Investors have a lot to consider right now, with one of the chief problems being a top heavy S&P 500. Just ten or so larger firms have driven the vast majority of the S&P 500’s YTD growth. Most focus on tech, but not all. Many investors, then, are leaning heavily on those firms via exposure to the S&P 500, despite the risk of focusing too much on tech. That may invite some to consider diversifying with a factor like active smid cap exposure, which adds flexibility and small, mid-cap firm agility.

Why look to small and mid-cap firms now? Small-cap stocks may be seeing a tailwind from upwards earnings revisions. Markets are seeing more positive than negative EPS estimate revisions, with not much of a discrepancy between small and large caps in that area.

Rising mergers and acquisitions may seem somewhat unlikely to a casual observer, but markets seem to be expecting conditions to improve for further M&A. That would also benefit small and mid-sized firms that could partake in such moves. Finally, valuations look tempting for investors intrigued by the case for small caps.

See more: “Gen Z Clients: The Active ETF Investing Generation?”

So, why use active for small and mid caps? Some areas of the market seem to favor an active approach and benefit greatly from fundamental research. When investing in smaller companies, research and due diligence can make a huge difference. But active ETF choices have historically been limited, so many investors have just defaulted to using index-based strategies. Luckily, firms like T. Rowe Price, long-time leaders in the small and mid cap space, now offer actively managed ETFs.

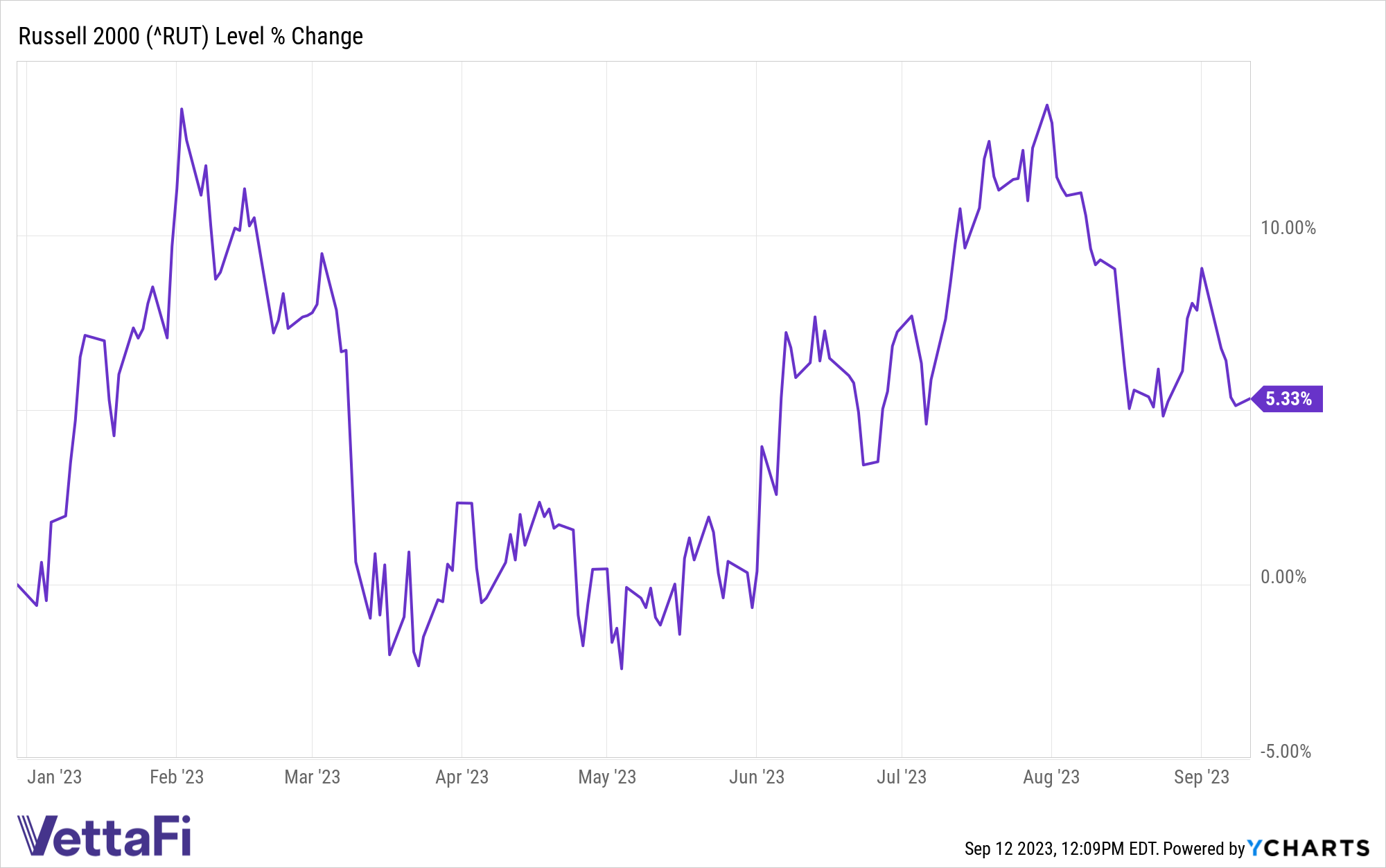

The small-cap-focused Russell 2000 has returned 5.3% YTD, meanwhile, a solid performance with potential as discussed above. An active smid cap ETF like the T. Rowe Price Small-Mid Cap ETF (TMSL) could offer a great way into the space. TMSL has the flexibility to span both growth and value styles while evaluating stocks based on profitability, stability, earnings quality, projected growth, and more. In the active research process, the portfolio managers also consider variables like the quality of a company’s management team, overall stability of the company, areas of innovation, and the potential for growing future market share.

Per YCharts, the Russell 2000 has returned 5.3% YTD.

By investing actively, TMSL’s managers can move nimbly throughout the space while applying those screens. While small caps do have their advantages, that approach can help assuage investors worries regarding small cap instability or weakness under the hood, in some cases. Charging 55 basis points, TMSL has added $13 million in inflows over the last month. For investors looking to add some active smid cap exposure, TMSL may be one to watch.

For more news, information, and analysis, visit the Active ETF Channel.