Several key economic indicators are released every week to help provide insight into the overall health of the U.S. economy. In this article, we explore three of the most important economic releases from the past week: the BLS employment report, job openings and labor turnover (JOLTS), and the ADP employment reports. By examining these data points, we gain valuable insights into the health of the labor market and by extension, the overall economy.

Policymakers and advisors closely monitor economic indicators, such as the three in this article, to understand the direction of interest rates, as the data can significantly impact business decisions and financial markets. In the week ending on June 1st, the SPDR S&P 500 ETF Trust (SPY) rose 1.73% while the Invesco S&P 500® Equal Weight ETF (RSP) was up 0.53%.

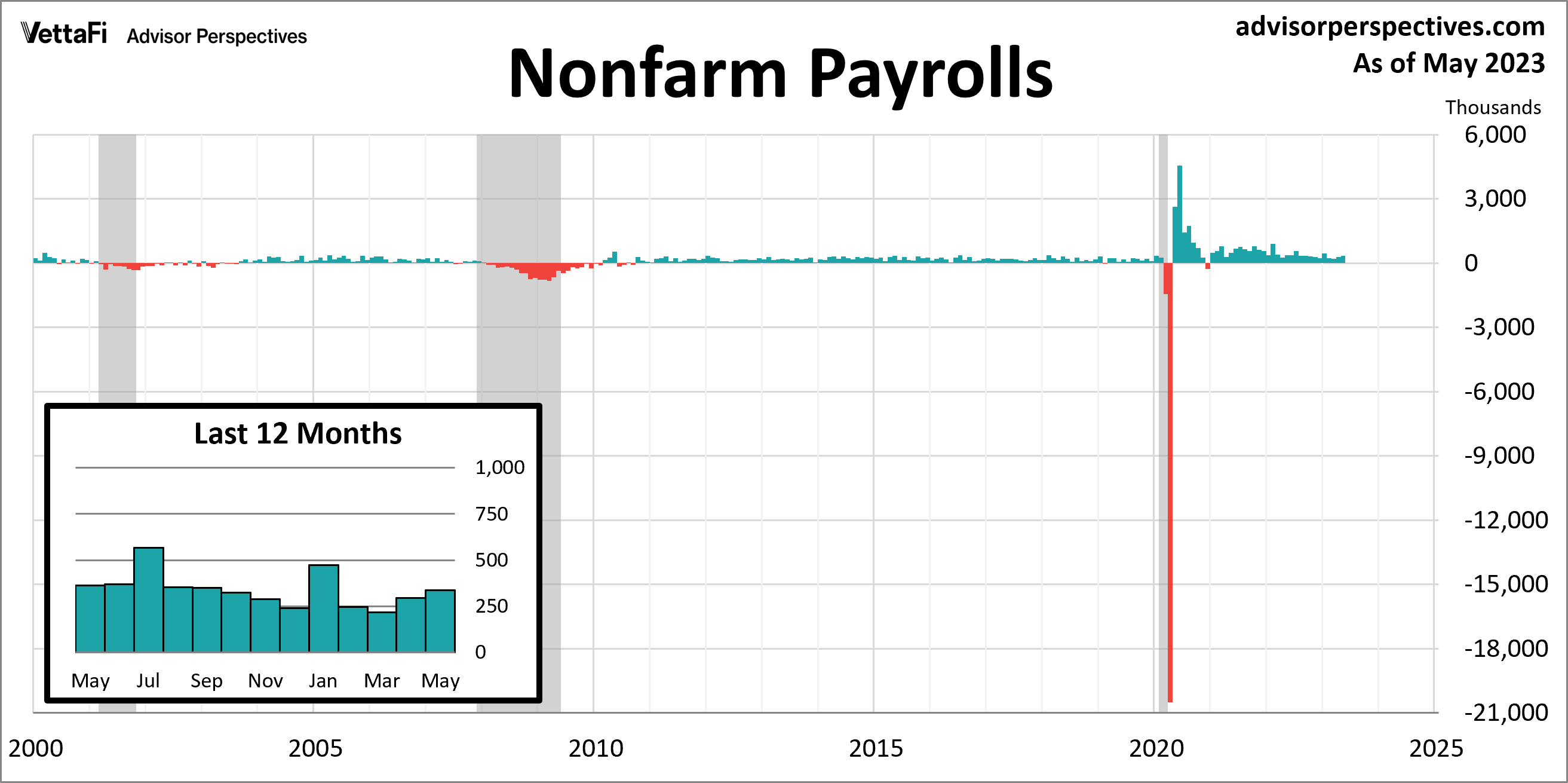

Employment Report

The labor market continues to heat up. The May employment report revealed 339,000 jobs were added last month, well above the expected 180,000 addition. May’s jobs numbers were the largest increase seen in the past four months and marked the third consecutive month that job growth has accelerated. Additionally, the report indicated that the unemployment rate rose to 3.7%, wage growth slowed to 4.3%, and the participation rate held steady at 62.6%. Overall, the strong jobs report came as a surprise and illustrates a resilient labor market despite the Fed’s efforts to cool the economy.

