Economic Overview

Economic data in April took a back seat to the drama in the regional banking sector, as the month closed with the second biggest bank failure in U.S. history. First Republic bank was seized by regulators over the weekend, and by Monday morning had a new owner in J.P. Morgan. The combination of rising interest rates and a balance sheet heavy in low interest rate (and interest-only) mortgages to high net worth borrowers doomed the once vaunted bank of the affluent. Only two months ago, FRC’s stock was trading near $125 per share. On May 1st, it was at $0.

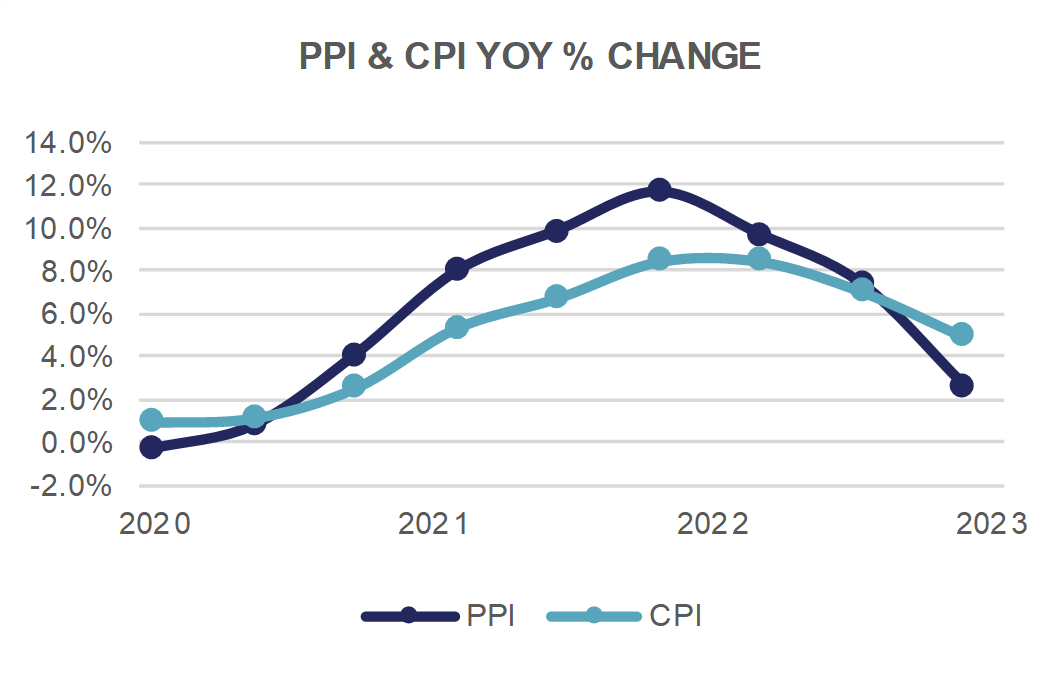

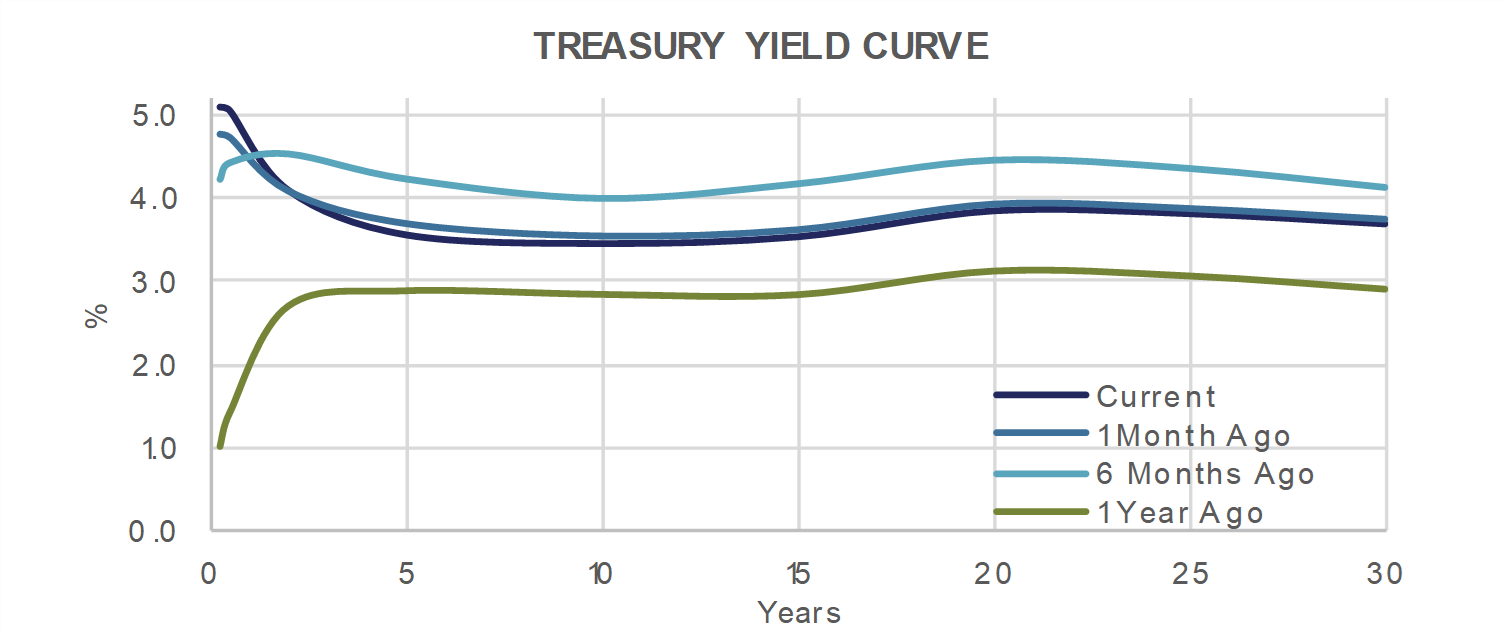

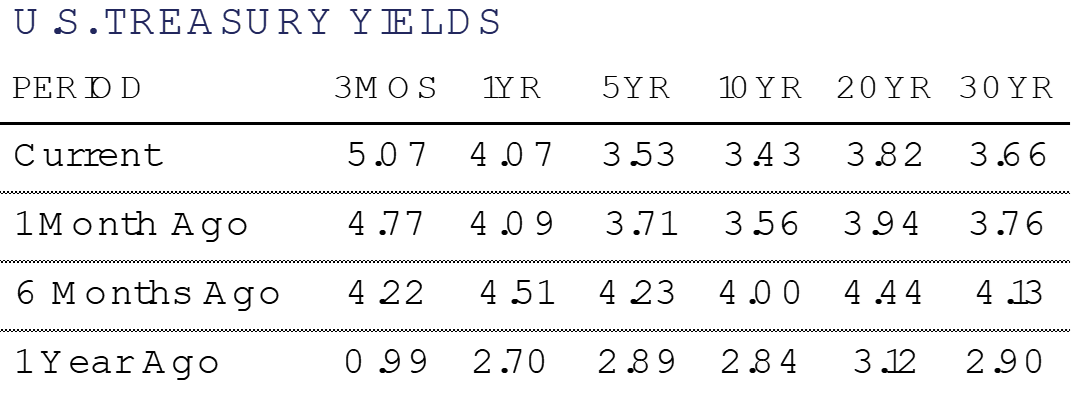

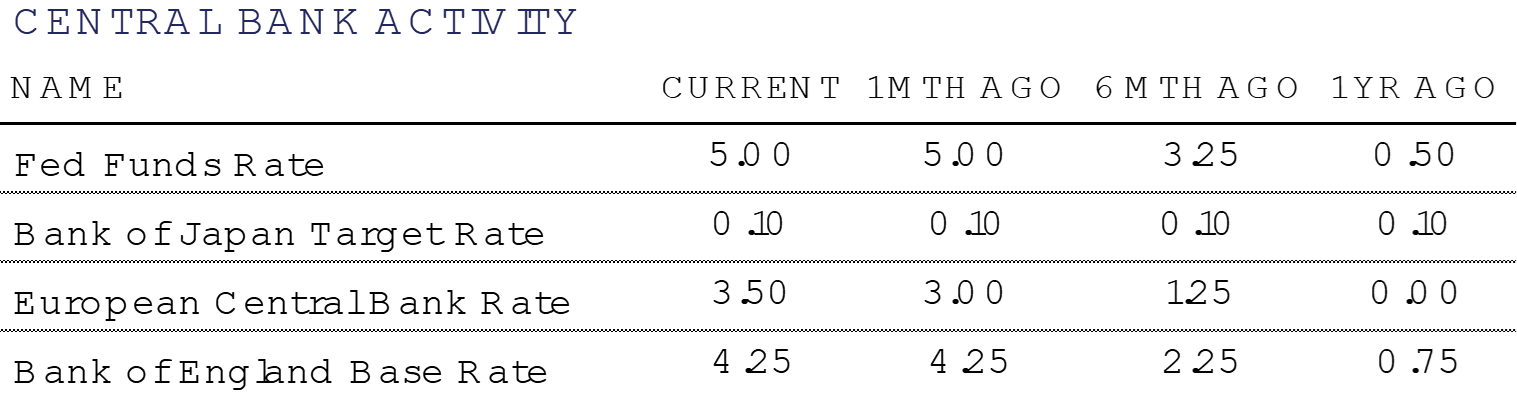

On the heels of this bank collapse, this week brings an FOMC meeting at which the FOMC is expected to hike short-term interest rates another 25 basis points, bringing the Fed Funds rate north of 5.0%. Despite the cracks appearing in the regional bank sector, the Fed appears to remain committed to bringing inflation back down to its target rate of 2.0%. It has a ways to go in that regard.

