There has recently been a broad‑based rally in value stocks over the past six months, but understanding secular risk is still critical for value‑oriented investors. Still, there’s a potential for the rally in cyclical stocks to continue, though in favor of names with higher-quality business models. In the T. Rowe Price Article, “Seeking Value Stocks on the Right Side of Change,” portfolio manager Mark S Finn, CFA, CPA, discusses how accelerating disruption creates potential opportunities for value investors.

Having taken advantage of the steep sell-off in consumer discretionary, financials, and other cyclical sectors hit hard by the economic shutdown in 2020, the fund should offer meaningful exposure to the reopening.

As stated in the article, “Now is not the time for value investors to forget the lessons of the past decade and a half, when a wave of technological innovation disrupted many traditional industries—a trend that, in some cases, the shifts in behaviors and priorities stemming from the coronavirus pandemic appear to have accelerated.”

Value investors need to understand secular risk. This knowledge will help investors avoid the inexpensive names bound for long-term headwinds from disruption and take on opportunities not fully appreciated by the market, despite being on the right side of change. Using these lessons informs T. Rowe Price’s investment decisions, as they seek quality cyclical stocks that could be well-positioned in the current environment, let alone the future.

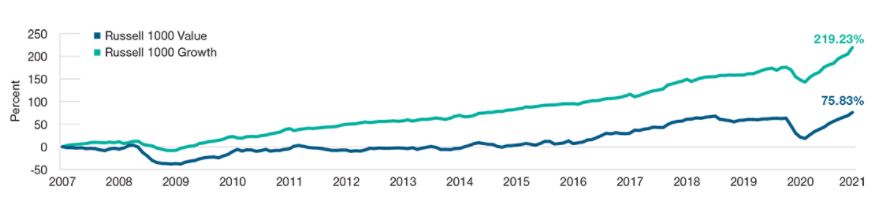

The cumulative growth in 12-month forward free cash flow per share.

May 31, 2007, to April 30, 2021.

Actual outcomes may differ materially from forward estimates.

Source: T. Rowe Price analysis using data from FactSet Research Systems Inc. All rights reserved.

From Disruption Comes Risk and Opportunity

Thanks to the disruption of traditional industries due to innovation, much hurt has been laid on value stacks for over a decade. During this time, innovation has disrupted industries by siphoning off profit pools or introducing deflationary pressures weighing on profit margins. In turn, these consistent headwinds lead to shrinking valuation multiples for companies on the wrong side of innovation.

As noted, “In keeping with our quality bias, we have remained cautious on energy stocks and prefer to find cyclical exposure in other industries.”

For T. Rowe Price, ongoing productivity gains from automation and improved reservoir management techniques in oil and gas fields should make hydrocarbons easier and less expensive to extract, which creates a challenging environment for operators to navigate. In the long term, that means having to be wary of the potential for growing concerns in the sector as the clean energy transition progresses.

With that said, some secular forces can create opportunities for value-oriented investors in mature industries. The firm’s emphasis on relative valuations tends to allow more flexibility to invest behind secular growth trends.

The Value of E-commerce

E-commerce is a theme that is usually the province of growth investors due to elevated valuations that price in a great deal of future earnings potential. “We believe this trend has more room to run as consumers become more comfortable purchasing a growing array of products online, including groceries. Greater adoption of e‑commerce means increased demand for the real‑world logistics that enable this pillar of the convenience economy.”

T. Rowe Price also likes the dominant players in the US air freight and logistics industry. Those companies offered exposure to rising e-commerce shipment volumes and have several layers that can expand gross margins in the coming years.

Digitalization and Semiconductors

There’s also favor for the companies producing the computer chips enabling the digitalization of the traditional economy. The long-term prospects for the developers of analog chips and tools used to produce leading-edge semiconductors are also attractive.

For the company, analog semiconductor businesses will benefit from the proliferation of their products in a wide range of industries. “These chips translate inputs from the physical world into digital information, making them essential to innovations that automate real‑world processes and reduce downtime through predictive maintenance. The auto industry, for example, is an important source of demand growth as vehicles electrify and the push for autonomous driving continues.”

The e-commerce value chain.

This growing demand is clearly great for well-positioned companies, but the broadening end markets for these products will help moderate the cyclicality in their earnings.

“We believe that the semiconductor capital equipment companies that we favor stand to benefit from increasing demand and the rising cost of producing the faster, more‑efficient chips enabling widespread digitalization and the intensive workloads associated with artificial intelligence.”

However the recovery cycle evolves, there’s a commitment to investing in quality businesses that trade at attractive relative valuations and offer exposure to several potential upside catalysts over a multiyear time frame. ” Understanding how the forces of innovation and disruption can create potential risks and opportunities remains central to our investment process and decision‑making. To this end, we seek to avoid names that we believe face persistent secular challenges while favoring attractively valued companies that could benefit from being on the right side of change.”

For more news, information, and strategy, visit the Active ETF Channel.