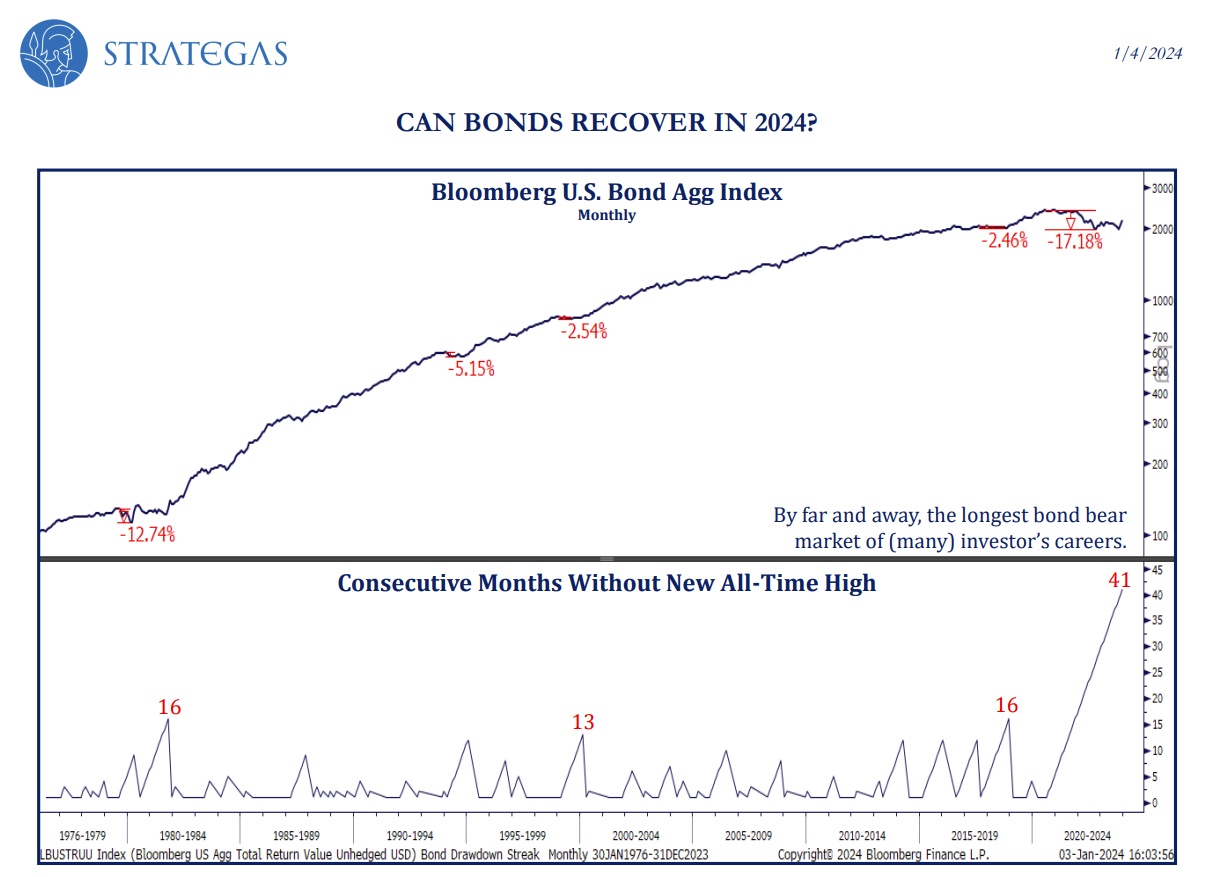

Longtime watchers of the Bloomberg U.S. Bond Aggregate Index, or the “Agg,” will recognize that it’s had a tough time of late. Per analysis from Strategas ETF Research, the Agg has gone 41 months without a new all-time high. While that may seem like a big ask, the longest it’s gone without such a marker was 16 months going back to 1976. Still, with green shoots in bond land, the right strategy, like an active bond ETF, could be the right play for a duration push.

A staid AGG could yet provide opportunities for outperformance.

While yes, it’s been the longest bear market for many bond investors, those investors can still look forward to some intriguing opportunities. To put it mildly, the Fed seems unlikely to raise rates this year, with markets pricing in potential rate cuts.

See more: Looking Back on Active Investing’s 2023 Tally

Instead, the big question around the yield curve may be timing and identifying the right slices of the duration pie. Falling rates may boost returns, but if bond markets jump the gun, prices could overshoot on overzealous optimism about the economy. Inflation and lagging rate hike aftershocks could still shake up the soft landing narrative and throw off bond projections. At the same time, the deficit may yet cause a cascade of Treasurys that inspire firms to refinance their own lower-rated debt.

An Active Bond ETF to Start 2024

So, while it may be time to add some more duration, investors may want to take an active bond ETF approach in doing so. The T. Rowe Price QM U.S. Bond ETF (TAGG) could be one option to do so. The strategy, which will hit its three-year ETF milestone this Fall, charges just eight basis points (bps). For that very competitive fee, which is lower than many passive strategies, the actively managed TAGG ETF seeks to exploit the insufficiencies of bond indexing and provide a total return exceeding the Agg, its benchmark.

Investing across a wide range of debt securities with an intermediate to a long-term set of maturities, the active bond ETF empowers its managers to seek the best opportunities in a complicated landscape. TAGG has outperformed its ETD Database Category and Factset Segment averages over the last month and could be one solid option to eye as 2024 kicks into gear.

For more news, information, and strategy, visit the Active ETF Channel.