Thought to ponder…

“The purpose of setting goals is to win the game. The purpose of building systems is to continue playing the game. True long-term thinking is goal-less thinking. It’s not about any single accomplishment. It is about the cycle of endless refinement and continuous improvement. Ultimately, it is your commitment to the process that will determine your progress.”

James Clear Atomic Habits

The View from 30,000 feet

Last week was a light week for earnings and economic data, but a heavy week for policy news, which provided investors another opportunity to eek out small gains in equities based on the continuation of a weak underlying trend. Investors spent most of the week grappling with opinions about the future path of rates in the context of recent speeches by Fed Presidents, trying to understand the impacts of policy on spending patterns and housing, attempting to decipher the intricacies of the debt ceiling debate and the evaluating the chances that the narrow rally in the largest names in the S&P500 might spill over to the remainder of the markets. There are two sides to every coin. The bulls point to coincident data and have hopes that current economic momentum will provide enough inertia to overcome the anticipated speed bumps caused by the clash of restrictive policy and tightening credit conditions. The bears point to trading ranges, valuation caps, liquidity squeezes and leading indicators foreshadowing lower prices for risk assets.

- Heavy week of news flow pushes expectations for rate cuts out to later in year and eases debt ceiling angst

- Retail sales data and big box retailer comments point to weakness and price sensitivity

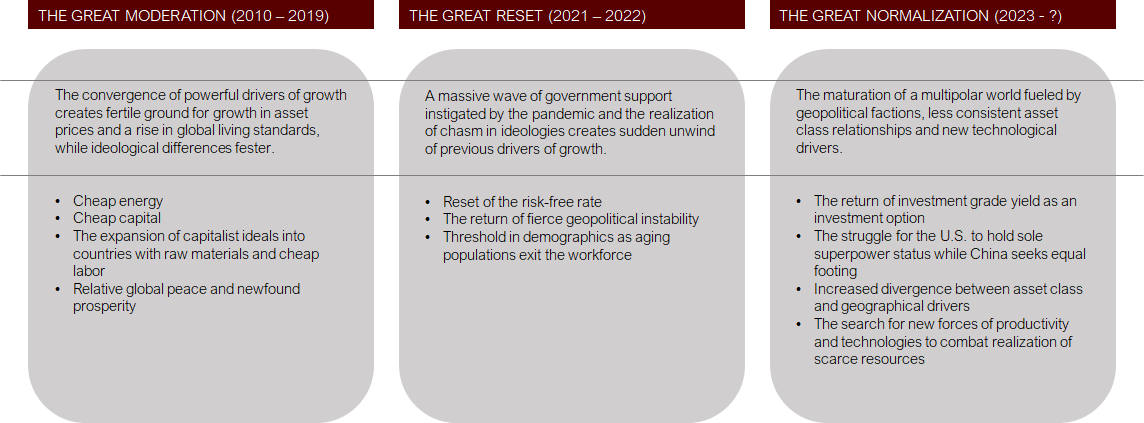

- The Great Moderation gives way to the Great Reset, followed by the Great Normalization

- The most Frequently Asked Question from client’s this week: What are the limits to the equity market continuing to rally based on narrow breadth?

Pushing expectations for rate cuts out to later in year and easing debt ceiling angst

- Judge for yourself from Fed comments where the center of mass is at the Fed:

- James Bullard – “may warrant taking out some insurance by raising rates somewhat more to make sure that we really do get inflation under control”.

- Michelle Brown – Signaled further tightening may be appropriate unless inflation drops more convincingly.

- Phillip Jefferson – ““Is inflation still too high? Yes”. “Has the current disinflation been uneven and slower than any of us would like? Yes. Butmy reading of this evidence is that we are doing what is necessary or expected of us”

- Tom Barkin – “you could tell yourself a story where inflation comes down relatively quickly with only a modest economic slowdown, but I’mnot yet convinced. I do wonder whether we’re going to need more impact on demand to bring inflation down to where we need to go”.

- Rapheal Bostic – Said he was “inclined” to pause to judge impacts.

- Neel Kashkari – “We should not be fooled by a few months of positive data”. “We still are well in excess of our 2% inflation target, and weneed to finish the job”

- Lorie Logan – “The data in coming weeks could yet show that it is appropriate to skip a meeting”. “As of today, though, we aren’t thereyet”, “we haven’t yet made the progress we need to make”.

- Current timetable on reaching a resolution on the debt ceiling:

- Estimate is that the Treasury General Account ended the week below $80b, with the X-Date (the day the Treasury runs out of money) to be sometime the first week of June.

- Bill text will be published on Sunday or Monday, reflecting ongoing negotiations between each party’s staff.

- McCarthy will lead a vote in House on Wednesday or Thursday.

