Analysts are warning many investors about attempting to call a bottom, as yesterday’s stock rally has hopes up. Markets and exchange traded funds (ETFs) need more than one good day for a recovery.

Stocks are modestly higher as investors try to turn Wall Street’s best performance this year into a two-day advance, says Sars Lepro for the Associated Press. Although the financial stocks that led the rally are keeping their gains, analysts caution that the market is still under water. Investors bought stocks furiously Tuesday on news that Citigroup Inc. was operating at a profit for the first two months of 2009.

World markets are also enjoying the news regarding Citigroup (C) as Asian markets rallied along with European markets taking modest gains. Jeremiah Marquez for Associated Press reports that the relief was likely to be temporary as the economic slump continued to ravage Asia’s export-driven nations. The fact that Citigroup turned a profit does not help the fact that many large economies are still suffering a slowdown.

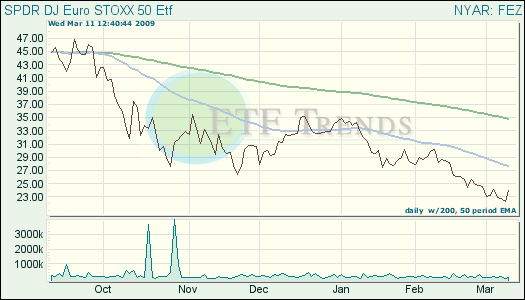

- SPDR Dow Jones EURO STOXX 50 (FEZ): down 30% year-to-date; up 3.6% for one week

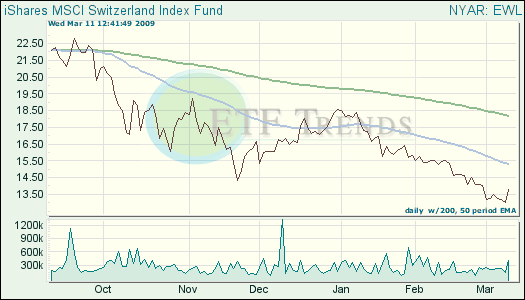

UBS AG, Switzerland’s biggest bank, posted a loss of $18 billion for 2008, with more losses anticipated in the coming year. Elena Logutenkova for Bloomberg reports that costs to settle a U.S. tax investigation and additional writedowns on securities enlarged the full years’ loss.

UBS agreed on Feb. 18 to pay $780 million and disclose the names of about 300 secret account holders to avoid U.S. criminal prosecution on a charge that it helped wealthy Americans evade taxes.

- iShares MSCI Switzerland (EWL): down 25.7% year-to-date; up 4.2% for one week; UBS is 5.1%