(The following white paper on ETFs from T. Rowe Price was written by R. Scott Livingston, global head of exchange traded funds product.)

Exchange-traded funds (ETFs) have become a cornerstone of the investment landscape. Unfortunately, however, there are still a number of misconceptions about these products. We believe it’s important to dispel these myths as they potentially could lead some investors to miss valuable additions to their portfolios.

With this in mind, here are six of the most common myths regarding ETFs:

Myth 1: All ETFs are based on passive strategies

When they were first developed, ETFs were strictly passive vehicles. Increasingly, though, more ETF offerings are actively managed, and there are now a variety of strategies available to investors across equity and fixed income asset classes.

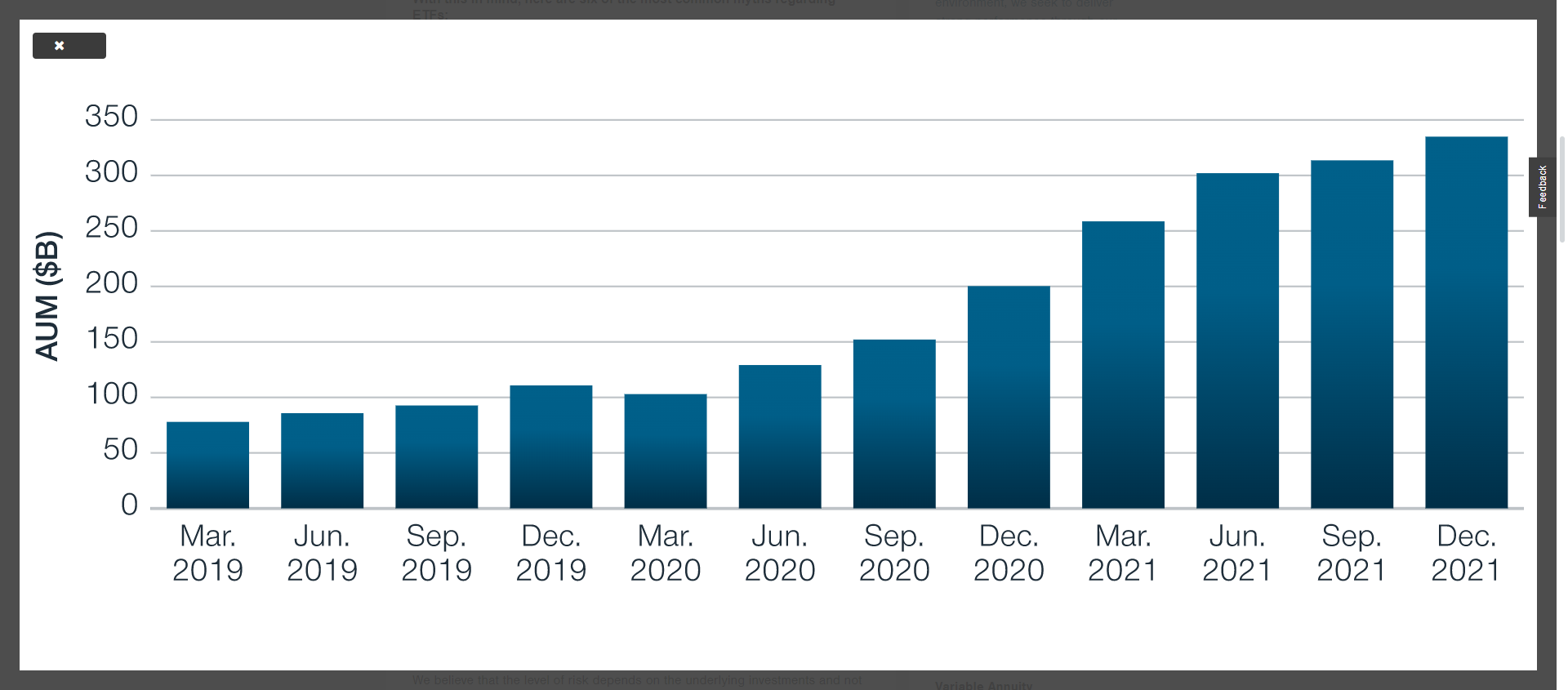

Actively managed ETF assets have grown substantially in recent years.

Growth of Actively Managed ETF Assets Under Management,* March 2019 Through December 2021

*The chart illustrates the quarterly total net assets of all actively managed ETFs traded within U.S. markets. Source: Morningstar; analysis by T. Rowe Price.

Myth 2: Passive ETFs are safer than active ETFs

We believe that the level of risk depends on the underlying investments and not whether an ETF is passively or actively managed. That said, most active managers have the flexibility to conduct research and attempt to anticipate risks. Applying their professional experience and judgment when making security selections, active managers look for specific sectors or companies with greater upside potential and seek to avoid those with inappropriate downside risk. This approach is not possible with passive ETFs, which seek to track the stocks or bonds held in an index.

