Yields make the world go round, and that may be truer now than ever. U.S. investors and advisors can not only find potent yields domestically but also abroad. Global high yield, particularly corporate bonds, are offering compelling yields above 8%, according to insights from T. Rowe Price. What’s more, active investing may provide a potent way into a space that can reward managerial knowledge and expertise.

See more: “T. Rowe Launches 5 Active Transparent ETFs”

Four themes are shaping global high yields according to a white paper from T. Rowe’s Mike Della Vedova, who manages the Global High Income Bond Fund. Those themes include yields, of course, but also healthier balance sheets, limited new issues, and volatility challenges.

In terms of yield, for example, Europe is providing some valuable opportunities, cheaper right now than U.S. high-yield bonds. The European high-yield bond market is younger, with more time for price discovery, the research added.

Corporate balance sheets, meanwhile, are healthy enough to keep defaults lower. That said, the delayed impact of interest rate hikes due to firms holding debt of various maturities should be noted. Many firms, meanwhile, issued debt in 2020 and 2021’s “attractive funding conditions,” the note adds. That may limit the appetite for new issues, creating a supply and demand gap that could appeal.

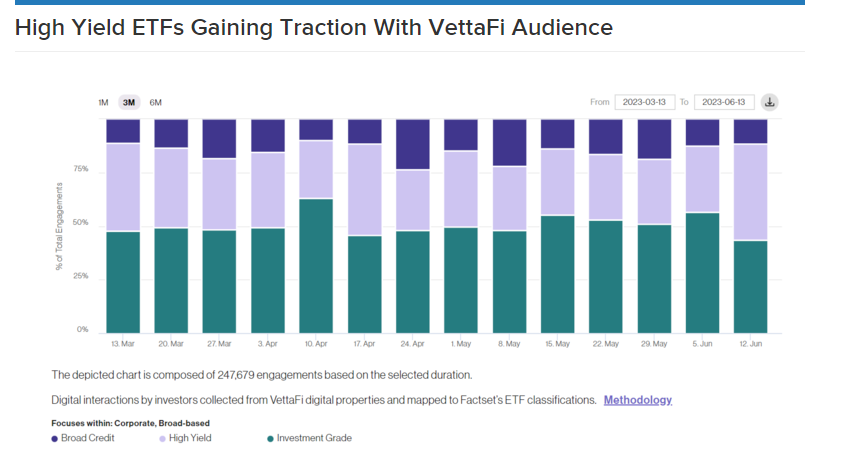

Of course, slowing economic growth and stubborn inflation create volatility that may weaken company profit margins. That hasn’t slowed down advisor interest in global high yield, however. Per research from Todd Rosenbluth, VettaFi’s head of ETF research, high-yield ETF interest has grown among advisors. That growth comes mostly at the expense of interest in investment-grade ETFs.

High-yield ETFs are receiving growing advisor engagement.

Navigating global fixed income can be hard. Using an actively managed broad-based strategy from an experienced manager can help alleviate the burden from ETF investors. Active management can provide advisors with the know-how to navigate the broader fixed income landscape, including global high yield. T. Rowe Price offers a suite of active ETFs, including fixed income strategies that advisors can consider. Those include ETFs like the T. Rowe Price Total Return ETF (TOTR), which actively invests across fixed income offerings for seeking the best total return.

For more news, information, and analysis, visit the Active ETF Channel.