- Senator Schumer will call caucus back for a vote sometime between Friday and Tuesday of the following week.

- Bottom Line

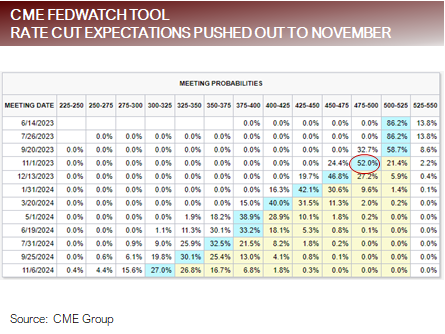

- Heavy week of speakers from the Fed focused on influencing markets that they are still nervous about inflation and not to expect cuts in 2023, successfully pushing easing expectations out to late in Q4.

- There is solid timeline shaping up for a debt ceiling deal.

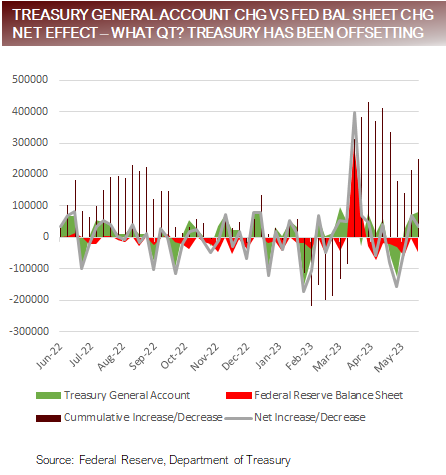

Liquidity conditions set to become more negative after passage of debt ceiling increase

Retail sales data and big box retailer comments point to growing weakness and price sensitivity

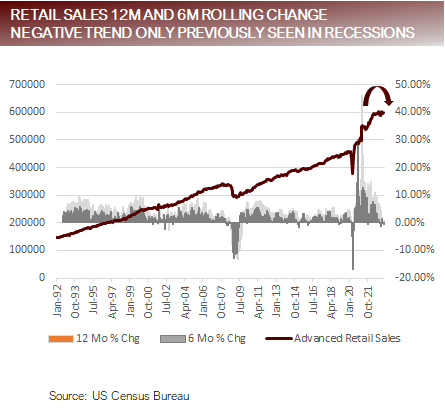

- Retail Sales numbers stumble

- Although monthly Retail Sales expanded by 0.4%, with the Control Group expanding by 0.7%, rate of change is negative.

- The 12-month change in Retail Sales was up only 0.67%, with the 6-month change coming in at -0.66%.

- The 6-month change has been negative 4 out of the last 6 months, a losing streak not seen since 2008.

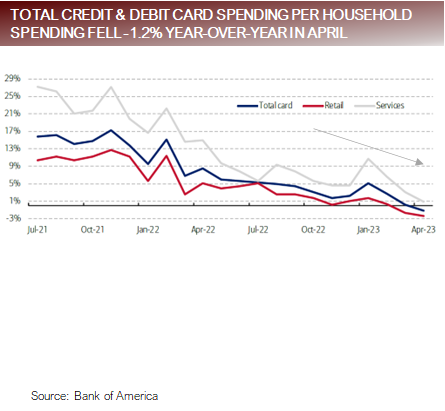

- Bank of America’s Consumer Checkpoint Report

- Total credit and debit card spending per household is negative on a year-over-year basis, with negative growth in Furniture, Fashion, Home Improvement, Clothing, Lodging and Housing Services.

- The only bright points were Restaurants and Airlines.

- Johnson Redbook Same Store Sales weak

• Redbook Sales year-over-year gain was 1.6%. To put this in context the average year-over-year gain for the period between 2010 and 2019 was 3.1%.

• Big box retail signals consumers struggling with inflationary pressures

- Home Depot – “with the buildup of inflation that we’ve seen, there’s certainly some price sensitivity, particularly with respect to those bigger-ticket discretionary items”

- Target – “pressure from inflation and rising interest rates affected the mix of retail spending in Q1 with a further softening in discretionary categories in the March and April time frame”

- Walmart – “stubborn inflation in dry grocery and consumables is one of the key factors creating uncertainty for us in the back half of the year because of the cumulative impact on discretionary spending and other categories, specifically general merchandise”

Retail Sales and spending data rolling over

The Great Moderation gives way to the Great Reset, followed by the Great Normalization

