Many baby boomers have parked their money in target-date mutual funds, but have since suffered losses of 25% or more in 2008. What happened?

It goes like this: You put your money in a target-date or life cycle fund, forget about it, and the fund manager re-balances your portfolio over time, moving your assets from stocks to bonds as you approach your retirement. As of today, may retirees are trying to recoup losses of 25% or more because their funds were treating them like 30-year-olds, reports Mina Kimes for CNN Money.

So what went wrong? Managers were betting that if they were in equities, they’d perform better – and they got nailed, along with everyone else. The problem is, they were nailing people in their sixties and seventies, says one analyst. One expert said that the typical target-date mutual fund was overly aggressive.

The performance of many funds in this genre were so dismal that it has caught the eye of Washington, and the Securities and Exchange Commission (SEC) and the Department of Labor were notified in February to investigate target-date funds. In response to allegations that they took too many risks, fund managers argue that retirees are likely to live for another 20 or 25 years after they stop working, which explains the equity stake.

The fact is that managers should have been prepared for investors to withdraw money at this stage, especially at this age, in case of an economic slowdown. Another shot at defense is that 2008 was a once-in-a-lifetime event that left no asset unscathed, save Treasuries. Investors beware: No investment is an excuse for autopilot and make sure the asset allocation fits your own idea of what’s sensible for someone your age.

What this really is is a lesson in looking under the hood to make sure that the allocation you’re seeking is what you’re actually getting. While these ETFs do what they should, it’s up to you to do a little homework and make sure it works for you. If you’re looking at target-date ETFs, this is very simple to do. Mutual funds only have to disclose their holdings once a quarter – with an ETF, you can check right now and know if the allocation is correct for your goals.

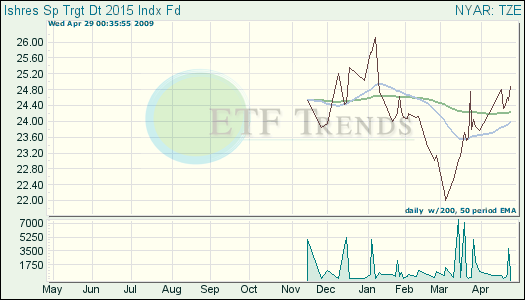

- iShares S&P Target Date 2015 Index Fund (TZE): down 0.52% year-to-date; currently it has 51.8% in domestic fixed income; 36.8% in domestic equities

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.