Some income-generating asset classes can be fertile ground for active managers, including preferred stocks. Enter the Principal Spectrum Preferred Securities Active ETF (CBOE: PREF).

Preferred stocks are a type of hybrid security that shows bond- and equity-like characteristics. The shares are issued by financial institutions, utilities, and telecom companies, among others. Within the securities hierarchy, preferreds are senior to common stocks but junior to corporate bonds. Additionally, preferred stocks issue dividends on a regular basis, but investors don’t usually enjoy capital appreciation on par with common shares.

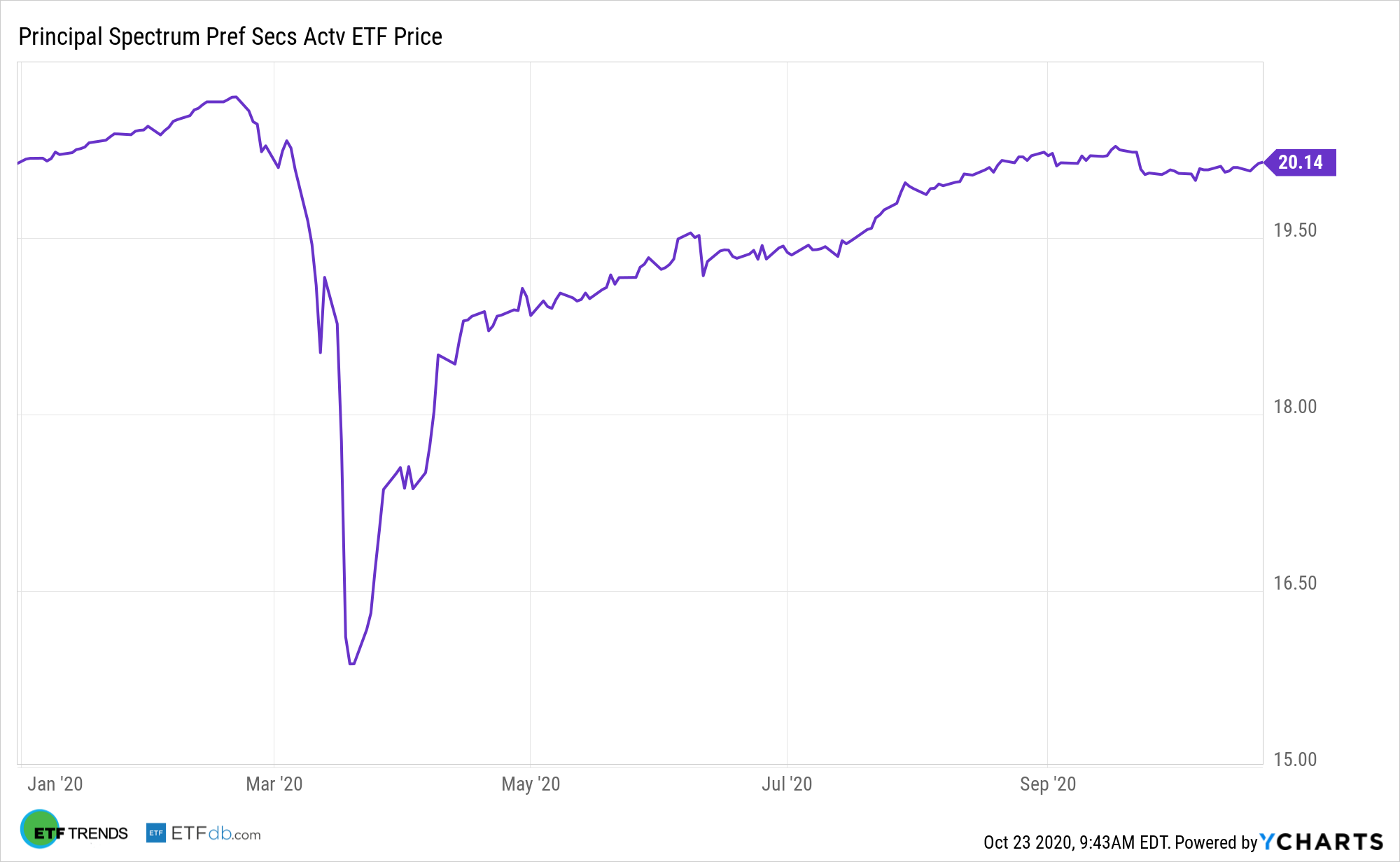

“Preferred stocks are popular investment options with income investors due to their junior position in the capital structure and hence relatively high yield as well as their favorable tax treatment. The preferreds sector, as many other fixed-income sectors, has gone through a roller-coaster ride since the beginning of the year,” according to Seeking Alpha.

How Can Preferreds Help Me?

Like common stock, preferred stock is issued by a company and traded on an exchange. Preferred stock prices can fluctuate, but most of the returns from preferred stock come from dividends. Unlike common stock, preferred stock dividends are predetermined and paid at regular intervals. These dividends are paid in full before any dividends are released to common stockholders.

PREF can act as a portfolio diversification tool and reducer of correlations. Another advantage of PREF’s active management is that the manager’s can look for value in an asset class that has been expensive for much of this year.

“Our main takeaway is that the sector’s increasingly expensive valuations has a number of knock-on impacts on investor portfolios. First, low overall yields mean fund fees create a larger relative drag on income,” reports Seeking Alpha.

Preferred stock is a class of equity security that typically pay fixed or floating dividends to investors and have “preference” over common stock, but are subordinated to bonds. The issuing company must pay dividends to preferred stockholders before common stockholders, and in the event of a bankruptcy or liquidation of the company’s assets, must put the claims of the preferred stockholders ahead of the claims of the common stockholders.

“Secondly, an increasing number of stocks are trading at negative yield-to-call, which, with increasing call activity, points to greater returns from active management. And thirdly, low overall yields suggest a more defensive stance in the sector as the opportunity cost of doing so is relatively low,” according to Seeking Alpha.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.