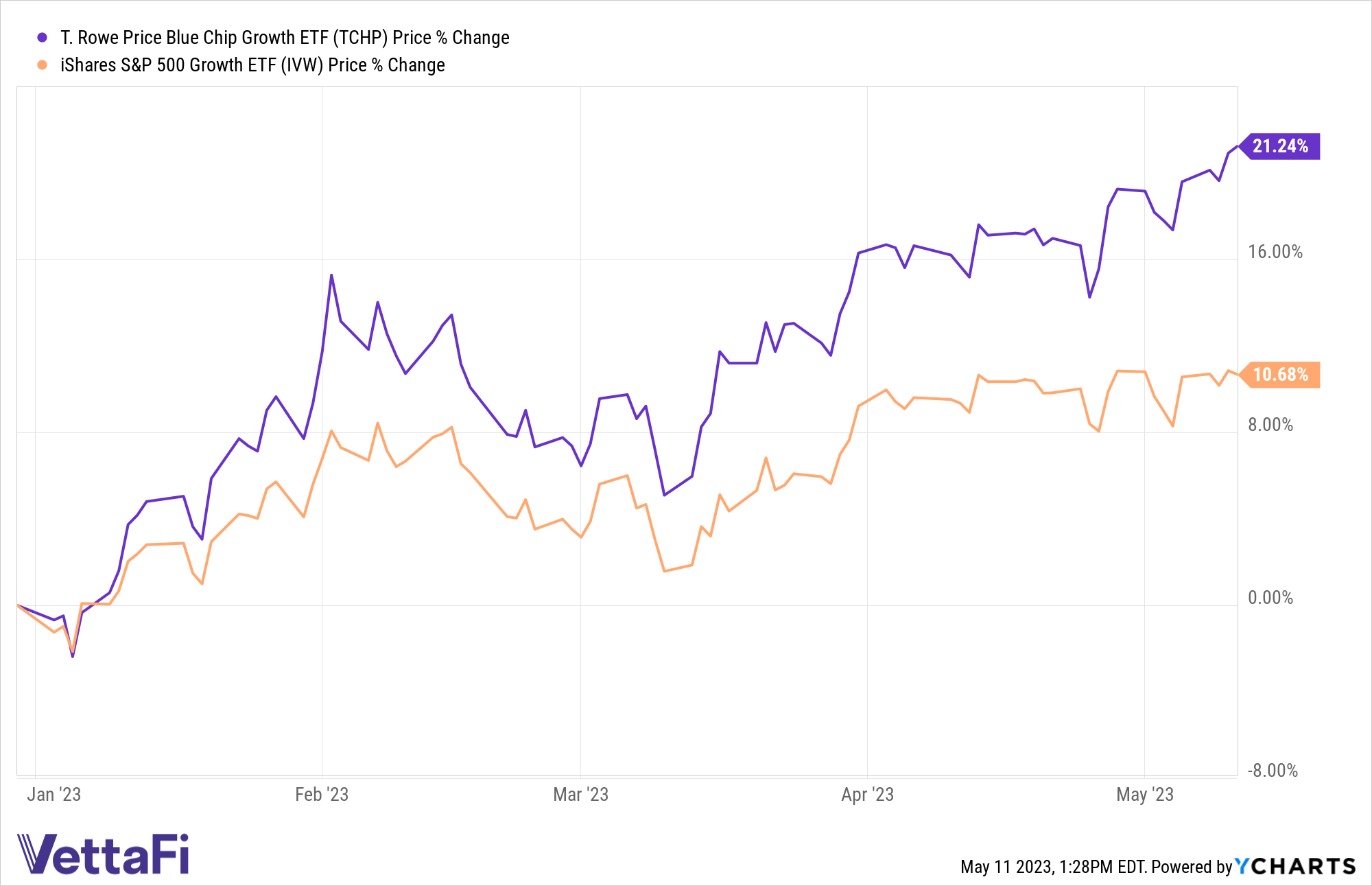

Not all active managers are created equal. Some have better track records in capturing alpha. This is no better demonstrated than comparing the long-term performance of two active ETFs. The T. Rowe Price Blue Chip Growth ETF (TCHP) has outperformed the iShares S&P 500 Growth ETF (IVW) by nearly 11 percentage points year-to-date as of May 10. That’s percentage points, not basis points.

Source: YCharts

“TCHP’s strong performance this year showcases why advisors are increasingly embracing active equity ETFs,” said Todd Rosenbluth, head of research at VettaFi.

See more: “Debt Ceiling Fight May Make Markets Go Sideways.”

TCHP targets large and medium-sized blue-chip company stocks with the potential for above-average earnings growth. The fund focuses on companies with leading market positions, seasoned management, and strong financial fundamentals.

“Active management is on display in 2023 with the benefits of security selection,” Rosenbluth added. “TCHP has a more concentrated approach than index-based large-cap growth strategies. This includes a hefty stake in Microsoft while owning stocks like Meta that are no longer part of the S&P 500 Growth Index.”

A Strategy for The Road Ahead

Active ETFs can be a valuable tool for investors during prolonged periods of market volatility or protracted economic downturns. While passive funds drive by looking in the rearview mirror, active strategies look through the windshield at the road ahead.

However, only a handful of active managers can provide alpha, regardless of market conditions. Active managers with greater resources and greater scope benefit from economies of scale, which can often translate to better returns.

TCHP is part of a lineup of active ETFs that T. Rowe Price offers. T. Rowe Price has been in the investment business for over 85 years. The firm conducts field research firsthand with companies, utilizing risk management and employing a team of experienced portfolio managers carrying an average of 16 years of experience.

For more news, information, and analysis, visit the Active ETF Channel.