There are some inklings in the markets that growth stocks may be starting to turn a corner. For example, 10-year Treasury yields recent steadied and the S&P 500 Growth Index is higher by almost 5% for the month ending June 18.

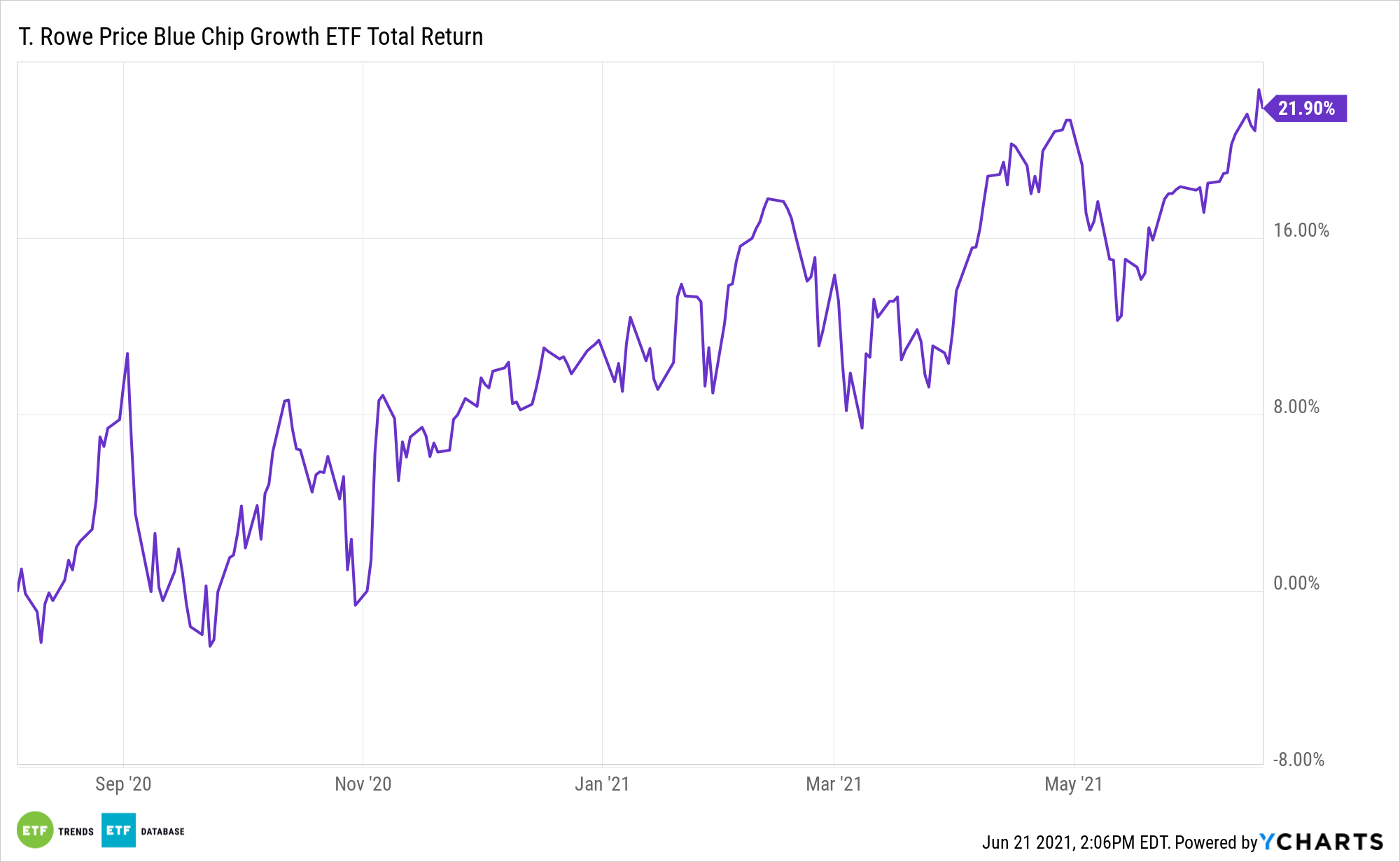

Still, it’s worth considering how quality can play pivotal role in mitigating some of the risk associated with growth. Enter the T. Rowe Price Blue Chip Growth ETF (TCHP).

TCHP is an actively managed fund, and that’s a potential source of allure for investors looking to blend quality and growth while positioning for a growth stock rebound.

“While quantitative models can help in identifying broad trends, isolating quality companies is ultimately a bottom-up effort that requires deep research and a fundamental approach to stock selection,” according to BlackRock research. “We believe this is an area where active disciplines can add value for shareholders, particularly as this unusual market and economic cycle powers on to its next phases.”

The Time Could Be Right for TCHP

A primary reason why growth stocks are lagging this year is that the economy is in recovery mode – a phase in the economic cycle that’s historically conducive to owning cyclical stocks. Many companies with the cyclical designation dwell in value territory.

However, as the recovery from the coronavirus pandemic advances and expansion takes hold, the tale easily turns. Additionally, it’s rarely a bad time to embrace high quality over low quality. Fortunately, many TCHP holdings fit the bill as high-quality names.

“Our research further found that stocks that scored higher on our quality screen performed strongly relative to their lower-quality counterparts when economic indicators were flat or falling,” adds BlackRock. “Assuming the economic data will invariably need to soften from the lofty levels of the post-pandemic restart, these findings would suggest a favorable set-up for quality stock performance.”

TCHP is a semi-transparent exchange traded fund, meaning its holdings aren’t disclosed on a daily basis, but many of the fund’s holdings at the end of the first quarter check both the growth and quality boxes. Those include Amazon (NASDAQ: AMZN), Facebook (NASDAQ: FB), Microsoft (NASDAQ: MSFT), and Apple (NASDAQ: AAPL), among others.

TCHP’s sector tilts confirm the quality/growth purview as technology and communication services combine for about 62% of the fund’s weight, as compared to 37.33% for the benchmark.

For more news, information, and strategy, visit the Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.