Despite the stock market turmoil that’s been dropping a heavy dose of volatility on investors due to inflation fears, dividends have been giving fixed income investors reason to cheer. However, it’s not prudent to simply pick a stock with the highest-producing dividend, but rather one that can sustain this level of income over time.

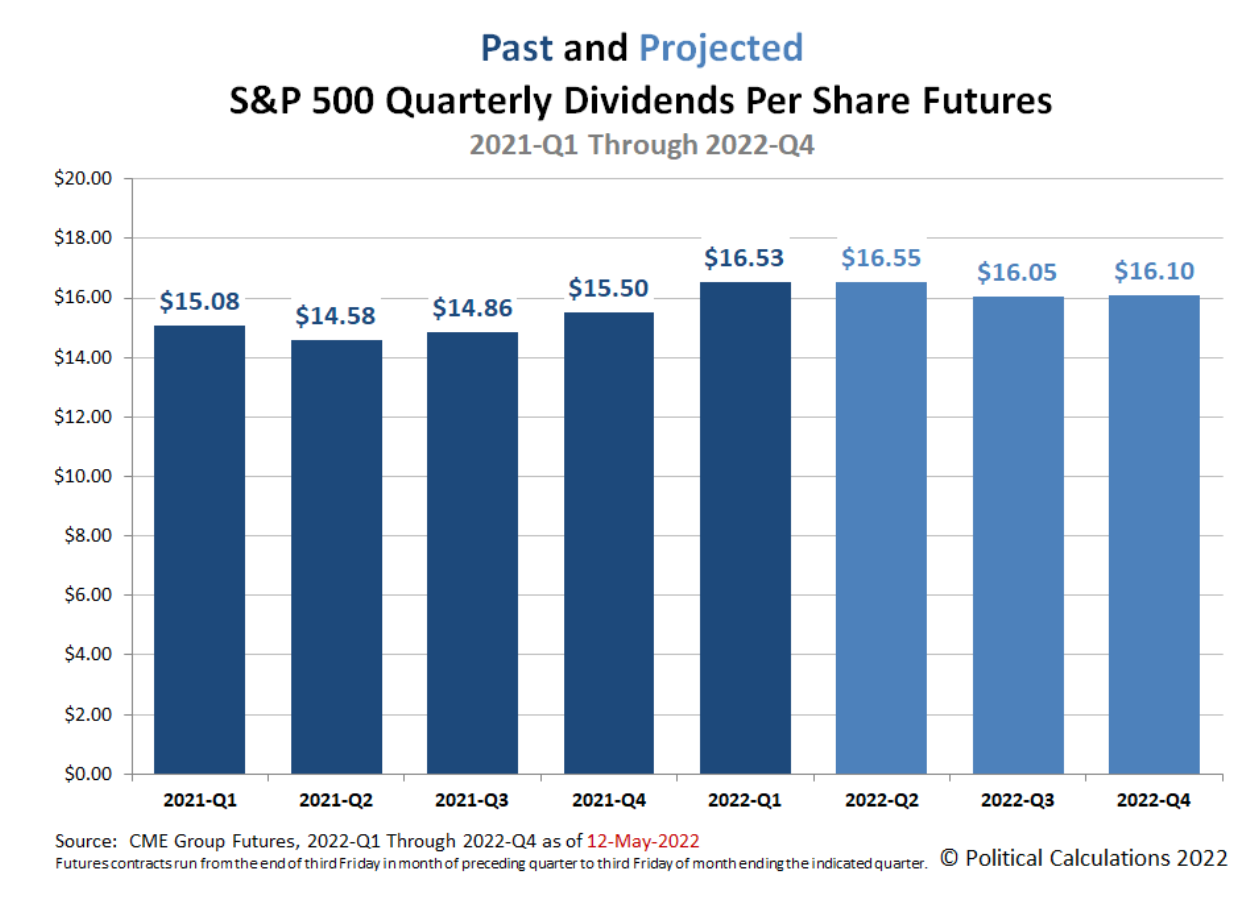

One bright spot moving forward for dividends is that projected dividend futures look positive through the rest of 2022. With the expectation of more rate hikes by the Federal Reserve, this should give income-focused investors a continued non-bond avenue for generating sources of yield.

“Dividend futures indicate the amount of dividends per share to be paid out over the period covered by each quarter’s dividend futures contracts, which start on the day after the preceding quarter’s dividend futures contracts expire and end on the third Friday of the month ending the indicated quarter,” a Seeking Alpha article by Ironman at Political Calculations explained.

Using Active Management

As mentioned, simply producing dividends in the short-term isn’t enough. Investors will want exposure to companies that can maintain dividends over time, which is where the T. Rowe Price Dividend Growth ETF (TDVG) comes into play.

Using an active management strategy driven by fundamental analysis, TVDG’s manager seeks stocks that aren’t all about yield and yield alone. Staying power is what the fund looks out for — names that can sustain their dividends over time while also having solid fundamentals.

The portfolio typically holds between 100 to 125 dividend‑paying stocks selected through analysis based on fundamentals such as the potential for generating excess cash flow, the potential trajectory of the company’s financial condition, and the quality of the stock’s management. The portfolio maintains a relatively broad set of equities across industries to help manage position sizes and control the risk profile.

TDVG employs a conservative, “growth‑at‑a‑discount” approach that emphasizes dividend growth, especially when valuations appear temporarily depressed. Rather than chasing returns, this research-driven approach is designed to help limit the volatility typically experienced from shifts in momentum or changing investor sentiment.

For more news, information, and strategy, visit the Active ETF Channel.