With interest rates low and inflation creeping higher, dividends are taking on added importance in investors’ portfolios. Dividend growth strategies are increasingly relevant in the current market environment.

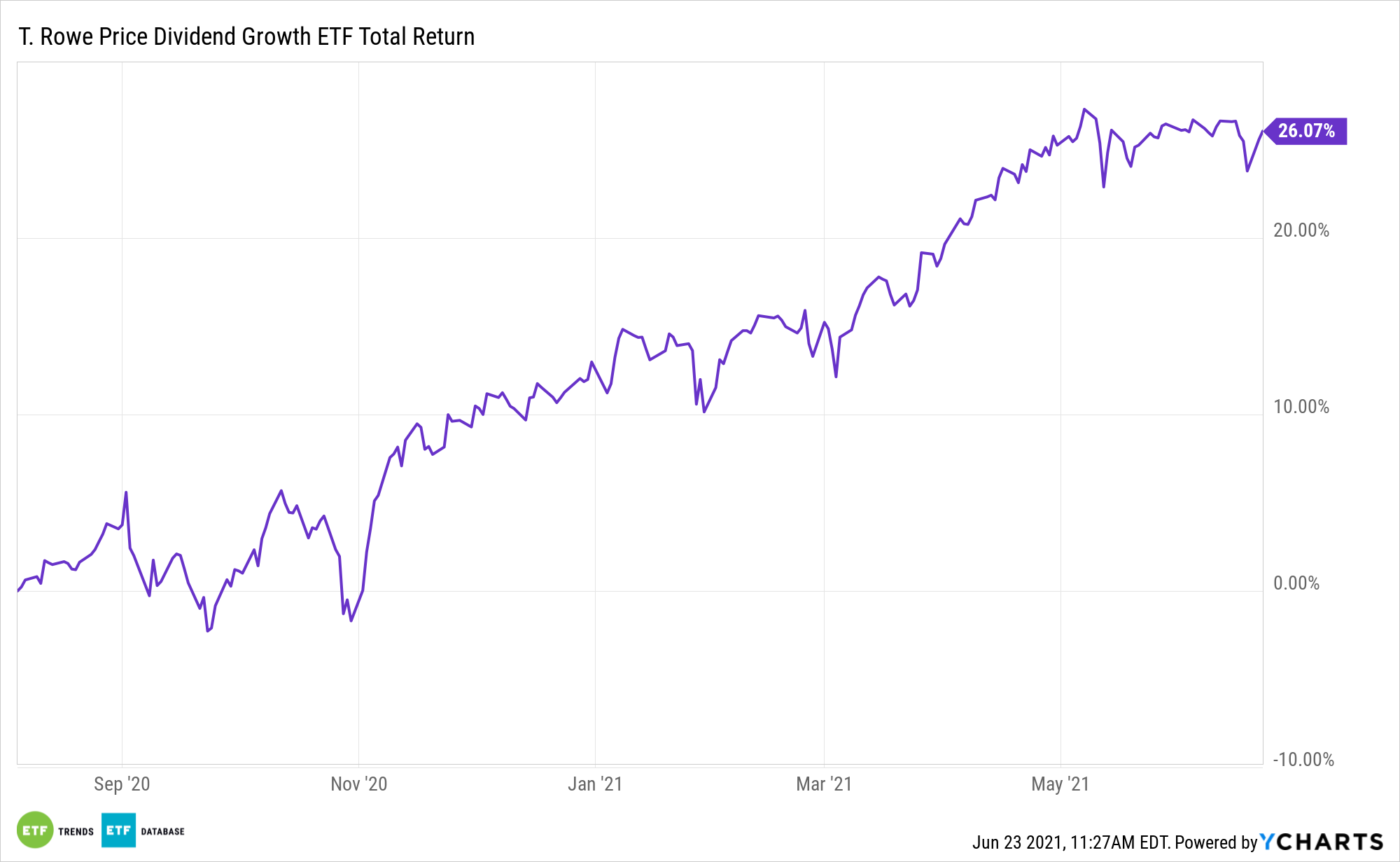

Considering that elevated importance, investors may want to evaluate pairing active management with dividend growth. The T. Rowe Price Dividend Growth ETF (TDVG) does just that. The exchange traded fund is appealing to a broad swath of investors, including both retirees and younger demographics.

“Many retirees rely (at least in part) on the regular income that dividend stocks throw off. Nonretirees, meanwhile, enjoy ‘getting paid to wait’–or the idea of collecting quarterly income from stocks while holding on for stock price appreciation,” writes Morningstar’s Susan Dziubinski. “Historically, dividends have been a key component of total returns, though that impact has been muted during the past several years as low- and no-dividend-growth stocks have driven a large portion of market return.”

Some competing passive strategies emphasize dividend increase streaks in their weighting methodology, but TDVG takes a different approach. The fund’s management team allocates at least 65% of its assets to stocks with encouraging dividend growth prospects and names with the ability to raise payouts over time.

As an active fund, TDVG isn’t confined by an index, meaning it has some flexibility. That flexibility extends to being able to scoop up stocks that are undervalued. Between some value holdings – appropriate in today’s climate – and dividend growth, TDVG could be a viable idea for long-term investors seeking reliable equity income. Plus, it’s not designed to embrace excessively high dividends.

“Growers typically don’t boast burly yields like yielders do, though they have their advantages. Notably, companies that regularly boost their dividends are usually profitable and financially healthy,” adds Dziubinski. “As such, these companies generally show some resilience during market downturns. Further, dividend-growth stocks can provide some inflation protection.”

TDVG is a semitransparent ETF, meaning its holdings aren’t disclosed on a daily basis. At the end of May, the fund’s top 10 holdings included Microsoft (NASDAQ: MSFT), Apple (NASDAQ: AAPL), and Visa (NYSE: V).

TDVG is the the ETF counterpart to the famed T. Rowe Price Dividend Growth (PRDGX), a mutual fund that Morningstar rates “silver.”

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.