A record rate cut in South Korea has raised hopes that it will be enough to get the exchange traded fund (ETF) and economy back on the path to growth.

The one-point cut is the largest rate cut in the country’s history. This move came after China disclosed their economic indicators for November, which shows the country will slow substantially more than expected, reports Bettina Wassener for The New York Times. The Bank of Korea’s cut on Thursday was its fourth in two months, and took its key interest rate down to 3%, much more than analysts predicted.

South Korea is in a bad position and the rate cut is in reaction to an emergency situation. More policy may be needed. The region’s banks and economic systems are all intact, however, the bank is calling upon governments to step up and help bolster their economies.

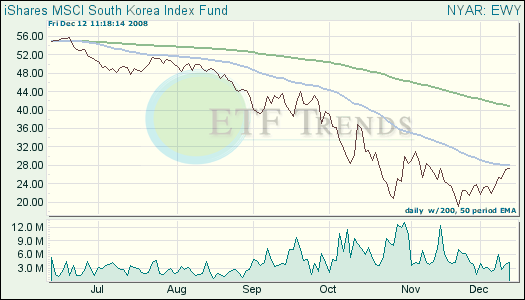

- iShares MSCI South Korea (EWY): down 57.4% year-to-date

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.