By John Welling, Director, Equity Indices, S&P Dow Jones Indices

As China’s economy matures, consumption and service-related industries are becoming structurally more important. Because the country’s stock market continues to have significant exposure to “old economy” sectors, many market participants are seeking alternative index solutions to participate more directly in China’s fastest growing areas.

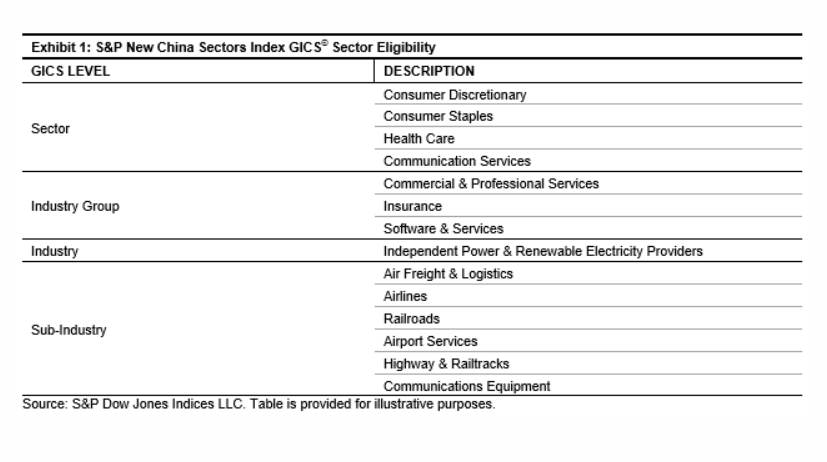

Launched in September 2016, the S&P New China Sectors Index provides access to Chinese companies operating in specific industries poised to benefit from the country’s transition to a consumer- and service-oriented economy. The index includes all Chinese share classes, including A-shares and offshore listings (including those listed in the U.S.), as well as companies with a Hong Kong domicile. To distribute exposure more evenly and improve liquidity, 10% single stock caps are applied semiannually, and selection is limited to large and liquid stocks.

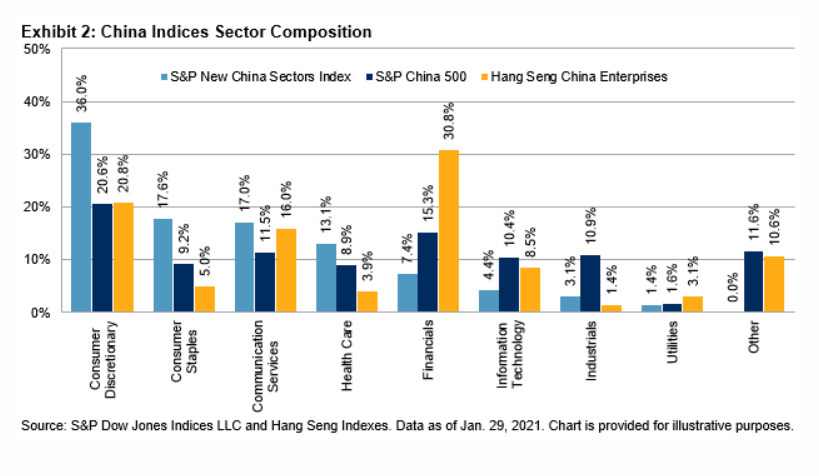

This focus on “new China” provides substantial relief from slower growing sectors of the economy, which retain a high exposure within existing, widely used Chinese equity benchmarks, such as the Hang Seng China Enterprises Index (HSCEI).

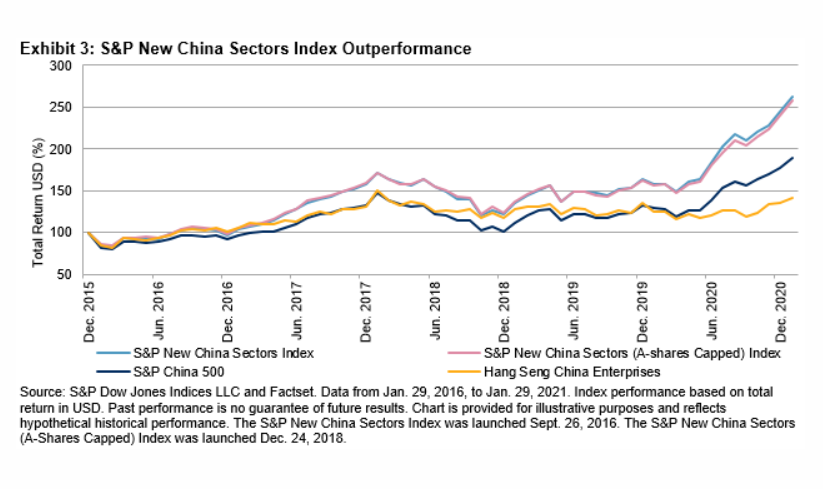

Slower growth among these “old economy” sectors has translated into lagging equity performance, particularly in recent years. Over the latest five-year period, the S&P New China Sectors Index has returned more than 25.3% per year, while the HSCEI has returned only 10.8%—an outperformance that speaks to the powerful driving forces of the more surgent economic sectors.

