Dimensional Fund Advisors (DFA) recently launched three actively managed exchange traded funds. The funds are off to a great start in the actively managed space.

The ETFs extend how clients may access Dimensional’s investment approach, which draws insights from financial research to emphasize areas of the market with higher expected returns and adds further value through daily implementation that has been tested, refined, and advanced for over 39 years. Dimensional has one consistent investment philosophy that underpins all strategies managed by the firm, regardless of asset class, region, or investment vehicle.

“The $601 billion manager founded by David Booth has amassed over $700 million among its three debut ETFs, which launched in November and December, according to data compiled by Bloomberg. The trio has absorbed roughly $337 million so far in 2021,” reports Katherine Greifeld for Bloomberg.

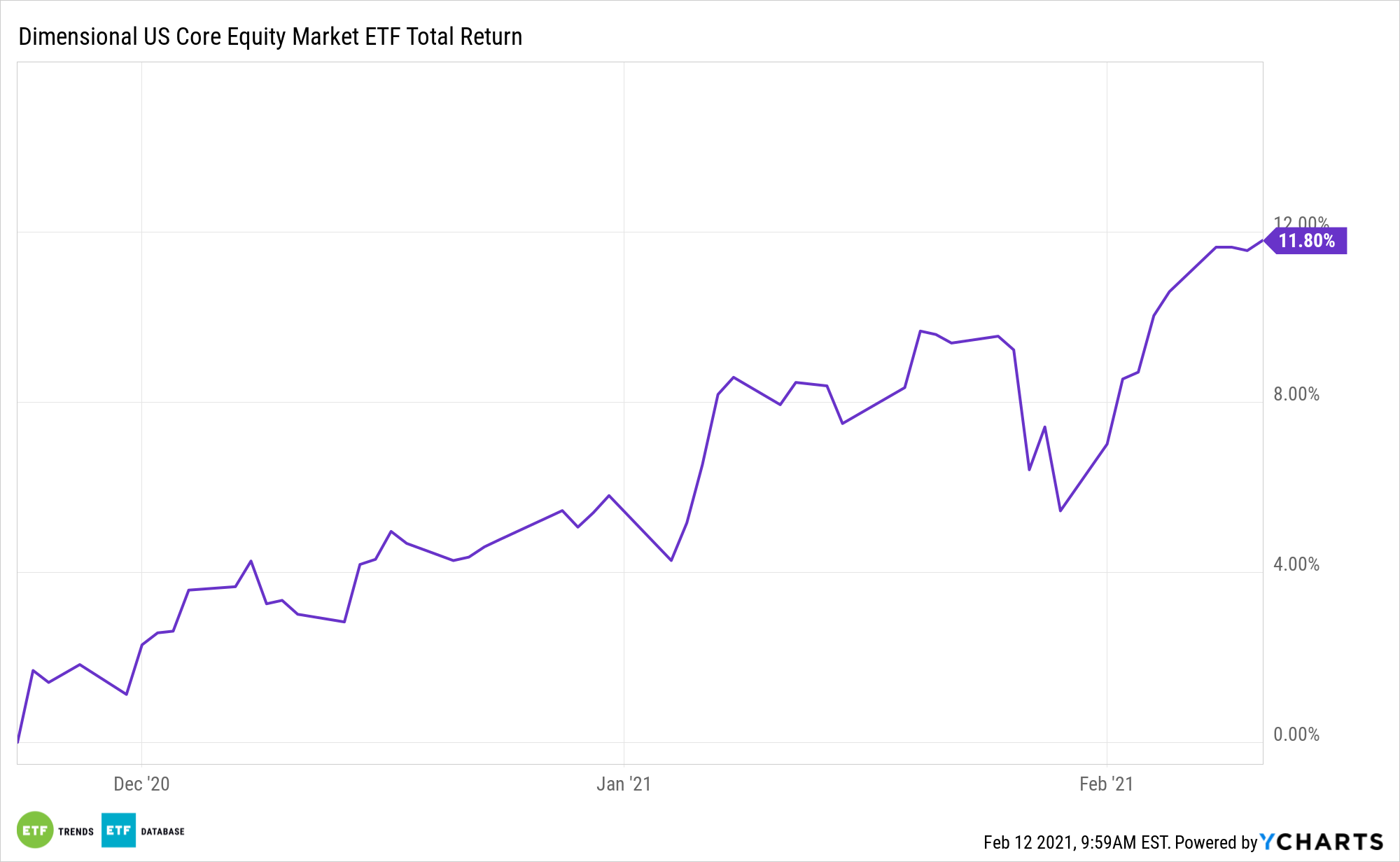

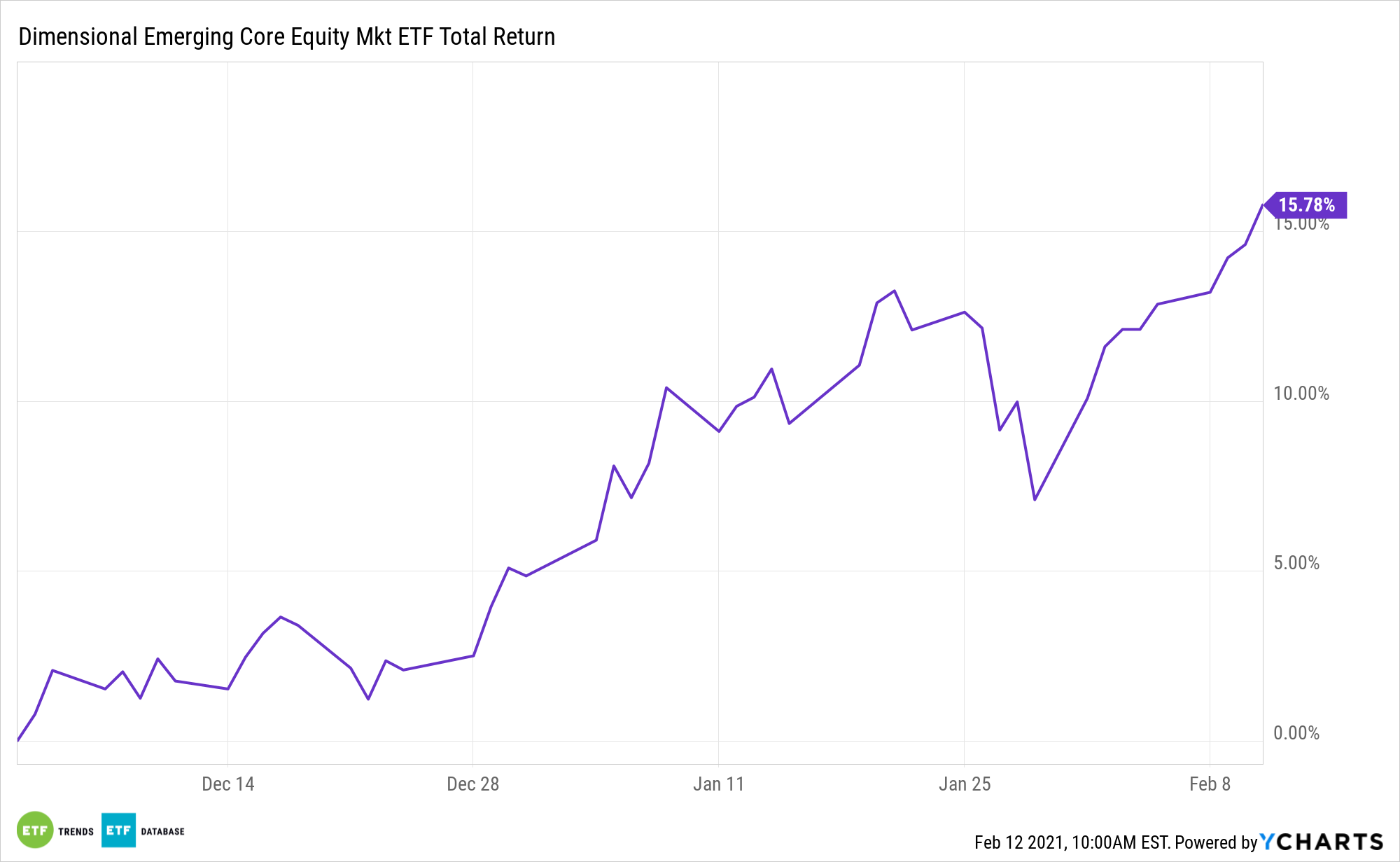

DFA’s three active ETFs are the Dimensional US Core Equity Market ETF (NYSE Arca: DFAU), Dimensional International Core Equity Market ETF (NYSE Arca: DFAI), and the Dimensional Emerging Core Equity Market ETF (NYSE Arca: DFAE).

An Impressive ETF Debut for DFA

DFA is known for being one of the sharpest quantitative managers. Prior to introducing its own ETFs, the firm provided indexes and methodologies for John Hancock Investment Management ETFs, a relationship that remains intact.

Dimensional Core Equity solutions are designed to offer broadly diversified, all-cap core exposure, emphasizing securities with higher expected returns using variables such as company size, relative price, and profitability. The Core Equity market portfolios aim to achieve a light level of tilt from market cap weights and low tracking error to the market through a daily managed approach.

“The strong start is a good omen for the Wall Street holdouts now entering the ETF industry, and for mutual fund managers who have seen investors fleeing to cheaper options,” according to Bloomberg.

For more on active strategies, visit our Active ETF Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.