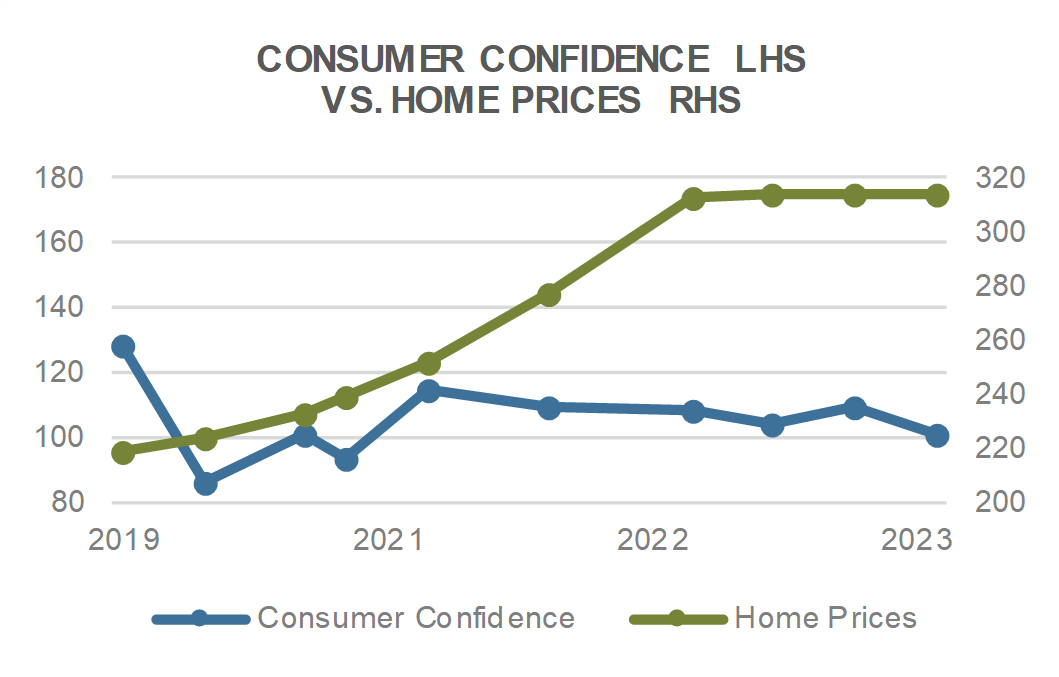

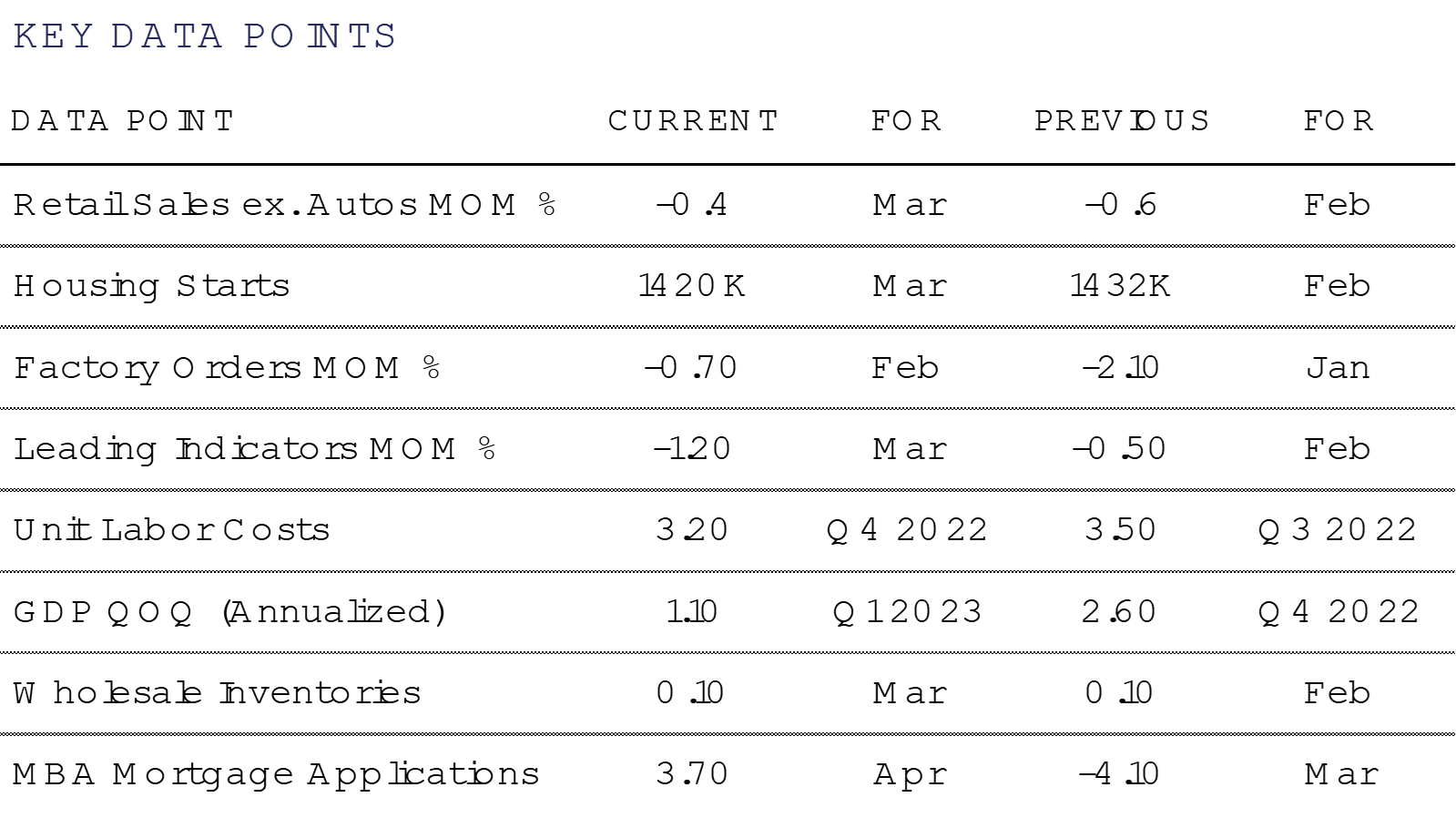

The Employment Cost Index rose a higher than forecast +1.2% in the first quarter of 2023, and is now up +5.0% year over year. The Fed’s preferred measure of inflation, the PCE Deflator, edged up +0.1% in March for a +4.2% YoY increase. Moreover, the PCE Core Deflator rose +0.3% MoM, or +4.6% YoY. Despite a lower than expected read on Q1 GDP (+1.1% versus expectations for +1.9%), inflation still remains the top concern for the Fed.

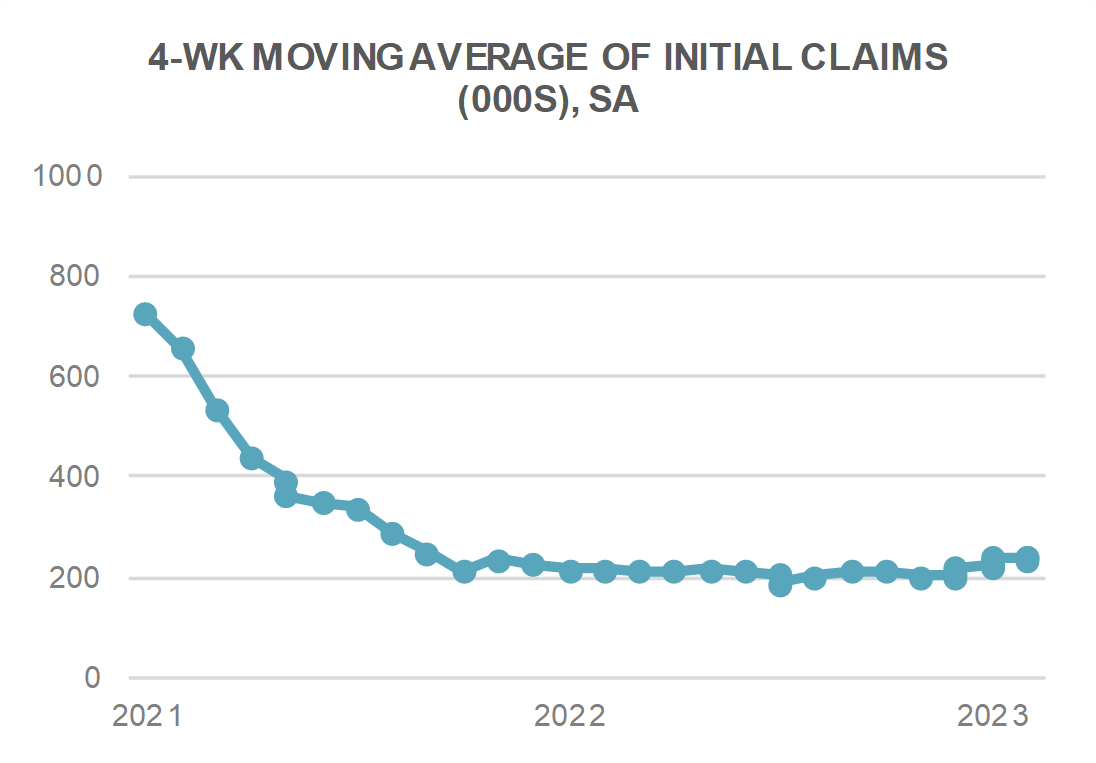

Despite rising interest rates and a slowing economy, the employment picture remains robust. The February JOLTS Job Openings number came in at a heady 9.9 million, while tomorrow’s reading for March is estimated to show +9.7 million job openings. The Unemployment Rate in March came in at a modest +3.5% as Nonfarm Payrolls rose by 236k. Average Hourly Earnings rose +0.3% MoM, or +4.2% YoY. The Underemployment Rate remains just +6.7%.

With three U.S. bank failures having occurred since March, and the Fed seemingly resolute in its pledge to bring inflation under control by raising short-term interest rates, markets appear on edge. Although underlying wage and employment numbers remain strong, and corporate earnings look reasonable, the yield curve remains heavily inverted, suggesting an economic slowdown, and a possible recession is imminent. What we wonder is, given the aforementioned labor market strength, if a recession does occur, will anyone notice?

