U.S. investors may be tired of the shift to a macro environment defined by lingering inflation and high interest rates. That doesn’t mean the grass is necessarily greener on the other side, however, as intriguing EM equities opportunities also face those macro issues.

An active investing approach could be one option for those looking to diversify outside the U.S. for exciting foreign equities opportunities while also avoiding foreign firms facing challenges similar to those faced by many U.S. companies.

See more: “3 Key Takeaways From T. Rowe Price’s 2024 Outlook“

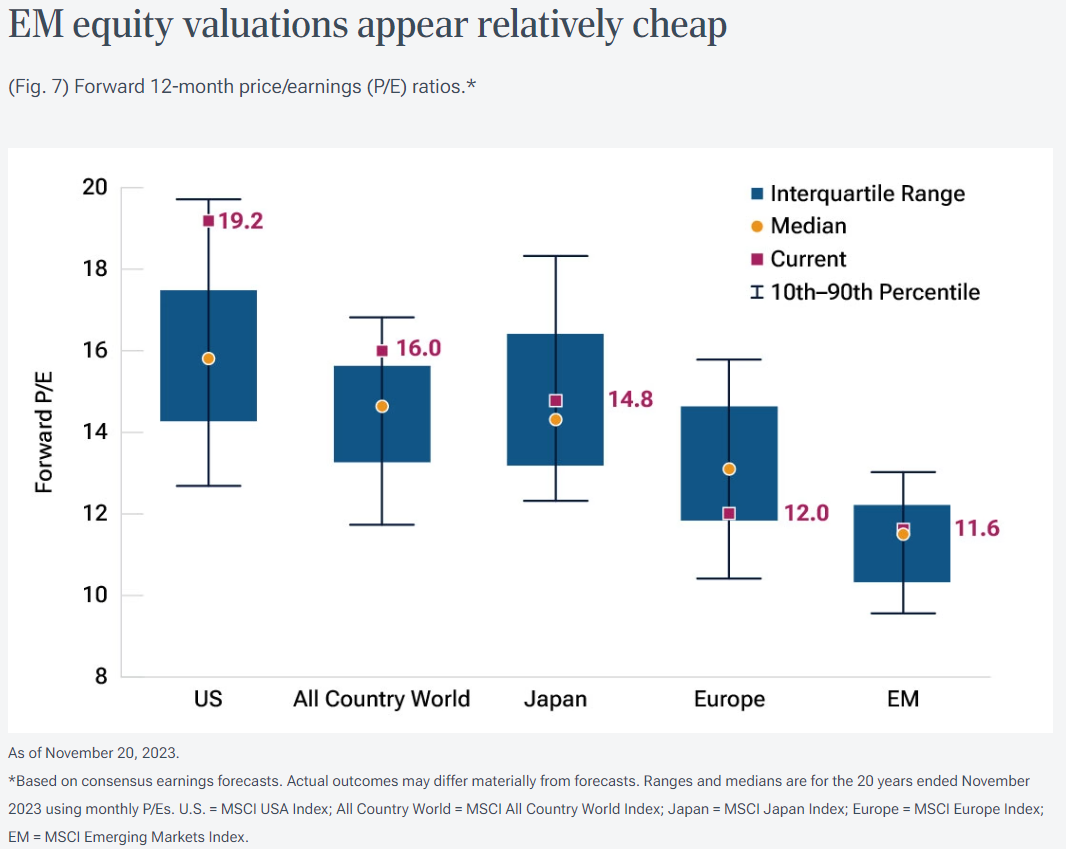

What are those EM equities opportunities to watch out for right now? Research from T. Rowe Price underscores areas with some attractive valuations as well as upside. The broad shift away from centralized supply chains, per the firm’s analysis, combined with potential stimulus opportunities, could favor EM nations.

EM Equities present some appealing valuations for investors per T. Rowe Price analysis.

That said, not all EM equities opportunities are created equal. Indeed, for many index makers and market watchers, China remains an “emerging markets” nation. However, the country stands apart from many other emerging markets not only because of its sheer size but also because of its outlook. China looks sluggish entering 2024, with leadership there outwardly acknowledging tough times for the economy.

Moreover, the opportunities “within” emerging markets don’t always match up. Like any economy, a given market will see its ups and downs, but outside investors may lack the expertise or experience to navigate its idiosyncrasies. Those factors together all underline the value of an active approach to foreign equities.

Should Investors Choose Developed International Exposure Instead?

That said, EM equities offers just one route away from expensive U.S. equities. Developed nations can appeal, too, and in some cases may appeal more to U.S. investors looking for reliable track records. Various sectors within developed markets can also see their own upswings that merit a look as much as EM equities overall might, for example.

At the end of the day, emerging markets can be hard to navigate and may not be suitable for all investors. There are many geopolitical risks to consider with EM, including those associated with emerging economies.

Some investors considering EM may also want to consider developed international regions, with active investing a potent tool to operate in both spaces. Developed international equities markets like Japan’s offer exposure to a mix of industries, including stalwart tech names that combine benefits like improved governance, innovation, and potential stimulus.

In this case, T. Rowe Price International Equity ETF (TOUS) provides a diversified active approach to well-established international markets like Europe and Japan. For only 50 basis points, the fund actively invests across a range of industries and market caps, but primarily through established large-cap companies showing high growth potential.

For more news, information, and analysis, visit the Active ETF Channel.