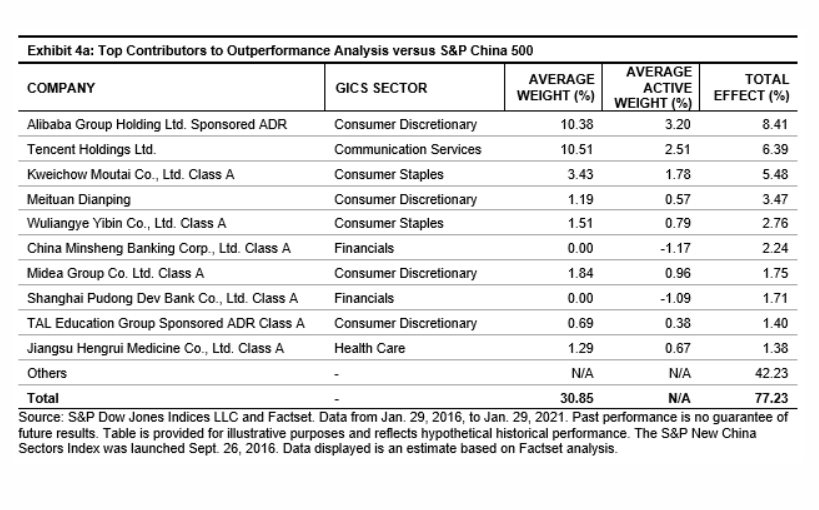

What Has Driven the Outperformance?

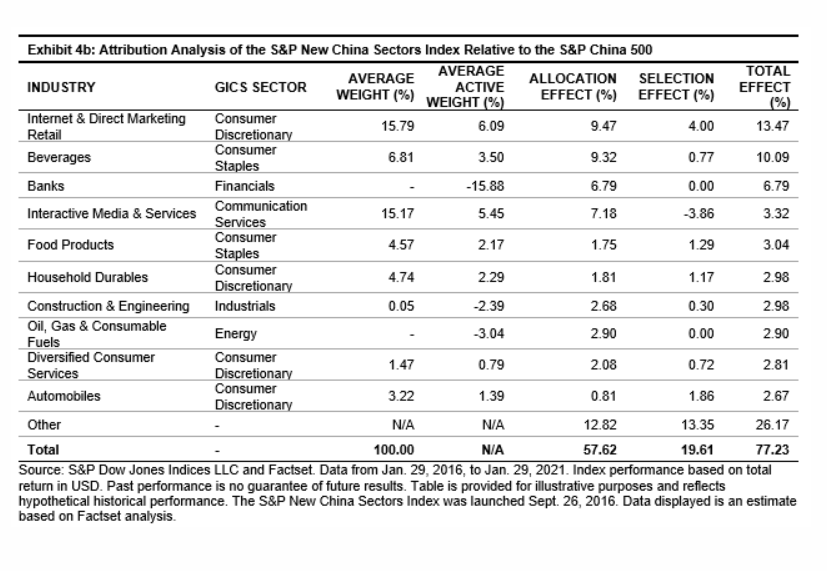

Analysis of top contributors shows that outperformance was spread out widely, with tech-giants Alibaba and Tencent contributing most toward outperformance, while Kweichow Moutai and Meituan Dianping further illustrated the importance of the rising consumer. The top 10 contributors accounted for just under half of the outperformance of the S&P New China Sectors Index versus the broad-based S&P China 500 over the most recent five-year period.

Industry attribution, meanwhile, shows that outperformance was concentrated largely within the “new economy” sectors. This outcome is even more apparent when compared with the HSCEI, in large part due to its greater concentration in banks and other “old economy” industries.

By focusing on consumer- and service-related companies, the S&P New China Sectors Index offers a high level of differentiation from traditional Chinese equity benchmarks and more directly measures one of the key megatrends affecting the Chinese economy.

For further information, refer to our Talking Points overview of the S&P New China Sectors Index.

Originally published by Indexology, 2/19/21

The posts on this blog are opinions, not advice. Please read our Disclaimers.