Leveraged loans and their related exchange traded funds are regaining fans this year as advisors look for the elusive combination of income and protection against rising Treasury yields.

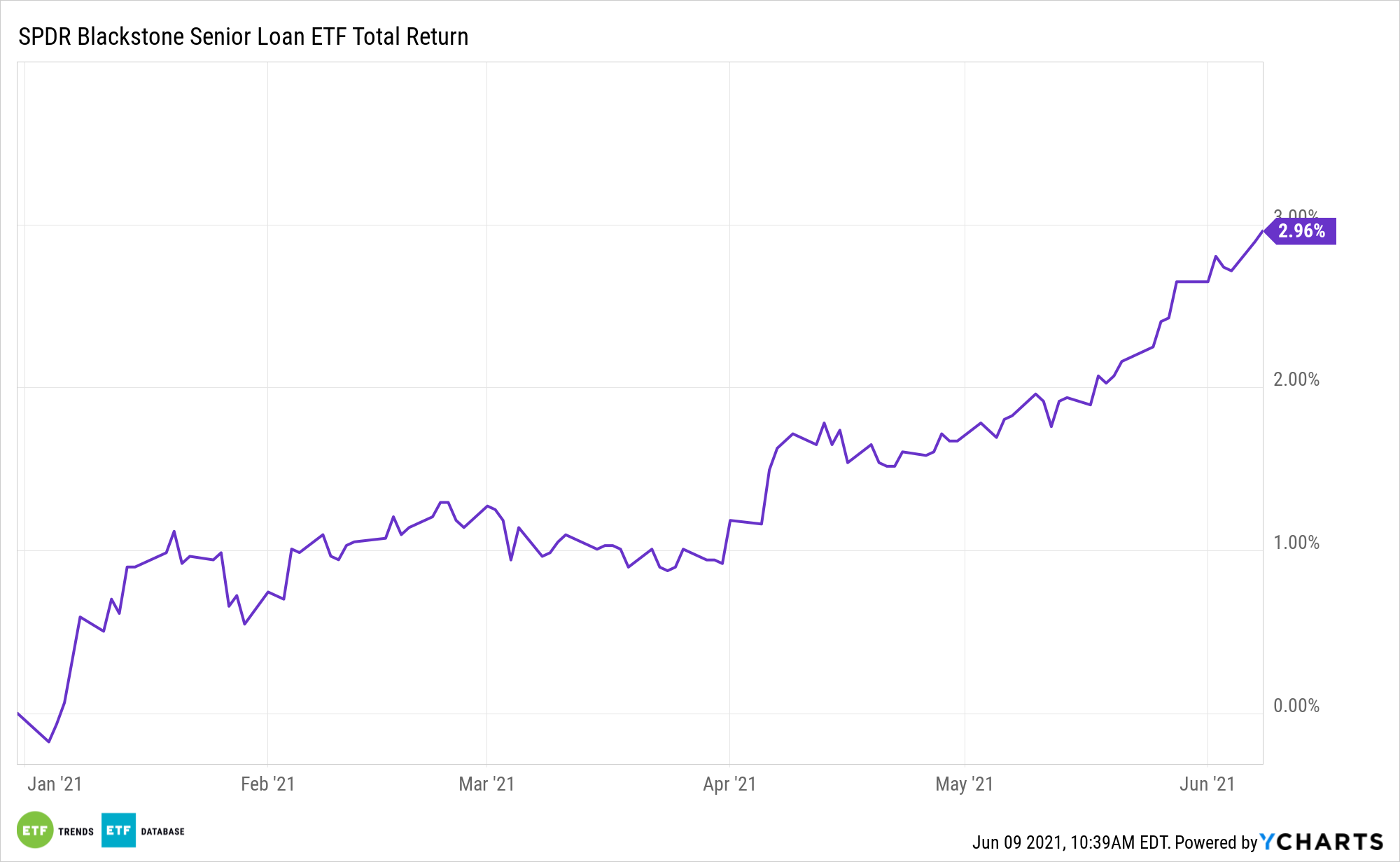

That trend could continue benefiting the actively managed SPDR Blackstone/GSO Senior Loan ETF (NYSEArca: SRLN). The $5.55 billion SRLN looks to top the Markit iBoxx USD Liquid Leveraged Loan Index and the S&P/LSTA U.S. Leveraged Loan 100 Index.

Leveraged loans or senior loans are generally high-yield bonds with the “senior” representing the fact that these bonds take precedence over other forms of corporate debt in the event of issuer default. SRLN has a 30-day SEC yield of 3.82%, according to issuer data. While that trails the yield on traditional junk bond indices, the trade-off works in investors’ favor when it comes to interest rate risk.

SRLN’s 301 holdings have a weighted average of 44 days to reset, presenting investors with a buffer against sudden spikes in Treasury yields. Said differently, rates on SRLN components “float” whereas coupons on standard junk bonds are fixed.

“High yield credit is also not immune to duration headwinds, as yield curve changes have subtracted 145 percentage points from the overall 1.92% return in 2021,” according to State Street research. “One high income sector — senior loans — has been able to sidestep duration-induced price declines as a result of its floating rate structure, while still participating in the credit rally. So far this year, senior loans are up 2.4%.”

SRLN has another favorable trait to offer investors: inflation-fighting prowess. That’s relevant because, due to the floating rate component of senior loans, SRLN’s duration is well below that of the Bloomberg Barclays U.S. Treasury Inflation Protected Securities (TIPS) Index.

“Thus, concerns about inflation and the potential for interest rates to rise further (as the consensus has forecasted) may mean the loan category — as a result of its lower duration — may hold its value more than other credit instruments,” adds State Street.

Additionally, if the Federal Reserve suddenly moves to hike interest rates in an effort to dampen rising consumer prices, SRLN would benefit because its holdings’ coupons would increase due to the subsequent rise in short-term rates.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.