To say cannabis exchange traded funds are experiencing a renaissance is a drastic understatement. One thing is clear: the AdvisorShares Pure US Cannabis ETF (MSOS) is leading the charge.

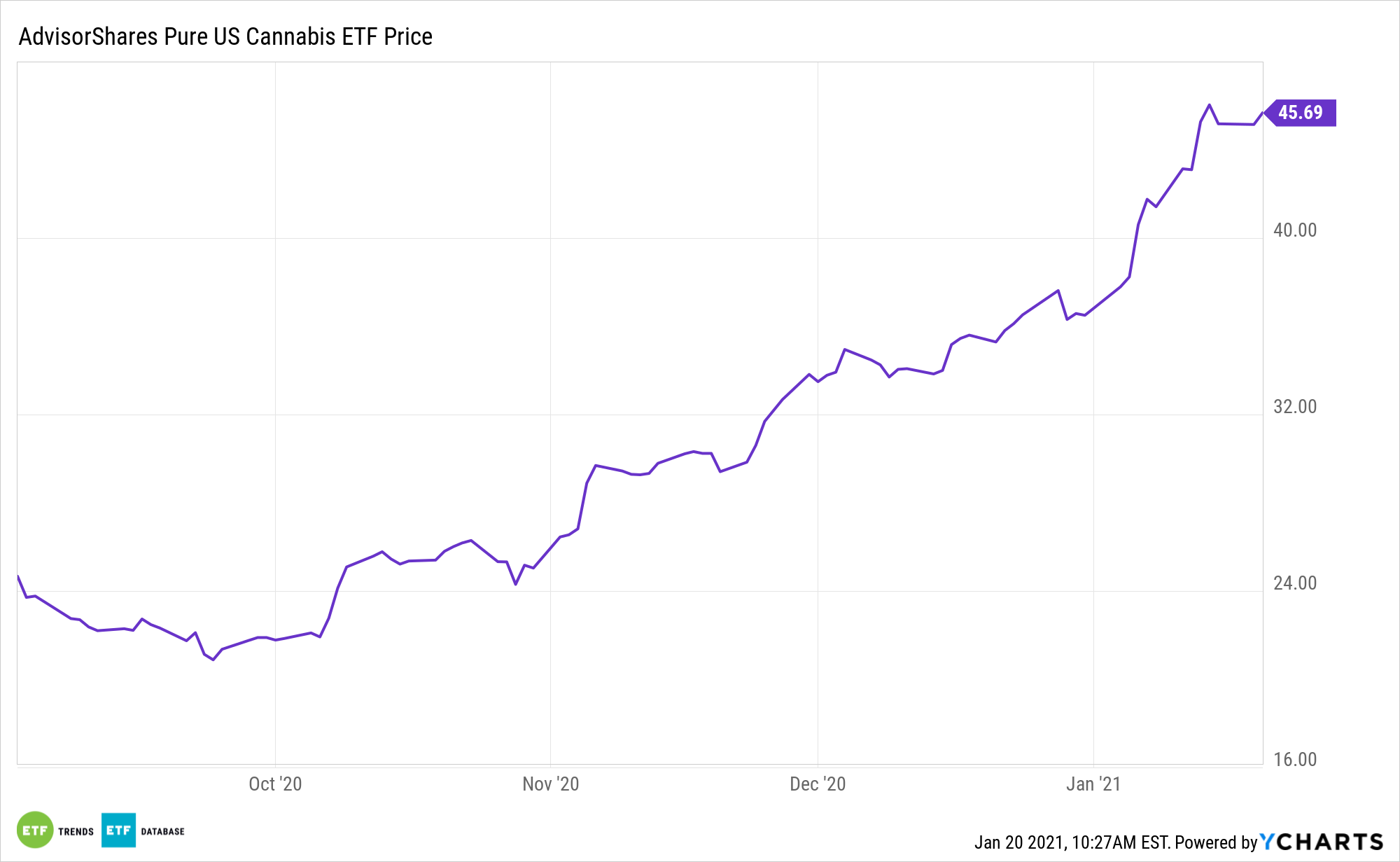

The actively managed MSOS, which debuted last September, has more than doubled in value over the past several months. Investors are taking notice, as highlighted by the fact that MSOS is now home to over $600 million in assets under management.

MSOS is first U.S.-listed active ETF to deliver exposure dedicated solely to American cannabis companies, including multi-state operators (MSOs). MSOs are U.S. companies directly involved in the legal production and distribution of cannabis in states where approved.

The AdvisorShares ETF is the first of its kind to focus on U.S. cannabis equities. That’s beneficial seeing that the U.S. is the fastest-growing marijuana market in the world.

MSOS seeks long-term capital appreciation by investing entirely in legal, domestic cannabis equity securities. MSOS’ domestic equity strategy allows this active ETF to allocate its underlying portfolio among multi-state operator (MSO) companies as well as other U.S.-based cannabis-focused areas such a REITs, cannabidiol (CBD), pharmaceuticals, and hydroponics.

Prospects for Marijuana Legalization

The marijuana-related sector has been strengthening as investors anticipate that the incoming Biden administration could loosen regulations. Meanwhile, more U.S. states have legalized sales in recent proposition votes.

Most recently, New York – the fourth-largest state by population – signaled it could join the roster of states with legal recreational cannabis.

The global cannabis market is expected to grow to $630 billion by 2040, compared to just $12 billion today. The cannabis industry is expected to expand into a $22 billion hemp-derived CBD product market in 2022, up from $591 million in 2018. Looking ahead, Canada’s cannabis industry is projected to grow six-fold in market value by 2026, up from $1.6 billion in 2018.

MSOS is up a staggering 33% over the past month.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.