The steel industry has been on the decline for the first time ever in two decades, according to the World Steel Association, giving the related stocks and exchange traded funds(ETFs) a few hurdles.

Low prices mixed with low demand for steel has major global steel companies trimming production and cutting costs wherever possible. For the year ahead, rolled steel is not going to see a reversal of this trend, and employment will further reduce and investment will be scarce, reports Wang for China View.

Here is a glimpse at certain countries and their relationship with the steel industry:

- India: Mittal Steel has postponed development plans in India, as the iron and steel group has suffered a total loss of more than $100 million. Production has been reduced 35%, and the global steel market is not expected to rise anytime soon. As India has put forth economic stimulus plan to fund extensive infrastructure construction, several Indian steel firms began to pick up their sales volume in January this year.

- United States: Analysts note that the U.S. steel industry will benefit from President Barack Obama’s $787 billion stimulus package, where several hundreds of billion of dollars are to be spent on infrastructure development. Large steel makers suspended production one after another. More than 20,000 steelmakers have already been temporarily laid off, according to the United Steel Workers of America (USWA).

- South Korea: POSCO is the fourth-largest steel maker, and in an attempt to expand the domestic market, POSCO said that it would increase input this year by as much as 53% to 7.5 trillion won, including 1.5 trillion won in investment in overseas resources and steel firms.

- Australia: Down under steel production has halted 26% as giants such as Rio Tinto, BHP Biliton have revealed recent plans to cut employment on 6,000 employees. Rumor has it that Aussies are looking to China for investment and to help stave off difficulties.

- China: The iron and steel industry in China can possibly bottom out earlier than those in other countries, as the nation has resorted to macroeconomic measures to stimulate economic growth and expand domestic consumption. China outpaced other steel making countries in term of gross steel output in 2008, and it would keep or retain its position in 2009.

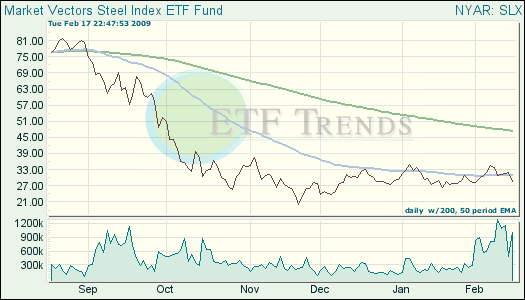

Market Vectors Steel ETF (SLX): up 12.8% over three months; POSCO is 6.9%; Arcelor Mittal is 10.3%; Rio Tinto is 9.9%

For full disclosure, some of Tom Lydon’s clients own shares of SLX.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.