-Founder and Chief Investment Officer, Newfound Research, will introduce a brand new approach that simply and elegantly reinforces your core equity exposure.

Simplify has recently come out with a suite of so-called PLUS Convexity ETFs, including the Simplify US Equity PLUS Convexity ETF (SPYC), Simplify US Equity PLUS Downside Convexity ETF (SPD), and Simplify US Equity PLUS Upside Convexity ETF (SPUC).

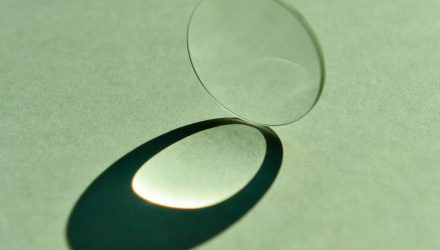

The Simplify US Equity PLUS Convexity ETF tracks the large cap US equity market while boosting performance during extreme market moves up or down through systematic options overlay. The options component of the fund will create a convex equity payoff, with the hopes of increasingly protecting capital as market drawdowns deepen and accelerating performance as market rallies strengthen. The strategy is intended to boost equity performance during extreme market conditions.

The Simplify US Equity PLUS Downside Convexity ETF tracks the large cap US equity market while boosting performance during extreme market moves down through a systematic options overlay. The options component of the fund will create a convex equity payoff on the downside, with the hopes of increasingly protecting capital as market drawdowns deepen. The strategy is designed to boost equity performance during extreme drawdowns.

Lastly, the Simplify US Equity PLUS Upside Convexity ETF tracks the large cap US equity market while boosting performance during extreme market moves up through a systematic options overlay. The options component of the fund will create a convex equity payoff on the upside, accelerating performance as markets rallies strengthen. The strategy is intended to boost equity performance during extreme market rallies.

Financial advisors who are interested in learning more about core equity portfolio strategies can register for the Friday, October 9 webcast here.