ETF investors have seen many flashy names launch over the last few years, with active strategies spiking this year especially. Savvy ETF investors will recognize, however, that often it is prudent to see how an ETF performs first. ETFs tend to pick up interest after accruing three-year track records. With the active equity ETF TEQI hitting three years of performance early next month, it may be worth taking a closer look at the strategy’s approach.

TEQI, the T. Rowe Price Equity Income ETF, launched back on August 4, 2020. The active global equity ETF will then have three years of operation under its belt in a matter of days. That often can mean new flows arriving into a strategy. TEQI also surpassed $100 million over the last few weeks, putting it on the radar for a greater number of investors.

See more: “So Far in 2023, Active ETFs Top Performance Charts”

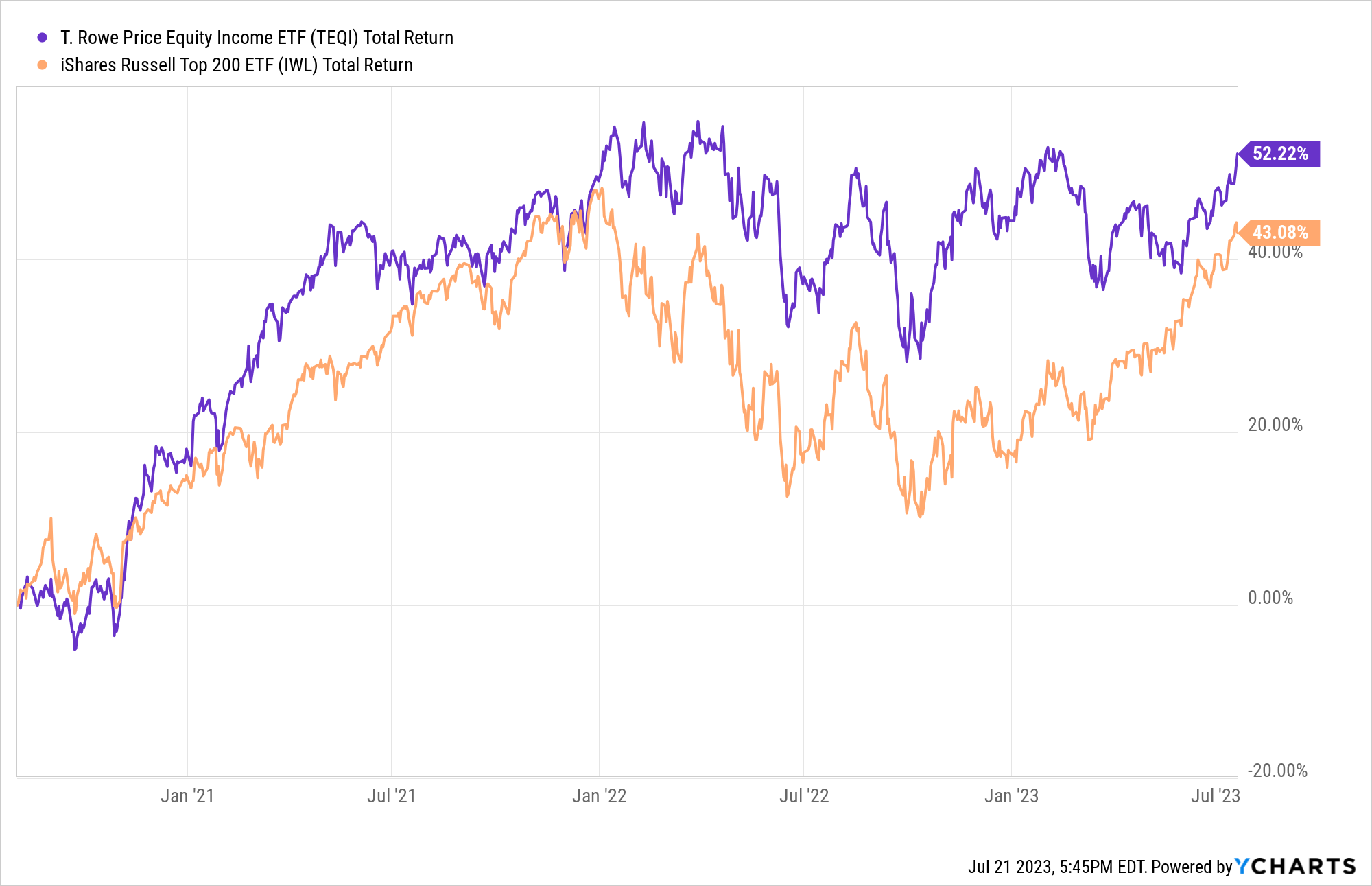

So what can investors expect from the active equity ETF’s three-year performance? According to YCharts, TEQI has returned 52.2% over the last three years. That outperforms a passive strategy operating in a similar space, according to LOGICLY: the iShares Russell Top 200 ETF (IWL). IWL returned just 43.1% in that same time frame.

TEQI has outperformed IWL, considered a peer ETF by LOGICLY, over three years, per YCharts data.

TEQI’s Active Equity ETF Approach

TEQI invests by selecting global large-cap firms that the portfolio manager believes are undervalued. They look out for firms with low price/earnings ratios, above-average dividend yields, and low stock prices compared to the fundamentals. By considering those factors, and sometimes leaning heavily into certain sectors, it entrusts its active managers to outperform indexed ETFs like IWL.

That leads TEQI to hold names like Johnson & Johnson (JNJ), which recently beat its Q2 earnings estimates. Active strategies are having an exciting year in terms of investor interest, and TEQI may be a strategy to watch in that vein. With the active equity ETF hitting its three-year mark in a very short time, it may be worth keeping an eye on the strategy’s moves in the weeks ahead.

For more news, information, and analysis, visit the Active ETF Channel.