While dividend stocks, including international fare, are receiving renewed attention this year, not all of the related exchange traded funds dwell in the limelight.

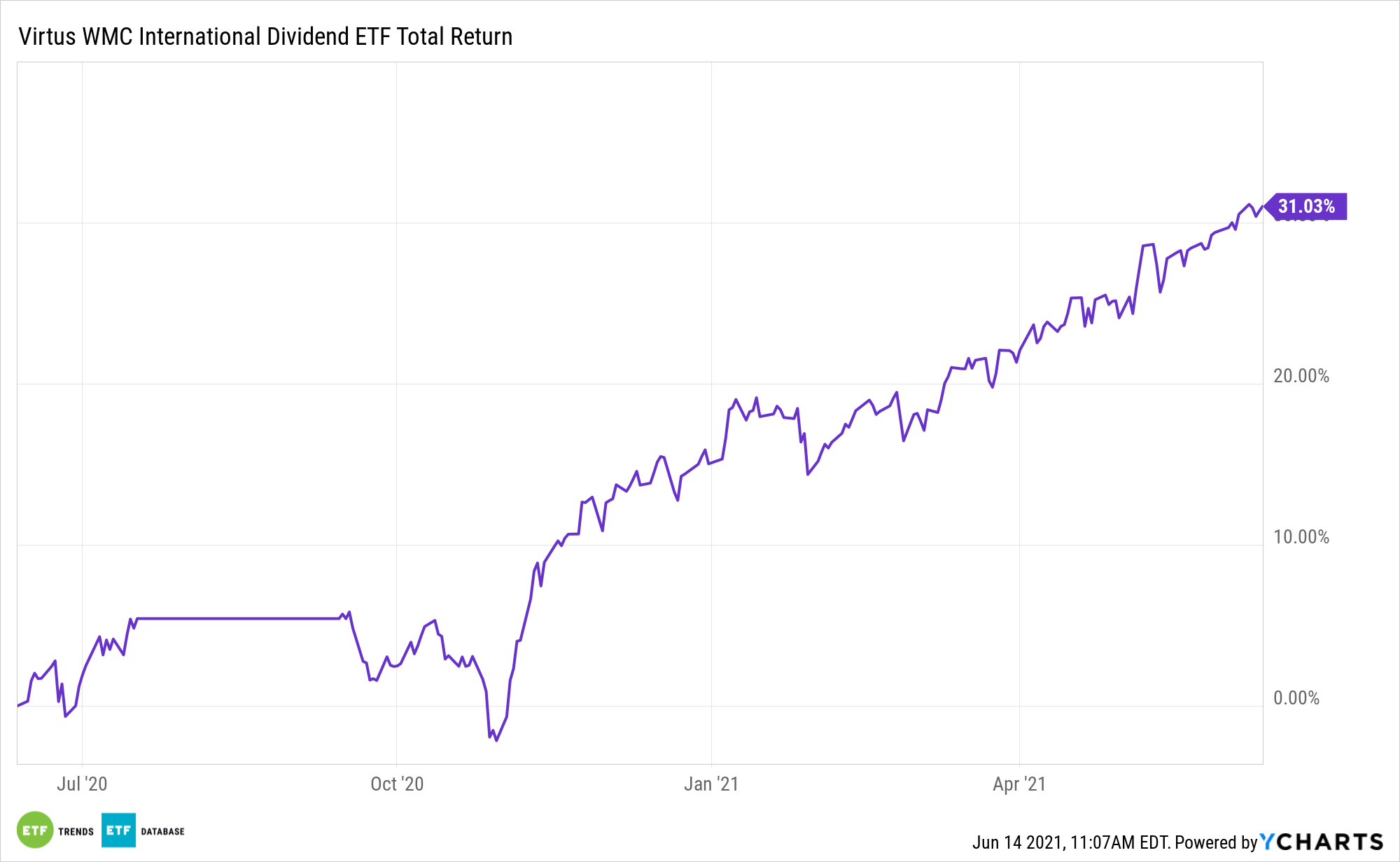

One hidden gem in the international dividend category is the actively managed Virtus WMC International Dividend ETF (VWID). Previously known as the Virtus WMC Global Factor Opportunities ETF, VWID turns four years old in October and looks to offer above-average dividend yield relative to broader international equity benchmarks.

In some regards, the early part of 2020 was a dividend debacle owing to the onset of the coronavirus pandemic, and that sentiment extended to ex-U.S. equities as an array of companies cut or suspended payouts to conserve cash. Those dark days are a reminder of the benefits of active dividend strategies because active mangers – in the case of VWID, it’s Wellington Management – can avoid payout trouble spots.

Fortunately, things are looking up for global payouts this year and VWID’s manager can capitalize on those trends too.

“International dividend payouts in certain sectors appear poised to accelerate for the rest of the year as companies become more assured about the economy and their cash-flow position. Some companies in the energy, mining, financial, and tobacco sectors have already raised their dividends this year,” according to Virtus research.

At the end of the first quarter, VWID featured energy, mining and tobacco names among its top 10 holdings. Another benefit of VWID’s active management style is that the fund can overweight cyclical value sectors, which are performing well this year. Conversely, the managers could opt to overweight defensive groups that didn’t wilt against the 2020 coronavirus backdrop, but also didn’t participate in the subsequent market rally.

Vital to the VWID thesis is that ex-US dividends are forecast to grow this year, and there are already inklings that’s happening, with green shoots emerging from some mining companies and Swiss pharmaceuticals names, as just two examples.

“We know that a substantial portion of the long-term total return from equity markets actually comes from dividends, reinvested dividends, and from dividend growth,” adds Virtus. “We know that dividend businesses tend to be solid, more stable in their cash flows. These factors should be beneficial to dividend-paying stocks going forward.”

VWID has a distribution rate of 2.09% as of June 10, according to issuer data.

For more news, information, and strategy, visit the Alternatives Channel.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.