The market presented new headwinds to the active ETF industry in the first quarter. Inflation rising to a 40-year high, a faster-than-expected rate increase schedule from the Federal Reserve, and Russia’s invasion of Ukraine all drove most global equity and fixed income markets lower. Yet despite these challenges, investors continued to allocate to active ETFs at a near record pace in Q1, while new asset managers entered the market and existing managers continued to innovate with new product listings and filings.

Citing data from FactSet, the latest NYSE Active ETF Update shows that assets managed in active ETFs reached $306.1 billion as of March 31, up $103 billion year-over-year. The market also saw 16 firms launch their first actively managed funds in Q1, including new entrants in the ETF space such as Capital Group, Engine 1, Fairlead, Ameriprise/Columbia, and Build Asset Management. In total, these firms raised nearly $1 billion during the quarter.

Source: Factset as of 3/31/2022

In the first quarter of 2022, 63 actively managed ETFs came to market, raising nearly $1.8 billion in AUM, up 10 funds year-over-year. More than 80 active ETFs have been filed with the SEC in the quarter and are about to launch, up roughly 25 from the year earlier.

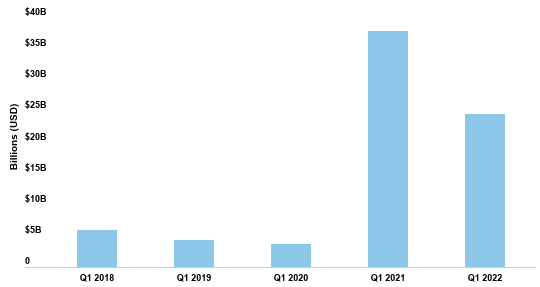

While Q1 cash flow into actively managed exchange traded funds reached $24.6 billion, down $13 billion year-over-year, it still marked the second-largest quarterly inflows in history, according to FactSet.

Source: Factset as of 3/31/2022

Product development continued to focus on the equity market, with 47 new ETFs focused on a range of strategies targeting domestic, international, or global equities. Dimensional launched the most ETFs during the quarter with seven, followed by Capital Group, Simplify, and Innovator, which each launched six.

“Active ETFs are increasingly popular due in part to market headwinds of high inflation, the war in Ukraine, and higher/faster-than-expected rate hikes from the Fed,” said ETF Trends’ head of research, Todd Rosenbluth. “Some advisors are realizing that with the increased market volatility, they prefer to work with a fund manager to steer the ship but have the benefits that ETFs provide, such as tax efficiency, liquidity, and lower expense ratios.”

Added Rosenbluth: “Furthermore, asset managers are providing investors with a choice rather than having to be reliant on just a mutual fund for active management.”

T. Rowe Price offers a suite of actively managed ETFs. T. Rowe Price has been in the investing business for over 80 years through conducting field research firsthand with companies, utilizing risk management, and employing a bevy of experienced portfolio managers carrying an average of 22 years of experience.

For more news, information, and strategy, visit the Active ETF Channel.