Some of the best dividend stocks and exchange traded funds (ETFs) are the ones that increase over time so that they match the inflation rate.

There are certain reasons a company will cut or increase a dividend, as explained by ABCs of Investing:

- Dividend Cuts. A company will pay out a dividend from its cash reserve so if the company is not making much money then it might reduce the amount of the dividend or even remove it altogether. This is better for the company so they do not bankrupt, but harder on shareholders. Bank of America (BAC) is an example, who has run into a number of problems related to sub-prime loans so rather than continue to pay out the normal dividend and risk running out of cash, the company decided to decrease the amount of dividend.

- Dividend Suspensions. This is the worst case scenario, as a company such as General Motors (GM), who has major financial problems, has stopped paying out shareholders. Changes to stock dividends will often affect the stock price – if the dividend increases then the stock may go up and vice-versa.

So, which companies are steadily paying out according to an inflationary schedule? Well, the S&P 500 Dividend Aristocrats was recently published and it includes companies that have increased dividend payouts over 25 years. Investing School explains that the Aristocrats Index is an equally-weighted index that is re-weighted every quarter. Also, all companies are reviewed annually to make sure that the companies have increased their dividends and new companies are added to make the list current.

Remember that just because this index does outperform the S&P 500 under normal market conditions, doesn’t mean that it will make you money. The list of companies includes:

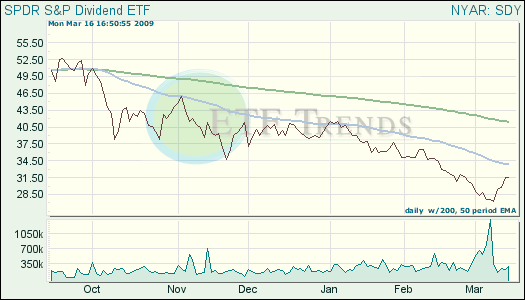

- SPDR Dividend ETF (SDY): This fund targets just the high-yield Aristocrats. It’s down 20.5% year-to-date; up 5.4% over one week. It yields 7.25%.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.