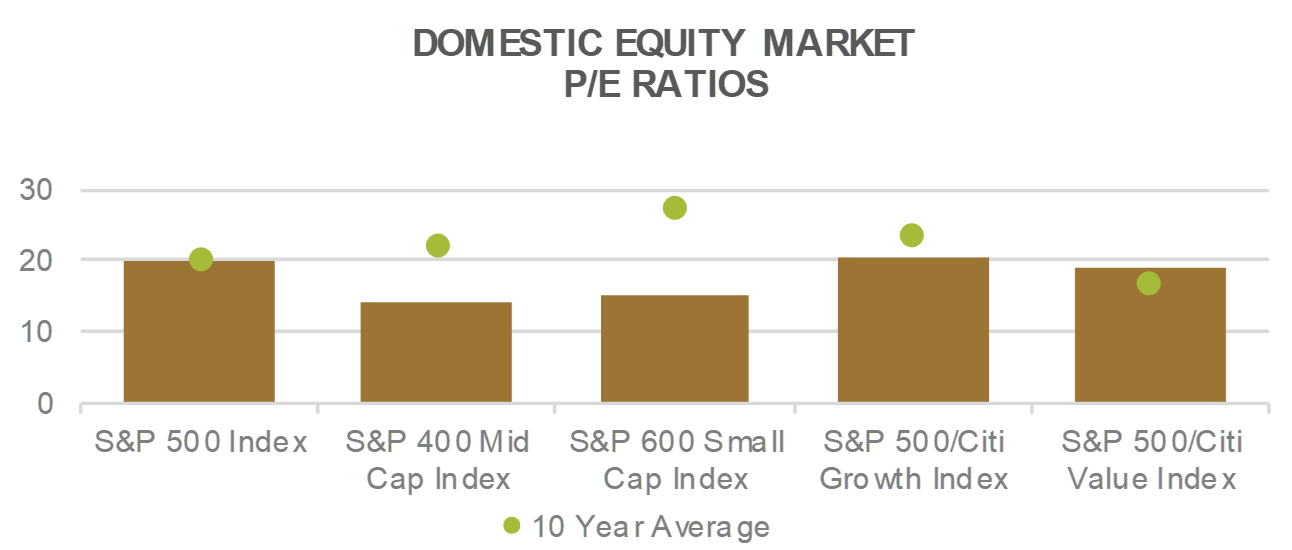

Domestic Equity

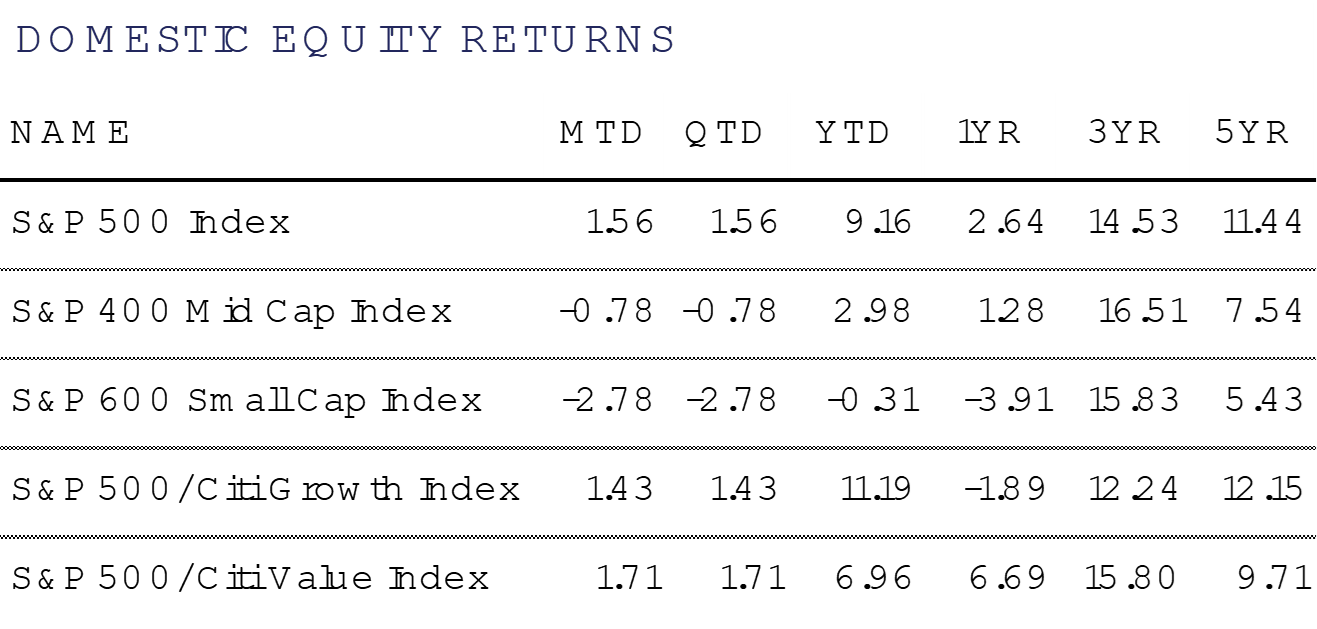

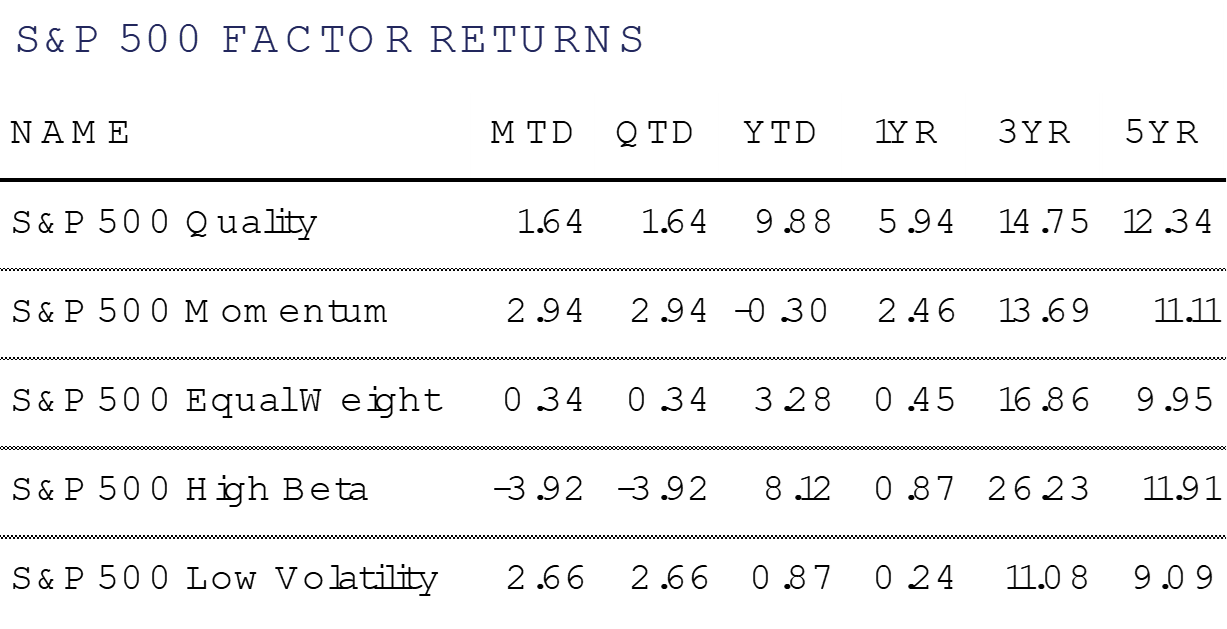

U.S. equities notched their second straight month of gains in April, with the benchmark S&P 500 Index gaining +1.6% to close at 4,169. Large-Cap equities have remained largely range bound for the past year, despite a plethora of negative headlines. Three of the largest bank failures in history have occurred in the past two months, yet the market has remained resilient. The S&P 500 rose +0.9% last week despite the headlines around First Republic Bank (JP Morgan is taking the Bank over this morning). Contrary to popular belief, equity volatility continues to plumb near term lows, with the VIX Index sub-16 this morning, underscoring low levels of equity market volatility. Earnings continue to come in better than expected, with 77% of companies reporting Q1 2023 earnings (205 of 267 constituents) so far beating on the bottom line. Taken together, the S&P 500 Index is quietly up +9.2% to start the year, and now has a positive 1-year return of +2.6%.

Much of the year’s gain can be attributed to the resurgence in Mega Cap Growth stocks and the top heaviness of the S&P 500. Apple and Microsoft represent just under 14% of the S&P 500 Index, and nearly 21% of the S&P 500 Growth Index, and have returned +30.8% and +28.4%, respectively year to date.

