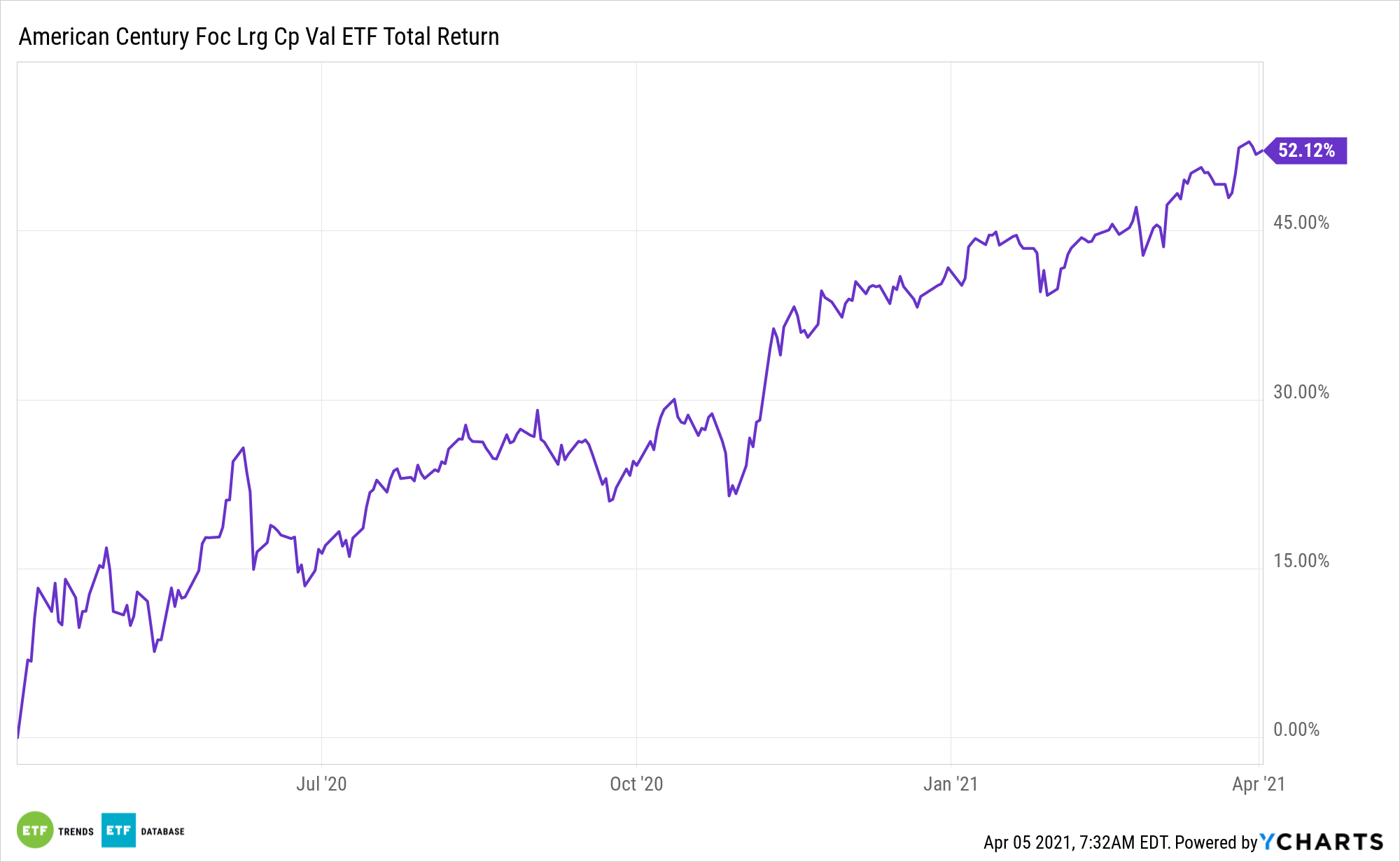

Value stocks were among the first quarter’s best-performing assets, and that fact alone could prompt advisors to consider some new strategies.

Enter the Focused Large Cap Value ETF (FLV). The Focused Large Cap Value ETF tries to achieve long-term returns through an investment process that seeks to identify value and minimize volatility. The fund is one of the actively managed non-transparent ETFs launched by American Century earlier this year.

FLV is one of the original active non-transparent exchange traded funds (ANTs) launched by American Century last year.

Adding to the allure of FLV right now is its value purity, and expectations that the recent rotation into value stocks could be long-lasting. RPV’s big exposure to resurgent financial services names also bolsters the case for the fund.

“At 20 times forward earnings, the S&P 500 is in the 90th percentile of its valuation over the past 30 years, per data from Goldman Sachs’ chief U.S. equity strategist, David Kostin,” reports Nicholas Jasinski for Barron’s. “But even investors feeling valuation vertigo can still find pockets of value in this market. Financials go for a 30% discount to the S&P 500, at just the ninth percentile of their historical relative range. Energy stocks, at a 13% discount to the index, are only at their 21st percentile relative valuation. Technology stocks, which trade at a 16% premium to the index, are at their 45th percentile over the past 30 years.”

The Value Hype Is Growing

FLV holdings and value stocks usually trade at lower prices relative to fundamental measures of value, like earnings and the book value of assets. On the other hand, growth-oriented stocks tend to run at higher valuations since investors expect the rapid growth in those company measures.

Value fans believe this time may be different for value stocks, pointing to improving measures of investment sentiment, abating fears of a recession, rebounding corporate profits, and lessening trade tensions between the U.S. and China. Furthermore, value stocks are now trading at some of their most attractive prices in years as the growth/value gap is as wide as it’s been in decades.

See also: The ETF Database Value ETF List

FLV includes companies attractively priced relative to their fair value and potential downside. Additionally, the management team incorporates fundamental research and downside analysis to manage risk, and dampen volatility, which should establish a risk/return profile for each stock that helps lead to a higher probability of long-term outperformance.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.