Active management has had a strong 2023 so far, attracting about 30% of inflows, despite representing less than 6% of total assets invested in ETFs. Strong performance has drawn much of those inflows, as active managers have been able to outperform passive strategies in this year’s churning markets. So far in 2023, 57% of active managers have outperformed passive strategies.

One such success story is the recently launched T. Rowe Price Capital Appreciation Equity ETF (TCAF), an active ETF that directly competes with funds like the SPDR S&P 500 ETF Trust (SPY) to offer exposure to U.S. large cap stocks.

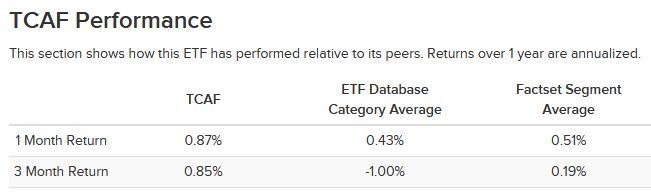

In the past three months, TCAF has outperformed SPY, 1.2% to 0.8%. It has also outpaced its ETF Database Category and FactSet Category averages over the same time period:

TCAF has outperformed its ETFdb and FactSet Category averages over a one- and three-month time period.

Source: ETFdb.com

TCAF launched in June, but as of September 20th, the fund had already gathered more than $230 million in new assets, per VettaFi’s LOGICLY.

See more: “Three Stocks to Know Active Capital Appreciation ETF TCAF”

Inside TCAF’s Portfolio: High Quality U.S. Large Caps

Run by well-known, two-time Morningstar manager of the year David Giroux, TCAF seeks exposure to high quality U.S. large-cap stocks. The manager applies both growth and value views to those stocks to suss out the firms with the highest capital appreciation potential.

That winnows the portfolio to approximately 100 names, including the firms exhibiting the best valuations, strong capital allocation, sustainable earnings growth, and other typical “growth at a reasonable price” fundamentals.

Giroux’s approach has led the fund to hold non-FAANG stocks like Thermo Fisher Scientific (TMO), which sells laboratory equipment, and Danaher Corp (DHR), a global medical conglomerate.

However, according to VettaFi’s LOGICLY, only 45% of TCAF’s holdings also appear in SPY.

For more news, information, and analysis, visit the Active ETF Channel.