Key Takeaways

The latest Schwab investor study provides encouraging signs for overall ETF usage and in particular actively managed ETFs.

The latest Schwab investor study provides encouraging signs for overall ETF usage and in particular actively managed ETFs.- Among non-investors surveyed, 45% expect to purchase an ETF in the next two years, citing diversification, ease of use, and low costs as the most appealing traits.

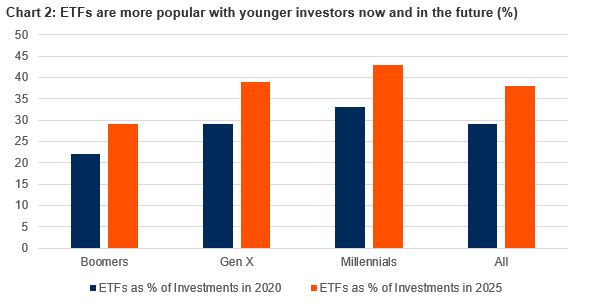

- Millenial investors expect ETFs to grow to 43% of their portfolio in five years, up from 33%, a higher rate than their parents.

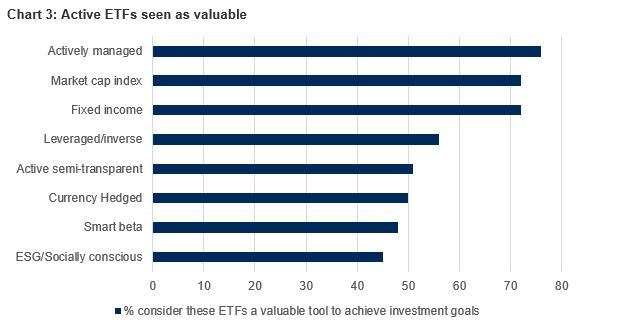

- Despite representing just 3.5% of the ETF market, actively managed ETFs were the most popular choice among the Schwab respondents to help reach investment goals, higher than market-cap weighted and smart-beta ETFs.

Fundamental Context

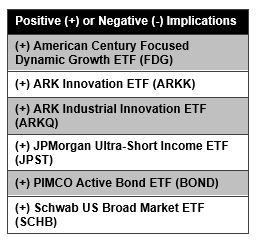

Growth is likely to come from younger ETF Investors and those not currently using ETFs. Even as ETFs have gained market share over mutual funds in the last few years, a newly released 2020 ETF Investor Study conducted by Charles Schwab provided insights into what is potentially in store for the future. Not surprisingly, 94% of the 1,500 current ETF investors were likely to consider purchasing an ETF in the next two years, but so were 45% of the 1,000 current non-ETF investors. When asked to explain why they were likely to consider buying ETFs, the top reasons cited were to diversify their portfolio (60%), ETFs are easy to buy and sell (49%), and ETFs are low cost (34%). Indeed, there are 12 ETFs rated by CFRA with expense ratios of 0.03% or less, including Schwab US Broad Market ETF (SCHB), which owns over 2,500 securities.

Among ETF investors surveyed, 41% considered themselves extremely confident in their ability to choose an ETF to achieve financial objectives, up from 18% five years earlier, while the percentage that said they were not at all confident fell to 6%, from 24%.

“Education is a key ingredient to success in all aspects of investing, so it is very exciting to see the evolution that has taken place with ETF investors’ familiarity and comfort with ETFs,” said David Botset, SVP of Product Strategy for Charles Schwab Investment Management.

Younger investors are more comfortable with ETFs than their parents or grandparents. While ETF investors surveyed currently had an average of 29% of investments through ETFs, those between the ages of 56 and 74 (Baby Boomers) had just 22%, while those between the ages of 40 and 55 (Generation X) and ages 25-39 (Milennials) had 29% and 33% of respective assets in ETFs. However, looking ahead to 2025, millennials expect this percentage to rise 43%, higher than the 38% for all surveyed, while Baby Boomers only expect it to climb to 29%.

Actively managed ETFs have a bright future. Although active ETFs represent just 3.5% of the $5.9 trillion U.S. listed ETF market, they were the most popular choice among the Schwab ETF investor survey respondents, with 79% saying they consider the product a valuable tool to help reach investment goals. Market-cap index ETFs (72%) and fixed income ETFs (72%) were the others to be chosen by more than seven in ten respondents.

When the survey was conducted last November, demand for actively managed equity ETFs, such as ARK Innovation ETF (ARKK 127 *****) and ARK Industrial Innovation (ARKQ 86 *****) were heating up.

Yet, the combined interest in actively managed ETFs and fixed income ETFs bodes well for JPMorgan Ultra-Short Income ETF (JPST), PIMCO Active Bond ETF (BOND), and others. Interestingly, active semi-transparent ETFs, such as American Century Focused Dynamic Growth (FDG), first came out only six months prior to the survey being conducted. However, these ETFs, which disclose holdings with a delay, were considered a valuable tool by slightly more respondents (51%) than the more established and fully transparent smart-beta index ETFs (48%).

Conclusion

As U.S. listed ETFs approach the $6 trillion mark, future growth will be aided as more retail investors gain comfort in the ETF wrapper and younger investors look to ETFs to support a likely higher asset base. For advisors, such insight is important as they look to support end-client objectives. CFRA provides forward-looking star ratings on approximately 1,900 equity and fixed income ETFs, inclusive of active and index-based funds, with a focus on reward potential, risk mitigation, and cost reduction.

Todd Rosenbluth is Director of ETF & Mutual Fund Research at CFRA.