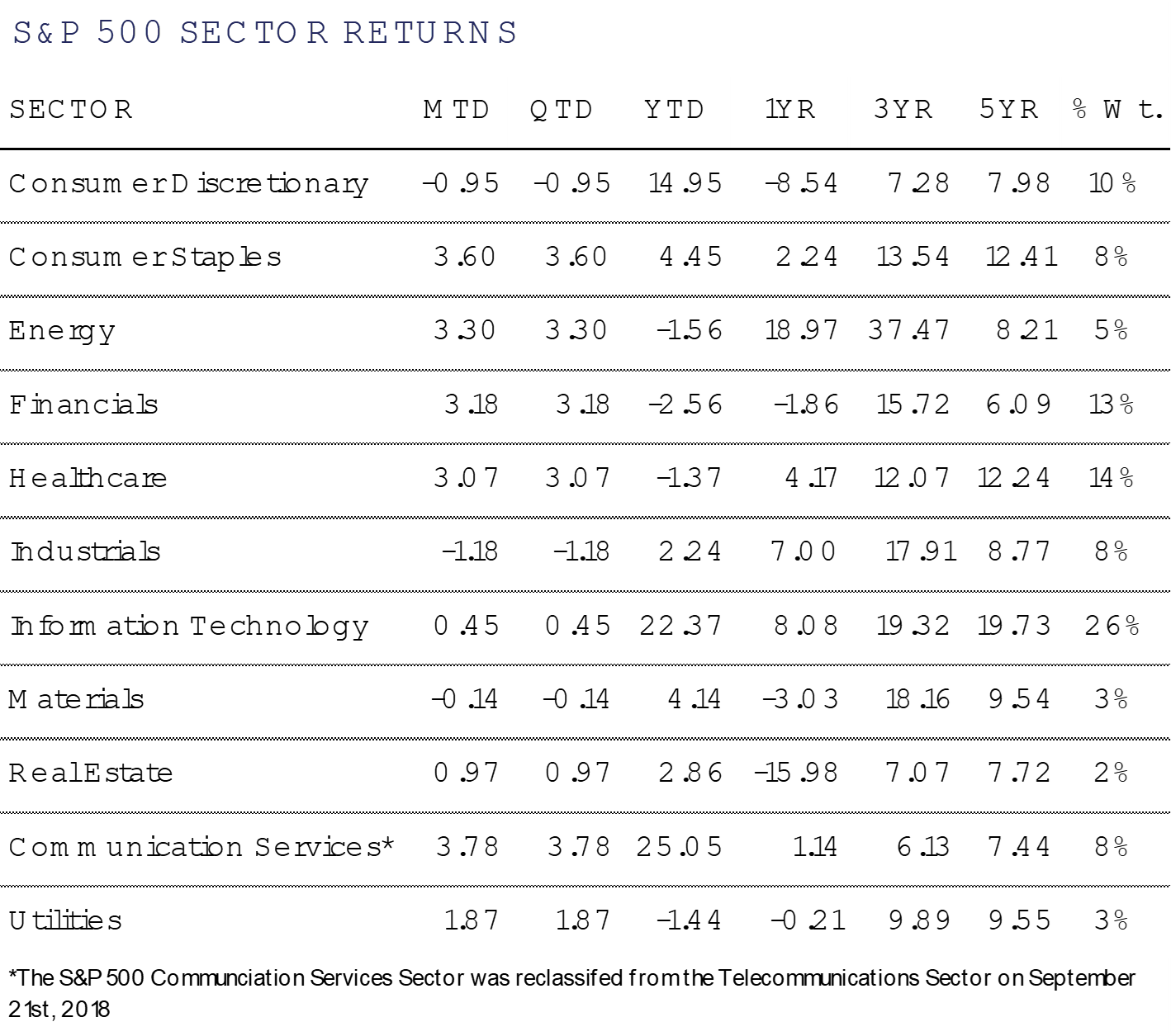

Growth stocks, as measured by the S&P 500 Citi Growth Index actually underperformed Value, as measured by the S&P 500 Citi Value Index during the month, despite strong quarterly results from Microsoft, Alphabet and Meta. Apple reports quarterly earnings this Thursday. The technology heaviness is more pronounced in the S&P 500 Top 50 Index, which gained +2.5% during the month, and is up more than +15.7% for the year. By contrast, Growth stocks are up +11.2% year to date, while Value is up +7.0%.

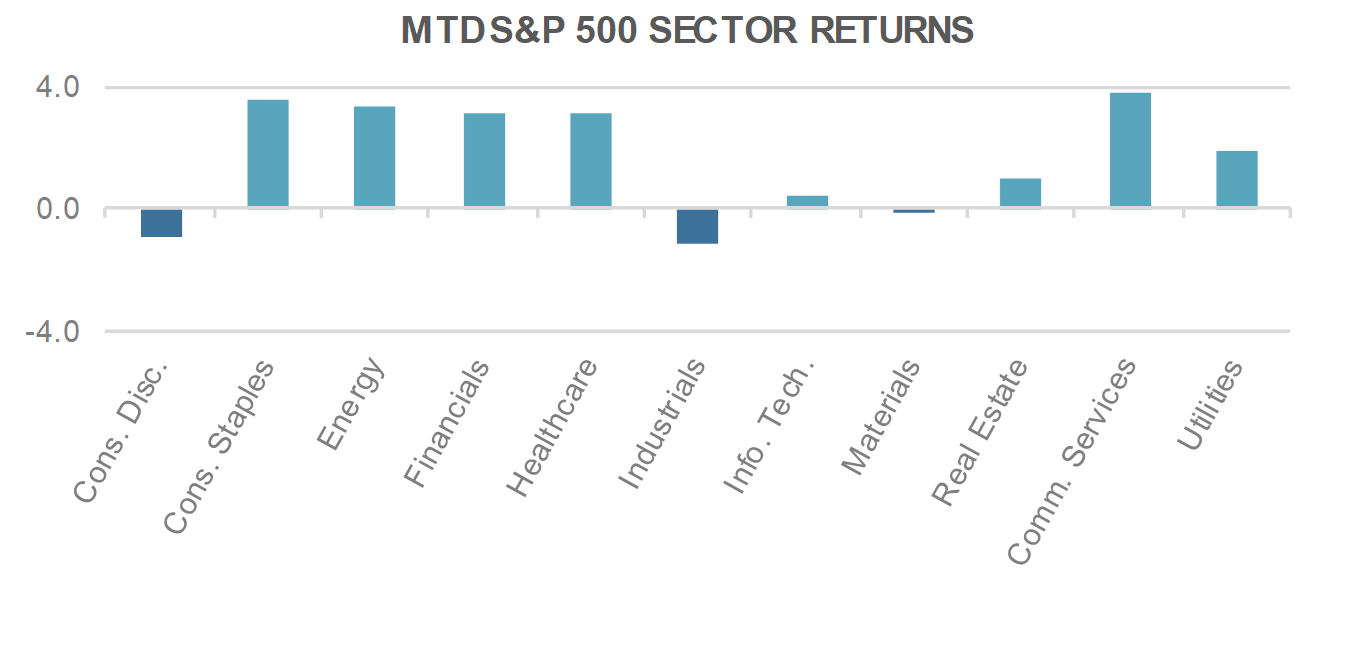

At the sector level, Value oriented sectors led the charge, with Communication Services (+3.8%), Consumer Staples (+3.6%), Energy (+3.3%) , Financials (+3.2%), and Healthcare (+3.1%) the top performers. Industrials (-1.2%), Consumer Discretionary (-1.0%), and Materials (-0.1%) were in the red. Notably, Small- and Mid-Caps, as measured by the S&P 600 and 400 Indices, both reported negative performance for the month as fears over slowing economic growth and continued regional bank struggles weighted on returns. Small- and Mid-Caps returned -2.8% and -0.8%, respectively on the month, and lag the broader market YTD.

