Prior to June 2020, investors interested in active U.S. large‑cap growth ETF strategies had few options. But that’s all changed. Advisors have had more choices for active ETFs in the last few years — particularly active U.S. large-cap growth ETFs.

A white paper from T. Rowe Price noted that many big tech names like Meta, Microsoft, and Amazon have left growth for value in key indices. As a result, there’s been a notable difference in the year‑to‑date performance of S&P 500 growth ETFs versus other growth benchmarks.

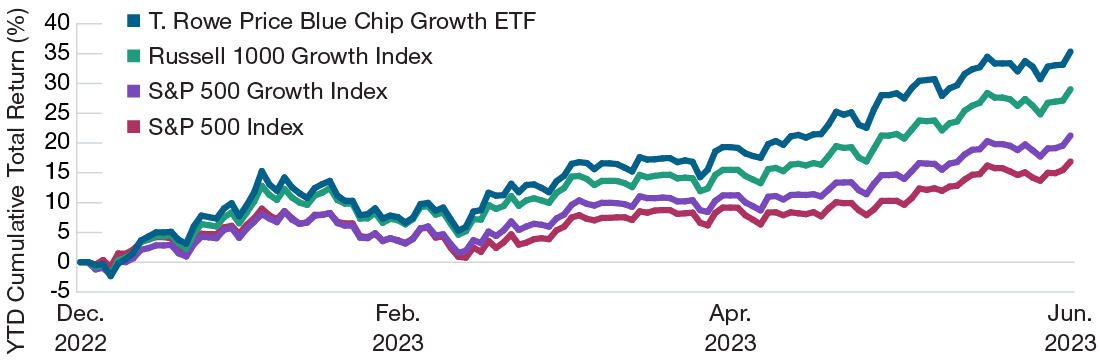

In the first half of 2023, the Russell 1000 Growth Index outperformed the S&P 500 Growth Index by about 632 basis points. And both were outperformed by the T. Rowe Price Blue Chip Growth ETF (TCHP).

1H23 Performance of Growth Indices

As of June 30, 2023.

Past performance cannot guarantee future results. Index performance is for illustrative purposes only and is not indicative of any specific investment. Investors cannot invest directly in an index.

Source: FactSet.

See more: “Active ETFs Outperformed Passive Funds in 1H 2023”

Growth ETF TCHP’s Adaptability

Managed by the same team that runs the popular mutual fund version of the strategy, TCHP targets companies with leading market positions, experienced management, and strong financials. Through its active approach to stock-picking, the fund takes a closer look at individual firms than a passive strategy does. The Blue Chip Growth strategy has been managed by T. Rowe Price as a mutual fund since 1993, and the ETF version, TCHP, hit its third anniversary in August.

By focusing on the most successful firms with seasoned management teams and an emphasis on a sustained growth outlook, TCHP actively identifies durable firms that can do well despite headwinds. Per T. Row Price, the fund “stayed true to its growth mandate as compared with the nontraditional characteristics currently portrayed in both growth indices.”

Its approach has led TCHP to hold the big tech names that have contributed so much to growth this year. And because it’s actively managed, it can adapt and pivot if the tech sector goes sideways.

T. Rowe cited the ETF as “an excellent example of why” active management “may be a better option for investors” amid market volatility. TCHP charges 57 basis points (bps), which is competitively priced for a fundamentally managed active strategy.

For more news, information, and analysis, visit the Active ETF Channel.