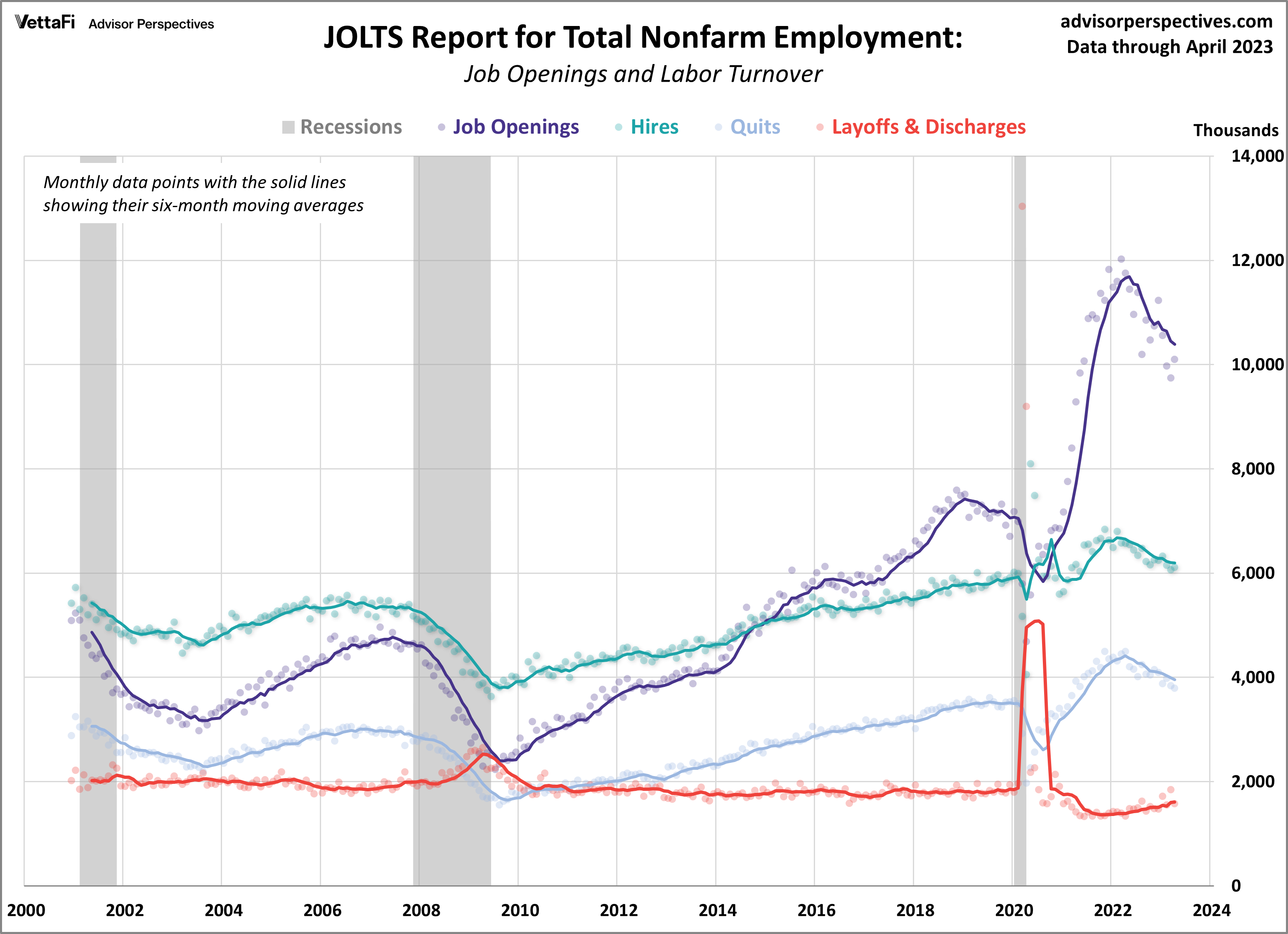

Job Openings and Labor Turnover (JOLTS)

The April JOLTS report revealed that the number of job openings rose for the first time in three months. In April, Job openings increased by 358,000 from the previous month, reaching a total of 10.103 million. While economists anticipated an increase, the actual figure exceeded expectations of 9.775 million vacancies. Other key data points from the report showed that the number of hires and quits were little changed at 6.1 million and 3.8 million respectively, while layoffs fell to 1.6 million.

The rise in job openings during April consequently led to an increase in the ratio of job openings per unemployed worker, reaching 1.79. The JOLTS data helps gauge labor demand and an imbalance between worker demand and supply could potentially result in upward pressure on inflation. The latest report demonstrates the resilience of the labor market amidst the Fed’s fight against inflation and puts pressure on the Fed to consider raising interest rates at the next meeting in June.