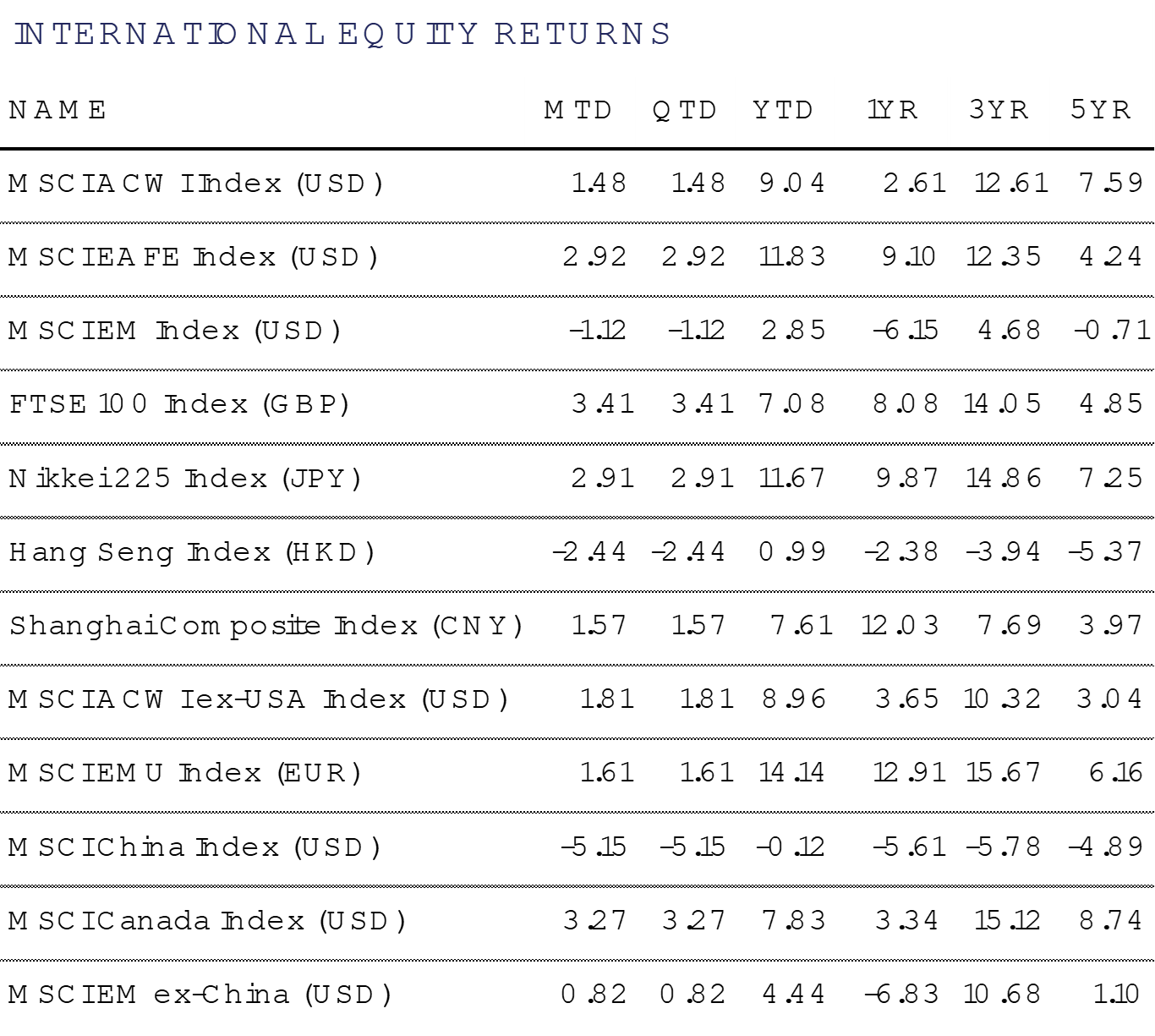

International Equity

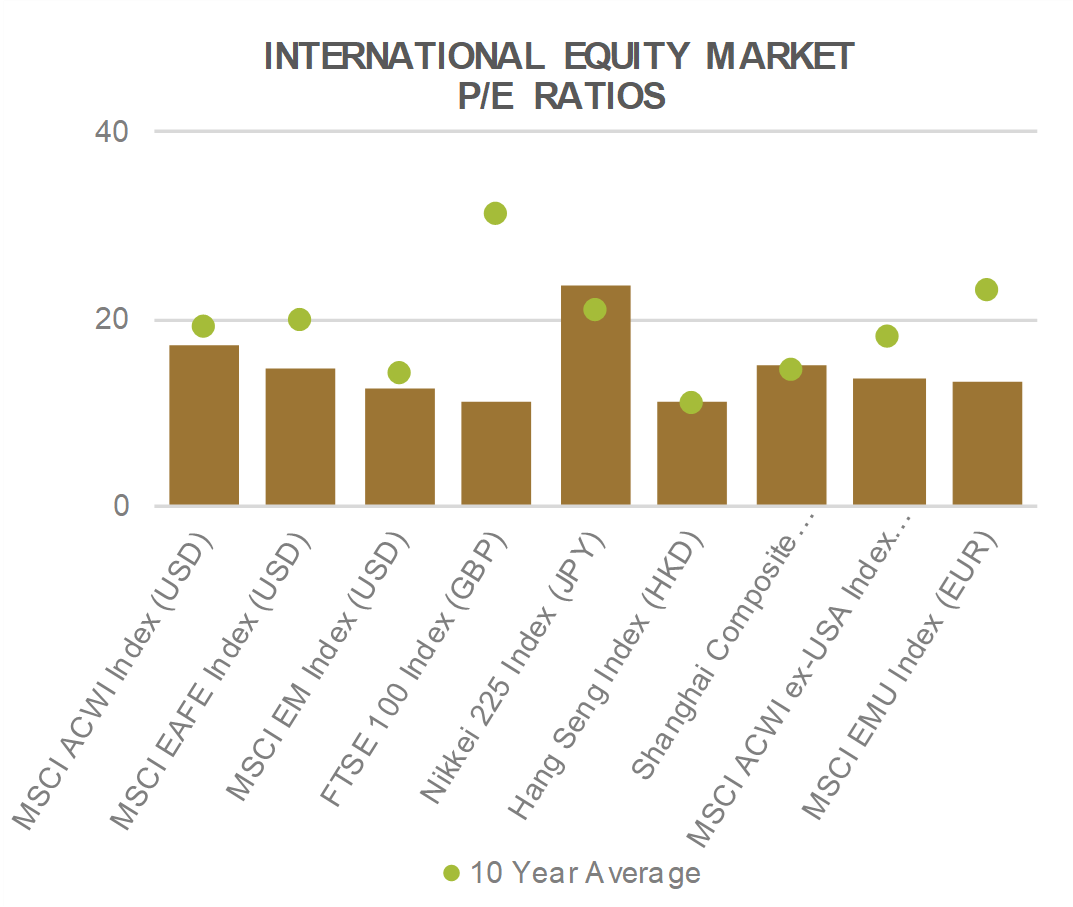

International markets posted mixed results during the month of April with Developed Markets (DM), measured by the MSCI EAFE Index, posting a +2.9% return and Emerging Markets (EM), measured by the MSCI EM Index, falling -1.1%.

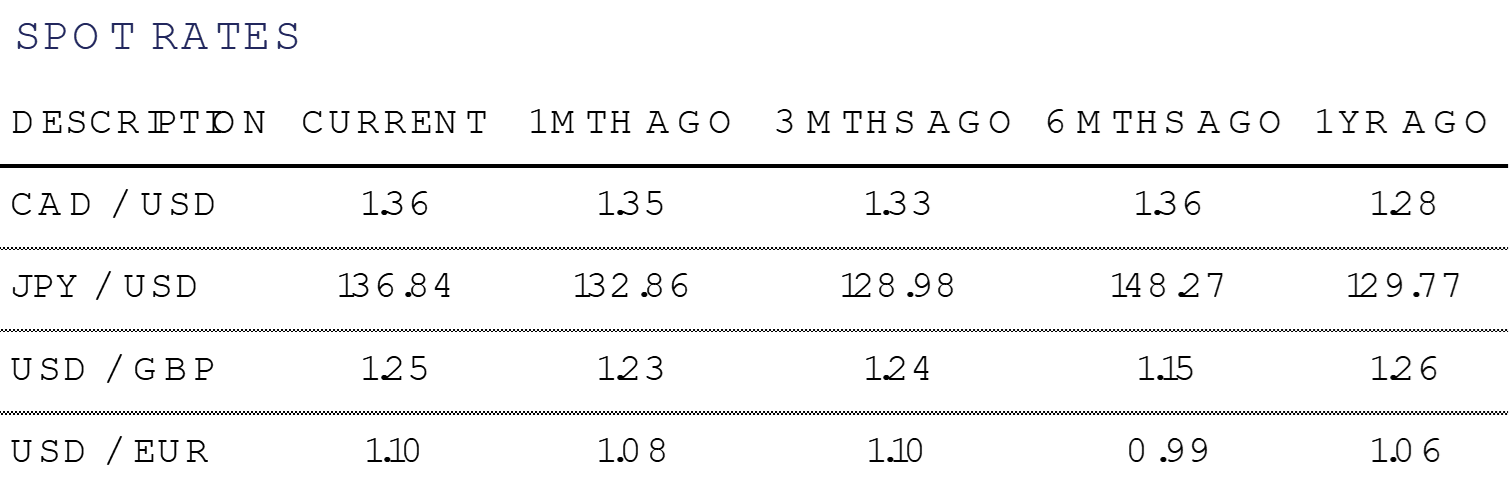

The Bank of Japan welcomed its newest Governor Kazuo Ueda in its April 27-28 meeting where he signaled a dovish tone and reiterated their commitment to ultra-loose monetary policy and yield curve control framework. However, for the first time the BoJ announced that it would conduct a broad review of its monetary policy as the country has struggled with achieving its price stability target over the last 25 year period. This, along with the government’s easing of border controls as the Golden Week Holiday arrives, sent stocks higher in Japan on the month, with the Nikkei 225 Index rising by +2.9% in local currency terms.