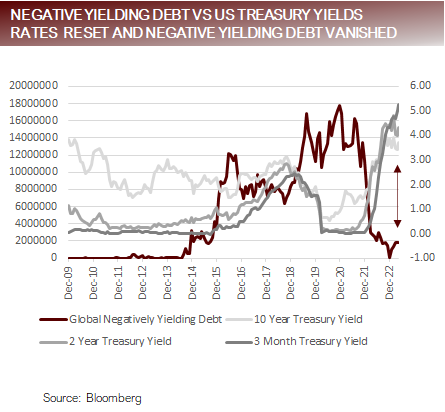

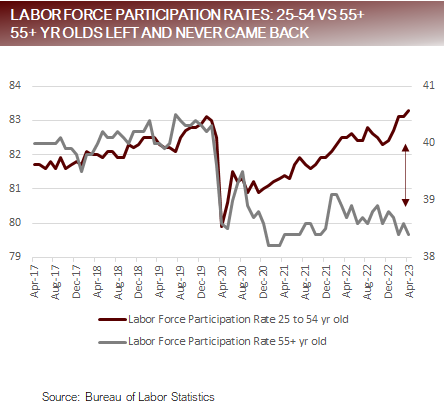

The Great Reset changed the dynamics of the workforce and asset allocation

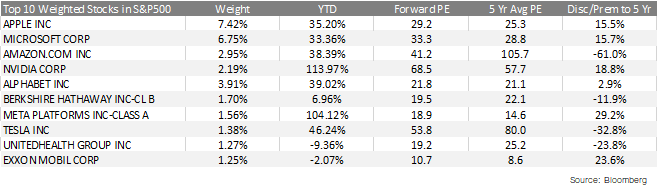

FAQ: What are the limits to the equity market continuing to rally based on narrow breadth?

• Details of 2023 market performance

• Key things to consider

- The top 10 companies make up 30.4% of the S&P500, with the top 5 companies making up 23.2% of the S&P500.

- The top 5 companies in the S&P500 make up a larger weight in the index than the bottom five sectors combined, which together include148 companies.

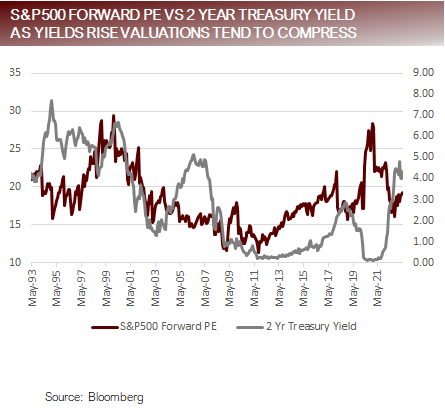

- Of the tech companies in the S&P500 who are leading the market higher, Apple, Microsoft, Nvidia, Alphabet and Meta all trade at apremium to their five-year average PE.

- Through Friday, the S&P500 Equal Weight Index was up 1.65% YTD and the Russell 2000 Index was up 1.26 YTD.

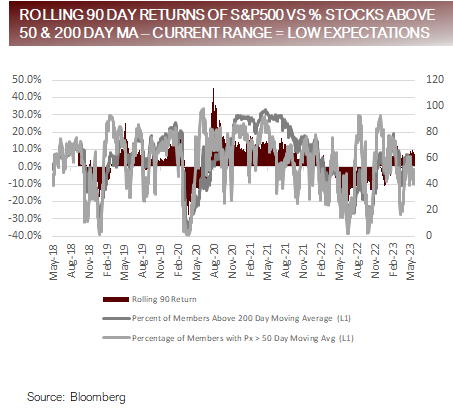

- The percent of member of the S&P500 trading above their 50 and 200-day moving averages is each at 50%.

• Are we at the limits?

• The markets are being buoyed by a select group of sectors and within those an even more select group of securities, the majority of which are trading above their long-term valuations. These factors taken against relatively high yields and the expectation for weaker earnings, creates a headwind for upside, and likely keeps market pinned in a trading range between 4300 and 3500, barring a change in policy.

Narrow rally combined with forward earnings pressure in the face of rising yields hampers upside

Putting it all together

- The consumer continues to be buoyed by a strong labor market, robust income gains and pandemic fueled savings, but even with those factors in their favor, consumer spending is fading.

- Dying momentum in the consumer’s willingness to spend, restrictive monetary policy, poor sentiment and tight credit conditions are pitted against a small group of stocks tenuous journey higher.

- The markets have begun to accept that rate cuts in 2023 may not be in the cards.

- Although the markets may initially rally on a debt ceiling deal, the intermediate-term implications mean a revitalization of the Treasury General Account (TGA). The resulting liquidity implications of refilling the TGA are likely to exacerbate the pains of the Fed’s Quantitative Tightening program and create another hurdle for the markets to overcome during the summer.

- Focus Point’s objective model designed to help determine the investment environment, the Focus Point Leading Market Indicator, continues to see a challenging market environment driven by poor liquidity conditions, relatively high valuations, poor sentiment leading to weak economic momentum, a positive volatility regime and a weak technical trend.

