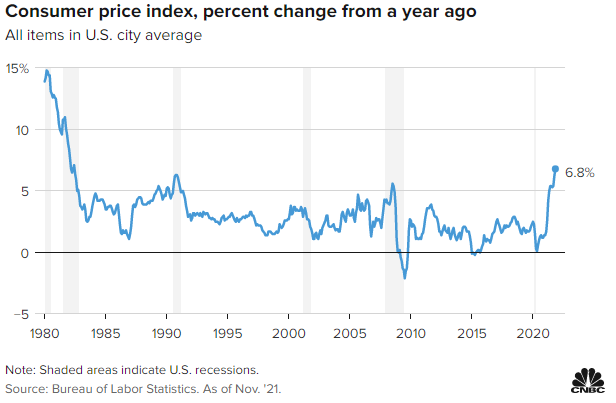

The consumer price index released November’s data, revealing somewhat higher-than-anticipated inflationary numbers as inflation continues to accelerate at a pace not seen since 1982, reports CNBC.

The CPI rose 0.8% for the month of November in a 6.8% increase year-over-year, the fastest rate of increase since June of 1982. Core CPI, which doesn’t include energy or food prices, rose 0.5% for the month and overall 4.9% year-over-year; it’s the fastest that core CPI has risen since 1991.

Image source: CNBC

Increases were driven by the usual players, with energy prices rising 3.5% last month and gaining 33.3% since November of last year — within energy, gasoline spiked 58.1%. Taking food into account, the gains in the two sectors were some of the fastest in 13 years, according to the Labor Department.

The housing crisis continues to grow, with the cost of shelter growing 3.8% for the year, the highest it has been since 2007. Shelter costs make up one-third of CPI, and the continued rises in housing costs make yet another inflationary pressure.

The ongoing pandemic is still the primary culprit of inflation, according to Fed officials, although the unique supply and demand pressures have resulted in higher-than-anticipated and longer-lasting inflation than policymakers might have originally expected.

“There’s no question no matter how you look at it, even if you take out the extremes caused by the pandemic, it’s still very high inflation,” said Randy Frederick, managing director of trading and derivatives at Charles Schwab. “This is still supply chain disruption, semiconductor-related inflation.”

All of this is creating an environment of uncertainty and volatility as markets bounce back and forth between inflationary fears and constantly updating news on Omicron, and these are the exact kinds of conditions that active investment managers and active funds can outperform in. Stock pickers have a chance to respond to market movements as they happen, shifting allocations around to maximize on price fluctuations.

Active management firm T. Rowe Price believes in the difference and benefits to active investing and active management. The firm currently offers eight actively managed ETFs for investors that are looking for a variety of options, including the T. Rowe Price Blue Chip Growth ETF (TCHP) within equities and the T. Rowe Price Ultra Short-Term Bond ETF (TBUX) within bonds.

For more news, information, and strategy, visit the Active ETF Channel.