Convertible bonds are enjoying their best year in over a decade. Some unique exchange traded funds feature exposure to the asset class without an all-in commitment, and the Principal Spectrum Tax-Advantaged Dividend Active ETF (PQDI) tops the list.

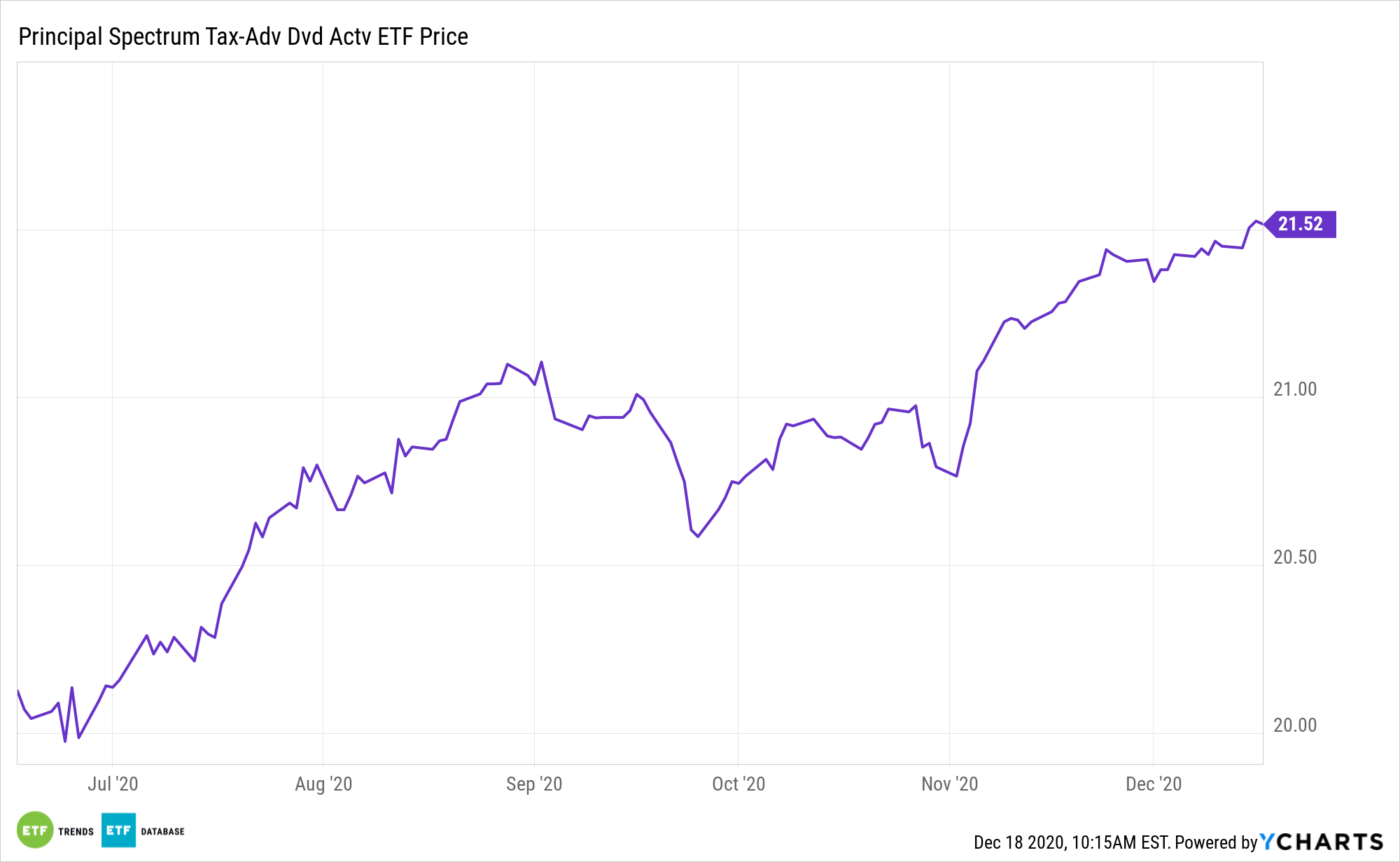

PQDI, which debuted in June, offers exposure to multiple income assets, including convertibles. The Principal ETF “seeks to provide current income. Under normal circumstances, the fund invests at least 80% of its net assets, plus any borrowings for investment purposes, in dividend-paying securities at the time of purchase,” according to Principal. “Such securities include, without limitation, preferred securities and capital securities of U.S. and non-U.S. issuers. The fund invests significantly in securities that, at the time of issuance, are eligible to pay dividends that qualify for favorable U.S. federal income tax treatment.”

Convertibles “returned 42.9% year-to-date through Dec. 15, as measured by the ICE BofA U.S. Convertibles index. This makes converts one of the top performing global asset classes this year. The S&P 500 has returned about 16%, the junk-bond market, 4% and even the technology-heavy Nasdaq Composite is behind converts with a 41% return. Converts are having their best year since 2009, when the market gained 49.1%,” reports Andrew Bary for Barron’s.

Why the PQDI Methodology Matters for Income Investors

Convertible bonds are a type of hybrid fixed-coupon security that allows the holder the option to swap the bond security for common or preferred stock at a specified strike price. Due to the bond’s equity option, convertible bonds typically pay less interest than traditional corporate bonds. The fund, though, does not convert its holdings into shares. Investors are exposed to the equity premium due to the way the bonds are priced.

“The rock-bottom zero percent yield is a reflection of the strong current demand for hybrid securities, which are increasingly favored by investors because they combine the upside of stocks and the downside protection of bonds,” adds Barron’s.

That scenario underscores advantages with PQDI, which holds a variety of hybrid securities.

PQDI has the objective of providing income and will invest in a diversified portfolio of USD denominated securities from all major sectors of the global U.S. dollar preferred and capital securities market. The fund will focus on income from dividends eligible for beneficial tax treatment, but it also invests in securities that are not eligible for such treatment. In particular, PQDI will seek securities that, at the time of issuance, are eligible to pay dividends that qualify for reduced U.S. federal income tax rates for “qualified dividend income” (“QDI”) or for the deduction of up to 20% of qualified real estate investment trust (“REIT”) dividends (“QRD”).

For more on active strategies, visit our Active ETFs Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.