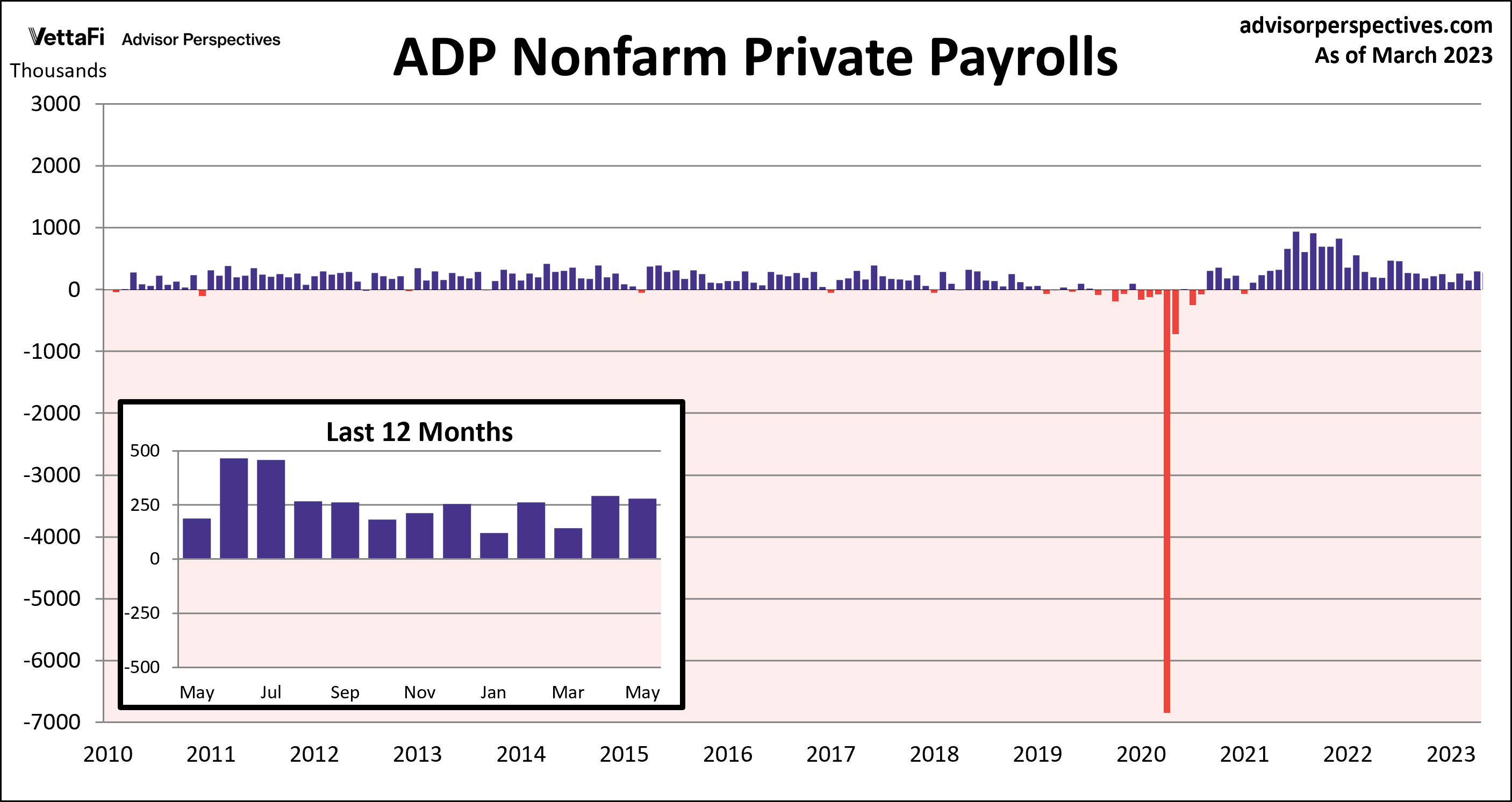

ADP Employment Report

The ADP employment report for May indicated robust job growth in the private sector. In May, there were 278,000 new private jobs added, a decrease from the 291,000 private jobs added in April. Despite the mild slowdown, the latest figure is much higher than the expected 170,000 gain and reinforces the resilience of the labor market in the face of the Fed’s rate hikes.

Other key details of the ADP report showed that annual pay growth has decelerated for the second consecutive month, settling at 6.5%. The slowdown in pay serves as a positive signal for the Fed, indicating that inflationary pressures, such as wage gains, are easing. Nonetheless, the fact that the labor market remains strong suggests that the future rate hikes could still be on the horizon.

Keep an eye out for these important economic indicators this week – May’s S&P Global Services PMI, May’s ISM Services PMI, and April’s data on the U.S. trade deficit. The PMI reports will provide timely insights into the strength of the country’s services sector, while the trade balance report will reveal the latest trajectory of the country’s economic growth. The S&P Global Services PMI is expected to rise for the fifth consecutive month to 54.5, which would be the index’s highest level in over a year. The ISM Services PMI is forecasted to inch down to 51.8 from 51.9 in April. The trade deficit is expected to shrink for a second straight month to -$63.30 billion.

For more news, information, and analysis, visit our Portfolio Strategies Channel.