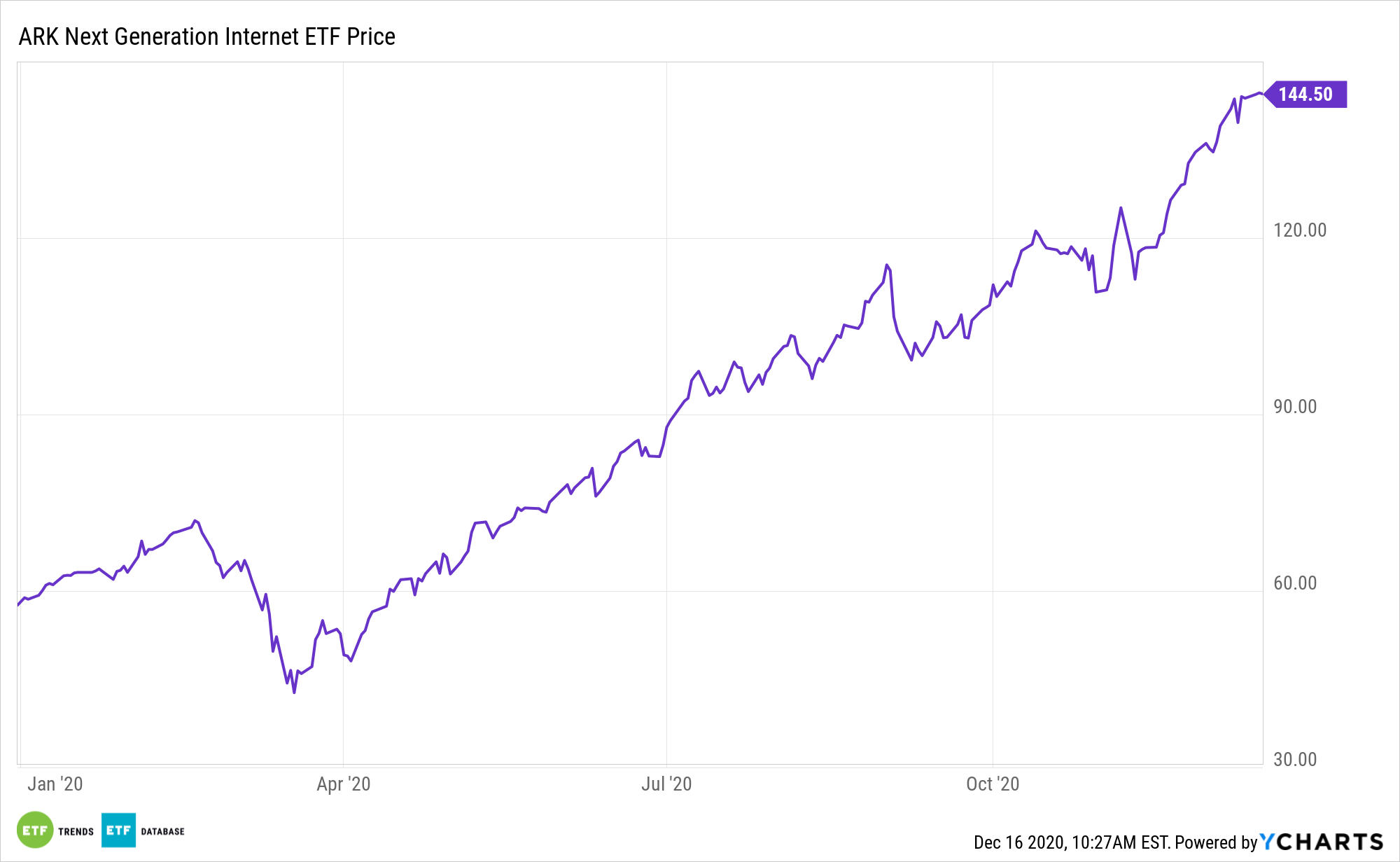

Internet stocks and exchange traded funds are delivering tidy returns this year. Leading the pack is the ARK Web x.0 ETF (NYSEArca: ARKW).

ARKW aims to capture long-term growth with a low correlation of relative returns to traditional growth strategies and negative correlation to value strategies. It serves as a tool for diversification due to little overlap with traditional indices. The actively managed strategy combines top-down and bottom-up research in its portfolio management to identify innovative companies and convergence across markets. This active strategy comes in the low-cost and efficient ETF wrapper.

Some ARKW components are levered to trends in online advertising spending, a point in the actively managed ETF’s favor because online ad spending is expect to jump over the next several years.

“We expect online ad spending to grow 20% next year and at a 14% average rate for 2022-24. By comparison, we expect total ad spending to increase 10.5% next year and at a 9% average rate for 2022-24,” writes Morningstar analyst Ali Mogharabi.

Breaking Down the ARKW ETF’s Stellar Year

Be it cord-cutting, online retail, or social commerce, ARKW has a legacy of allocating to disruptive corners of the internet segment.

ARKW components “are focused on and expected to benefit from shifting the bases of technology infrastructure to the cloud, enabling mobile, new and local services, such as companies that rely on or benefit from the increased use of shared technology, infrastructure and services, internet-based products and services, new payment methods, big data, the internet of things, and social distribution and media,” according to ARK Invest.

Add digital advertising trends to the list of compelling ARKW segments.

“We expect the market will return to solid growth next year, though, powered by the expansion of e-commerce and consumer time spent online that the pandemic has fueled, coupled with a return to economic growth,” notes Mogharabi. “We believe higher digital ad spending on direct-response (or bottom-of-the-funnel) campaigns and the return of more upper-funnel brand marketing will drive advertising budgets higher through 2024, leaving traditional ad channels like television competing for a stagnant revenue pool.”

While standard internet ETFs rely on companies like Amazon (NASDAQ: AMZN) and Facebook (NASDAQ: FB) to drive returns, ARKW allocates over 18% of its combined weight to Tesla (NASDAQ: TSLA) and Roku (NASDAQ: ROKU), two of this year’s best-performing names across sector and industry.

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.