When it comes to inflation-fighting fixed income instruments, investors often turn to Treasury Inflation Protected Securities (TIPS). Yet senior loans may also do the trick, with higher levels of income to boot. Enter the SPDR Blackstone/GSO Senior Loan ETF (NYSEArca: SRLN).

SRLN invests in senior loans given to businesses operating in North America and outside of North America. The portfolio may invest in senior loans through the loans directly via the primary or secondary market or via participation in senior loans, which are contractual relationships with an existing lender in a loan facility where the loan portfolio purchases the right to receive principal and interest payments.

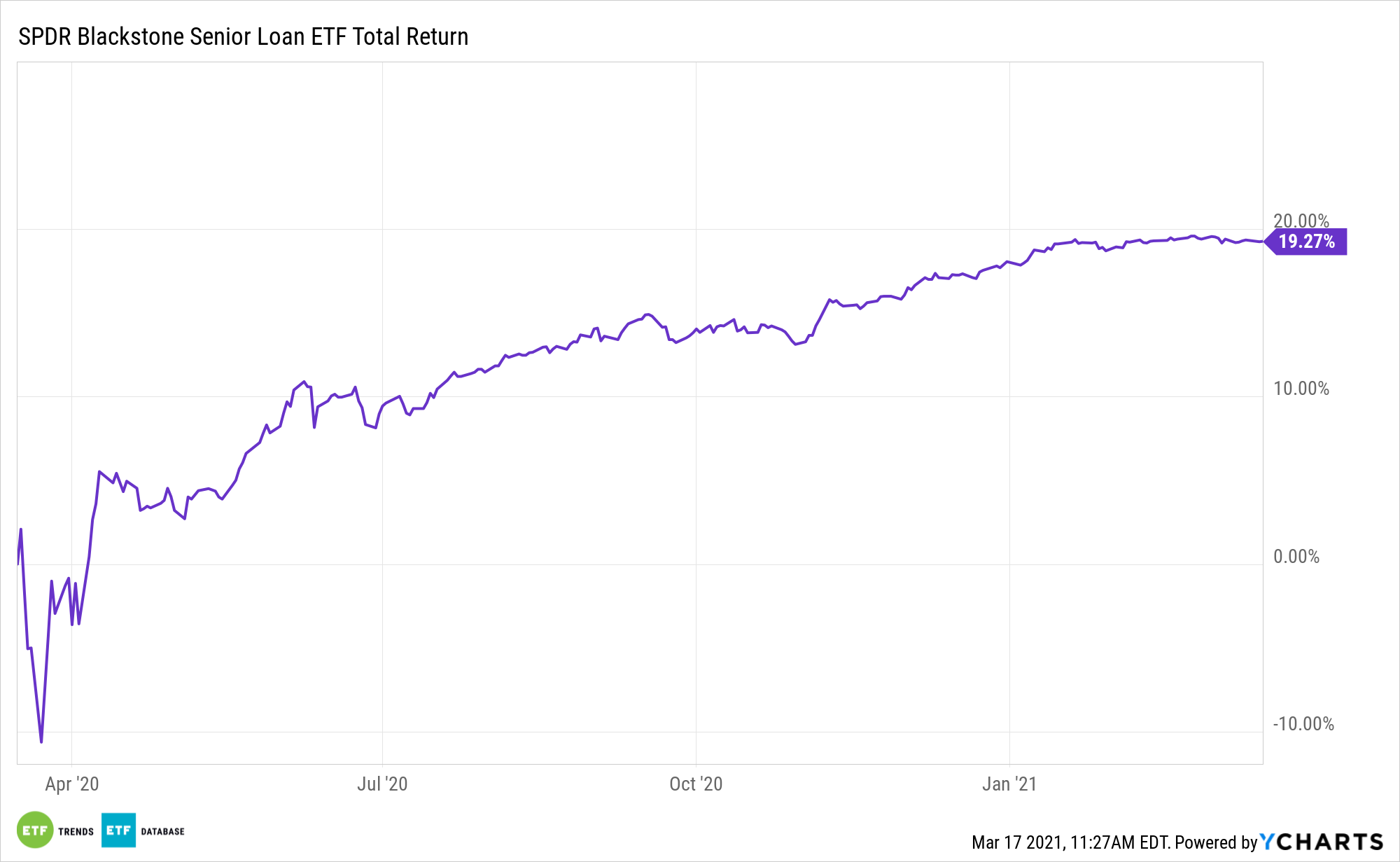

Data confirm rising inflation expectations are luring investors to SRLN and other senior loan ETFs.

“As economic growth and inflation forecasts climb, exchange-traded funds tracking loans have emerged as a haven of sorts as they’re poised to benefit from higher interest rates,” reports Katherine Greifeld for Bloomberg. “Those ETFs have lured more than $3 billion so far in 2021 and are on track for their biggest first-half haul since 2013, according to Bloomberg Intelligence data.”

Income Generation with Inflation Protection

The senior loans in SRLN’s portfolio are paid first. Higher payment priority assists liquidity in terms of the defaulting borrower having to sell assets in order to pay off creditors – in this case, senior loans within the SRLN portfolio are given higher priority – a viable option, especially during a market downturn.

“Growing concern over a pickup in inflation amid an economic revival has rippled across asset classes, whiplashing technology stocks and dragging down high-grade bonds,” according to Bloomberg. “It’s also shone a spotlight on high-yield debt as well as loans and notes that offer floating interest rates. Unlike the fixed payments on most conventional bonds, those on floating rates go up as benchmark rates do — helping preserve their value.”

Due to their floating rate component, bank loans are seen as an attractive alternative to traditional high-yield corporate bonds in a rising rate environment. Bank loan securities allow their interest rate to shift, or float, along with the rest of the market, whereas a fixed interest rate stays constant until maturity.

Bank loans are slightly safer than traditional high-yield bonds since they are secured by collateral and have historically shown lower default rates.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.