The seesawing of performance in Chinese equities continued during the month of April with the MSCI China Index falling -5.2% in USD terms. On April 18th, China reported first quarter GDP growth of +4.5%, but since then, stocks on the Shanghai and Shenzhen stock exchanges lost roughly Rmb3.6tn ($519 bn) in market cap combined. Even though GDP growth exceeded most forecasts, the selloff reflects investor’s uncertainty around whether growth can continue at this rate following years of lockdowns that resulted from China’s zero COVID policy. While volatile, stock indices in China remain flat year-to-date as investors are seemingly waiting for an ‘all-clear’ signal around policy and recovery from COVID related disruptions.

To the west, shares in Europe continued their strong performance with the MSCI EMU Index rising +1.6% on the month (in Euro terms). According to the preliminary flash estimate, GDP increased in the first quarter by +0.1% in the Euro Area and by +0.3% in the EU. The six hikes of this tightening cycle has seen the ECB take interest rates to 3.5% – its highest level since 2008. Investors will be keenly tuned in to learn if the ECB will continue with rate hikes at their next meeting on May 4th.

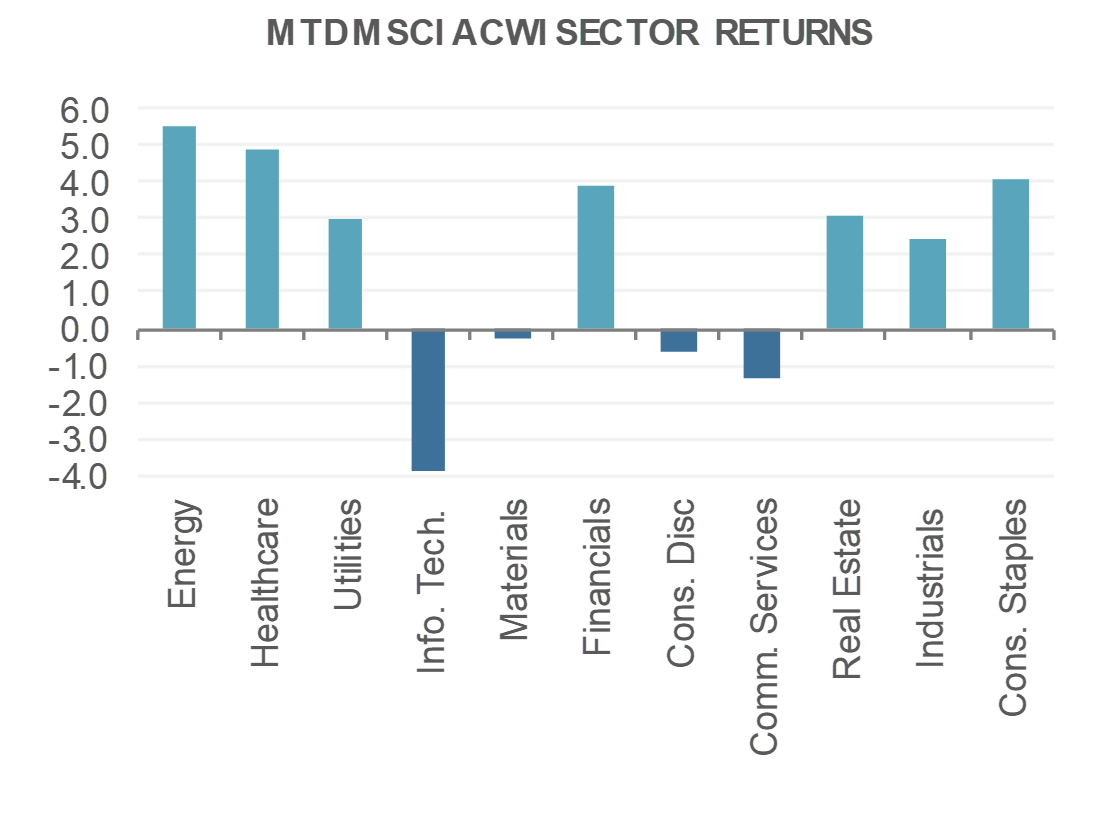

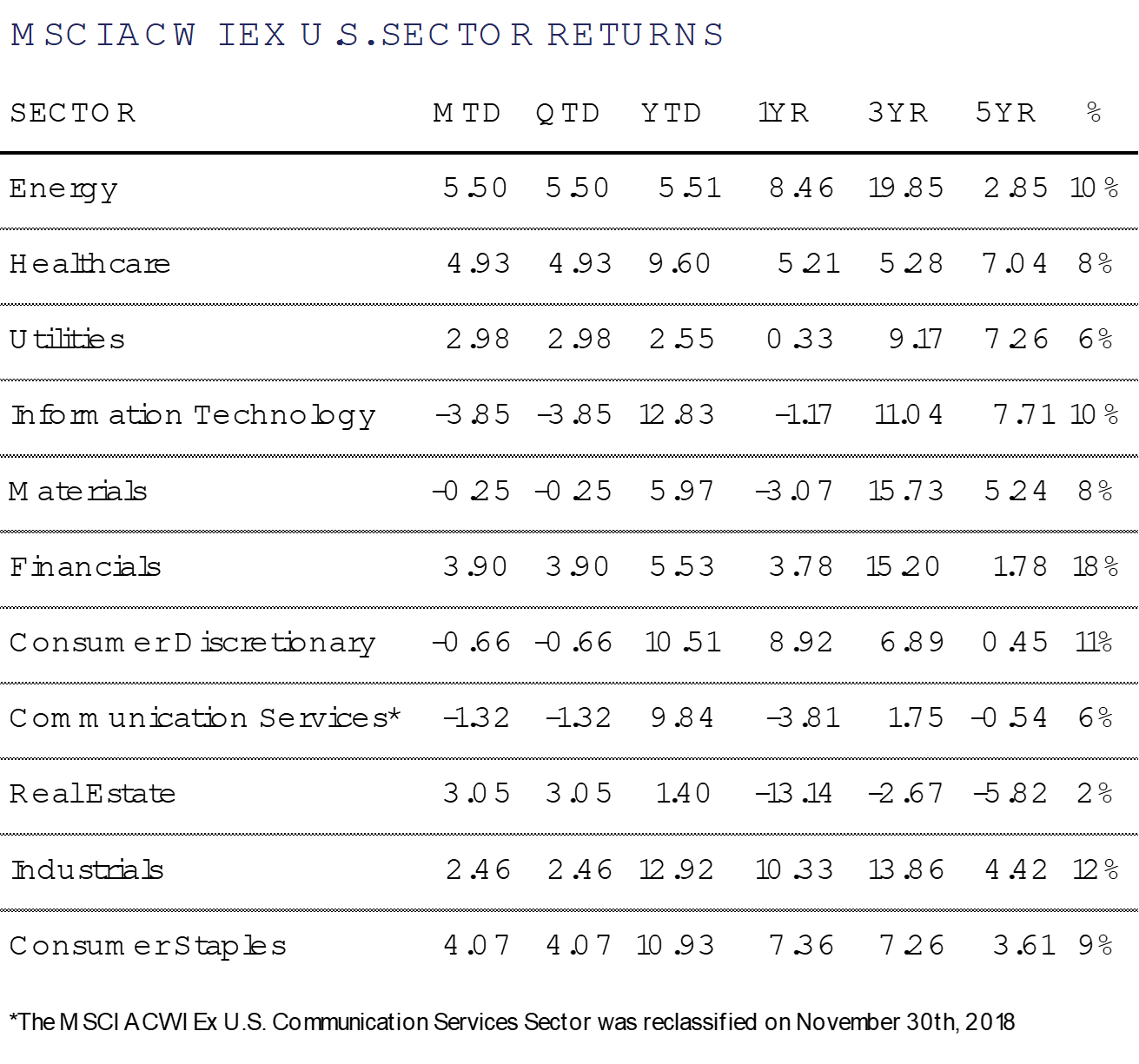

At the International sector level, Energy led the way (+5.5%), followed by Healthcare (+4.9%), Consumer Staples (+4.1%) and Financials (+3.9%). The laggards were Information Technology (-3.9%), Communication Services (-1.3%) and Consumer Discretionary (-0.6%).

Fixed Income

