2020 was a different kind of year. A new article from T. Rowe Price, “Why Dividend Growth Investing Has Staying Power,” explains how stocks that have consistently grown their dividends exhibited underperformance against the broader U.S. equity market last year.

However, given the atypical nature of the COVID-associated economic downturn, T. Rowe Price doesn’t believe there has been a structural shift that would require rethinking their strategy of investing in long-term dividend-growing stocks.

Instead, explains Thomas Huber, portfolio manager of the T. Rowe Price Dividend Growth ETF (TDVG), the firm believes the setup for high-quality dividend growers is “favorable”, thanks to low-interest rates and the potential for last year’s excesses to unwind.

“We believe that the defensive qualities that dividend growers traditionally have offered may have a better chance of asserting themselves” if and when market volatility returns, says Huber.

Dividend Growth Investing Is Not Broken

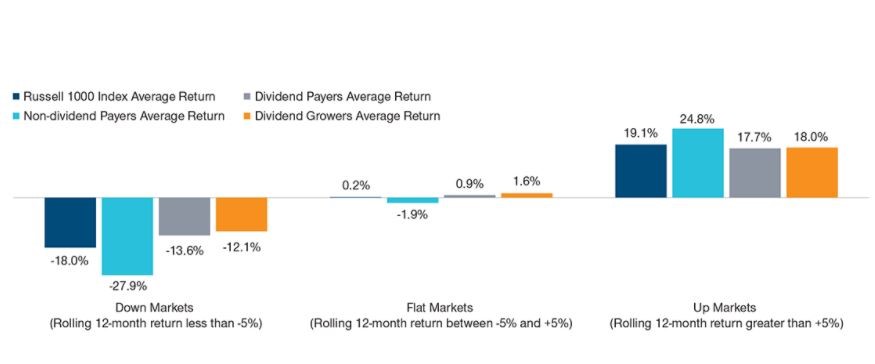

T. Rowe Price analysis cited in the article found that “dividend growth stocks in the Russell 1000 Index outperformed the index by an average of 5.88% during down markets over the 35 years ended December 31, 2020. This resilience contributed meaningfully to dividend growers’ strong historical performance.”

Last year’s slowdown broke the pattern, however, the root cause of which was largely the near-total shutdowns of various industries to stem the spread of COVID-19. These massive disruptions led to severe market dislocations, and in a momentum-driven environment, dividend growers found themselves excluded.

Yet “dividend growth investing is not broken,” writes Huber. Despite the challenges, the fund’s underlying holdings posted a healthy dividend growth rate in 2020. The benefits of this resilience should be felt over a full market cycle, he added, especially as high-quality stocks continue to grow their dividends and cash flow.

Past performance is not a reliable indicator of future performance. See Additional Disclosure

Cautiously Optimistic In 2021

2021 potentially offers a more supportive market for dividend-growing stocks. A significant majority of last year’s market returns originated from expanding price-to-earnings multiples, which boosted investor expectations for the most-outperforming stocks, regardless of their valuations. With that in mind, this year’s comparative year-over-year earnings for dividend growers and other laggards during last year’s run-up could attract investors. At the same time, if only moderate returns are generated, equities with an implied dividend yield of 2-3% and the prospect of consistent dividend growth could become appealing, especially as low interest rates persist in fixed income markets.

If interest rates begin to rise on inflationary pressures, due to fiscal stimulus concerns and the vaccination rollout, it could present some challenges to stocks whose outsized yields have historically contributed the majority of returns. However, as Huber writes, “Our fund historically has exhibited a negligible negative correlation to rising interest rates, in part because the stocks in which we invest have tended to grow their cash flows and dividends over time. We run our fund as a high dividend growth strategy, as opposed to one that focuses on stocks sporting high dividend yields.”

Long-Term Opportunities In Utilities, Financials

Over the long-term, opportunities exist in the traditionally defensive sector of utilities, which offer resilient cash flows and appealing dividend yields, as well as the opportunity to increase their rate bases due to the clean energy transition and the disaster-proofing of critical infrastructure. The financial sector also looks attractive, with many compounding stocks trading at reasonable valuations–which would be true, even without a rise in interest rates.

“We are cautiously optimistic about the near‑term outlook for U.S. equities while acknowledging that earnings are likely to be the main upside drive after a period of multiple expansion,” writes Huber. “At the same time, we recognize that elevated valuations and the potential for headline risk related to the rollout of coronavirus vaccines and the spread of resistant strains could lead to bouts of market volatility.”

“As always, we would tend to view any broad‑based market dislocations as an opportunity to build our positions in high‑quality dividend growers,” he added.

For more on active strategies, visit our Active ETFs Channel.

Additional Disclosure

Based on rolling 12‑month returns, measured monthly, from December 31, 1985, to December 31, 2020. At the start of every month, T. Rowe Price categorizes the Russell 1000 Index into various categories depending on dividend policy. We then calculate that month’s market cap‑weighted returns for each category.

We accumulate the returns during the full periods and calculate the annualized total returns for each category. Dividend growers consist of companies whose dividend growth over the prior 12 months was greater than zero. Dividend payers consist of companies whose current dividend yield is greater than zero. Non‑dividend payers consist of companies whose current dividend yield equals zero.

Sources: Data provided by Compustat; data analysis by T. Rowe Price