- Ultimately, until policy changes markets are likely to struggle to breakout of the current trading range. Unfortunately, for market participants who feel starved of market returns, the Fed’s messaging is they remain unconvinced inflation is subsiding and are unlikely to act to cut rates until they see labor market stress.

For more news, information, and analysis, visit the Beyond Basic Beta Channel.

DISCLOSURES AND IMPORTANT RISK INFORMATION

Performance data quoted represents past performance, which is not a guarantee of future results. No representation is made that a client will, or is likely to, achieve positive returns, avoid losses, or experience returns similar to those shown or experienced in the past.

Focus Point LMI LLC

For more information, please visit www.focuspointlmi.com or contact us at [email protected] Copyright 2023, Focus Point LMI LLC. All rights reserved.

The text, images and other materials contained or displayed on any Focus Point LMI LLC Inc. product, service, report, e-mail or web site are proprietary to Focus Point LMI LLC Inc. and constitute valuable intellectual property and copyright. No material from any part of any Focus Point LMI LLC Inc. website may be downloaded, transmitted, broadcast, transferred, assigned, reproduced or in any other way used or otherwise disseminated in any form to any person or entity, without the explicit written consent of Focus Point LMI LLC Inc. All unauthorized reproduction or other use of material from Focus Point LMI LLC Inc. shall be deemed willful infringement(s) of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Focus Point LMI LLC Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Focus Point LMI LLC Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.

All unauthorized use of material shall be deemed willful infringement of Focus Point LMI LLC Inc. copyright and other proprietary and intellectual property rights. While Focus Point LMI LLC will use its reasonable best efforts to provide accurate and informative Information Services to Subscriber, Focus Point LMI LLC but cannot guarantee the accuracy, relevance and/or completeness of the Information Services, or other information used in connection therewith. Focus Point LMI LLC, its affiliates, shareholders, directors, officers, and employees shall have no liability, contingent or otherwise, for any claims or damages arising in connection with (i) the use by Subscriber of the Information Services and/or (ii) any errors, omissions or inaccuracies in the Information Services. The Information Services are provided for the benefit of the Subscriber. It is not to be used or otherwise relied on by any other person. Some of the data contained in this publication may have been obtained from The Federal Reserve, Bloomberg Barclays Indices; Bloomberg Finance L.P.; CBRE Inc.; IHS Markit; MSCI Inc. Neither MSCI Inc. nor any other party involved in or related to compiling, computing or creating the MSCI Inc. data makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and all such parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to any of such data. Such party, its affiliates and suppliers (“Content Providers”) do not guarantee the accuracy, adequacy, completeness, timeliness or availability of any Content and are not responsible for any errors or omissions (negligent or otherwise), regardless of the cause, or for the results obtained from the use of such Content. In no event shall Content Providers be liable for any damages, costs, expenses, legal fees, or losses (including lost income or lost profit and opportunity costs) in connection with any use of the Content. A reference to a particular investment or security, a rating or any observation concerning an investment that is part of the Content is not a recommendation to buy, sell or hold such investment or security, does not address the suitability of an investment or security and should not be relied on as investment advice.

Important Disclosures

This communication reflects our analysts’ current opinions and may be updated as views or information change. Past results do not guarantee future performance. Business and market conditions, laws, regulations, and other factors affecting performance all change over time, which could change the status of the information in this publication. Using any graph, chart, formula, model, or other device to assist in making investment decisions presents many difficulties and their effectiveness has significant limitations, including that prior patterns may not repeat themselves and market participants using such devices can impact the market in a way that changes their effectiveness. Focus Point LMI LLC believes no individual graph, chart, formula, model, or other device should be used as the sole basis for any investment decision. Focus Point LMI LLC or its affiliated companies or their respective shareholders, directors, officers and/or employees, may have long or short positions in the securities discussed herein and may purchase or sell such securities without notice. Neither Focus Point LMI LLC nor the author is rendering investment, tax, or legal advice, nor offering individualized advice tailored to any specific portfolio or to any individual’s particular suitability or needs. Investors should seek professional investment, tax, legal, and accounting advice prior to making investment decisions. Focus Point LMI LLC’s publications do not constitute an offer to sell any security, nor a solicitation of an offer to buy any security. They are designed to provide information, data and analysis believed to be accurate, but they are not guaranteed and are provided “as is” without warranty of any kind, either express or implied. FOCUS POINT LMI LLC DISCLAIMS ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY, SUITABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE. Focus Point LMI LLC, its affiliates, officers, or employees, and any third-party data provider shall not have any liability for any loss sustained by anyone who has relied on the information contained in any Focus Point LMI LLC publication, and they shall not be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the information or opinions contained Focus Point LMI LLC publications even if advised of the possibility of such damages.