Myth 3: Active managers can’t outperform index funds or passive ETFs

While it is true that not every fund manager can outperform their benchmark, some do. While all active managers strive to outperform their benchmarks, we believe those with global resources and research platforms may have an advantage leveraging their capabilities and experience. At the same time, economies of scale can help to keep fees and expenses in check.

Myth 4: ETFs are only for short-term trading and market timing

Although they can be bought and sold throughout the day without trading frequency limitations, ETFs are often intended for use over longer-term investment horizons. With fewer operational expenses than some other financial instruments, ETFs can be a cost-effective way to maintain exposure to various investment strategies over longer periods.

Myth 5: ETFs should have full daily transparency of their underlying holdings

Full daily transparency was originally viewed as necessary for an efficient ETF-trading process. However, the industry has evolved, and there are now several ways for ETF strategies to operate efficiently while maintaining a level of trading confidentiality. For some ETFs, shielding their investment-related intellectual property can be important to prevent outside investors and competitors from using the information in a way that may be detrimental to performance. However, not every investment strategy requires such shielding. For example, because of the way bond markets work, it’s unlikely that competitors can gain a detrimental trading advantage by knowing the holdings of certain fixed income strategies.

Myth 6: ETFs with low daily trading volume are not liquid

An ETF’s daily trading volume is not necessarily an indication of how liquid it is. Instead, it may be more informative to look to an ETF’s underlying holdings when assessing liquidity. With holdings based in highly liquid markets, such as U.S. large-cap stocks, ETFs with low historical daily trading volumes can accommodate significantly higher volumes without causing major price swings. As a result, if the underlying holdings are highly liquid, the ETF should be liquid, as well.

Conclusion

Contrary to the myths, active ETFs can play an important role in investor portfolios. Supported by fundamental research and managed by experienced professionals with a focus on security selection and careful attention to risk, we believe active ETFs could provide investors the opportunity for enhanced gains and the potential for appropriate downside risk management.

For more news, information, and analysis, visit the Active ETF Channel.

Additional Disclosures

© 2023 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Important Information

Consider the investment objectives, risks, and charges and expenses carefully before investing. For a prospectus or, if available, a summary prospectus containing this and other information, visit troweprice.com. Read it carefully.

T. Rowe Price Active Equity ETFs are different from traditional ETFs.Traditional ETFs tell the public what assets they hold each day. T. Rowe Price Active Equity ETFs will not. This may create additional risks for your investment. T. Rowe Price active equity ETFs publish a daily Proxy Portfolio, a basket of securities designed to closely track the daily performance of the actual portfolio holdings. While the Proxy Portfolio includes some of the ETF’s holdings, it is not the actual portfolio. Daily portfolio statistics will be provided as an indication of the similarities and differences between the Proxy Portfolio and the actual holdings. The Proxy Portfolio and other metrics, including Portfolio Overlap, are intended to provide investors and traders with enough information to encourage transactions that help keep the ETF’s market price close to its net asset value (NAV). There is a risk that market prices will differ from the NAV. ETFs trading on the basis of a Proxy Portfolio may trade at a wider bid/ask spread than shares of ETFs that publish their portfolios on a daily basis, especially during periods of market disruption or volatility, and, therefore, may cost investors more to trade. The ETF’s daily Proxy Portfolio, Portfolio Overlap, and other tracking data are available at troweprice.com.

Although the ETF seeks to benefit from keeping its portfolio information confidential, others may attempt to use publicly available information to identify the ETF’s investment and trading strategy. If successful, these trading practices may have the potential to reduce the efficiency and performance of the ETF.

ETFs are bought and sold at market prices, not NAV. Investors generally incur the cost of the spread between the prices at which shares are bought and sold. Buying and selling shares may result in brokerage commissions, which will reduce returns.

This material is provided for general and educational purposes only. This material does not provide recommendations concerning investments, investment strategies, or account types. It is not individualized to the needs of any specific investor and is not intended to suggest that any particular investment action is appropriate for you, nor is it intended to serve as the primary basis for investment decision-making. T. Rowe Price Investment Services, Inc., its affiliates, and its associates do not provide legal or tax advice. Any tax-related discussion contained in this material is not intended or written to be used, and cannot be used, for the purpose of (i) avoiding any tax penalties or (ii) promoting, marketing, or recommending to any other party any transaction or matter addressed herein. Please consult your independent legal counsel and/or tax professional regarding any legal or tax issues raised in this material.

Risk Considerations: All investments are subject to market risk, including the possible loss of principal. Active investing may have higher costs than passive investing and may underperform the broad market or passive peers with similar objectives. Passive investing may lag the performance of actively managed peers as holdings are not reallocated based on changes in market conditions or outlooks on specific securities.

T. Rowe Price Investment Services, Inc.

© 2023 T. Rowe Price. All Rights Reserved. T. ROWE PRICE, INVEST WITH CONFIDENCE, and the Bighorn Sheep design are, collectively and/or apart, trademarks of T. Rowe Price Group, Inc.

202301-2685193