The month of April closed out with a bang. In the final week of the month, First Republic Bank stock, which had already declined significantly in 2023, experienced another leg down. As the week was coming to a close, there was rampant speculation about how the government should respond or intervene. Afterhours on Friday the 28th, word got out that the bank had been seized and bids were being solicited for the assets.

Even with this development, the Federal Reserve remains likely to raise the Federal Funds Rate on May 3rd at the conclusion of their two day meeting. Many are expecting this to be the final hike, to be followed by holding rates near current levels until inflation falls to more acceptable levels.

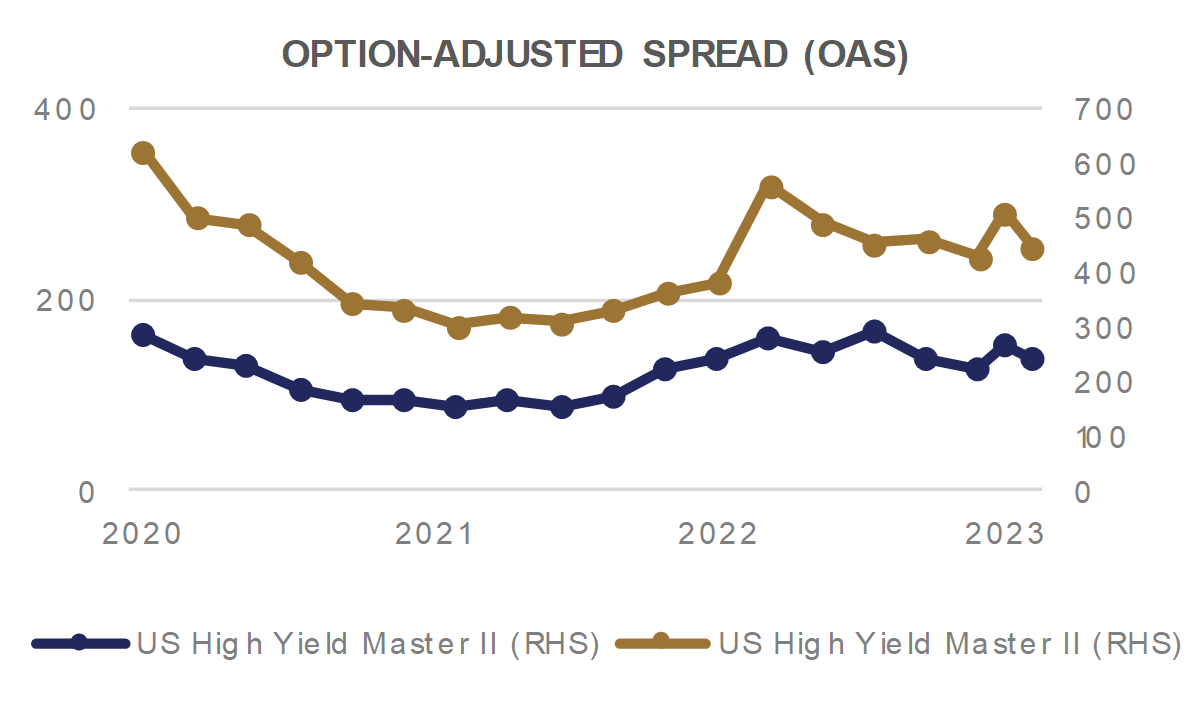

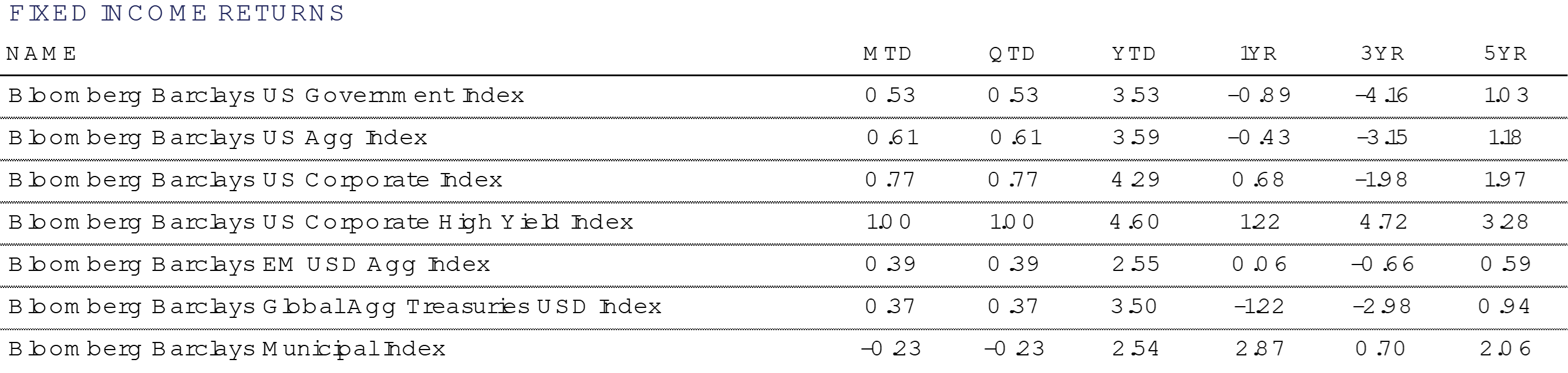

In April, riskier bonds were the top performers. This was driven by low volatility in the month. Interest rates were relatively stable across the curve, and credit spreads were practically stationary, neither adding nor subtracting from performance in the Investment Grade and High Yield bond markets.

Without any headwinds to negatively impact the returns of riskier bonds, Investment Grade Corporate and High Yield Corporate Bonds handily outperformed Government Bonds and The Aggregate Bond Index (which has a large allocation to Government Bonds).

Tax-free Municipal Bonds were easily the worst performer for the month, and the only index with a negative return in an otherwise placid market. Municipal bonds are also trailing YTD. Both of these results are unusual to see because Municipals have been a steady performer for an extended period of time. This very fact explains much of the lag we are now seeing. Tax-free Muni Bonds had become slightly overvalued when compared to Treasury Bonds. As Munis become more expensive, it is not unusual to see demand for these bonds recede until valuations fall enough to become compelling once again.

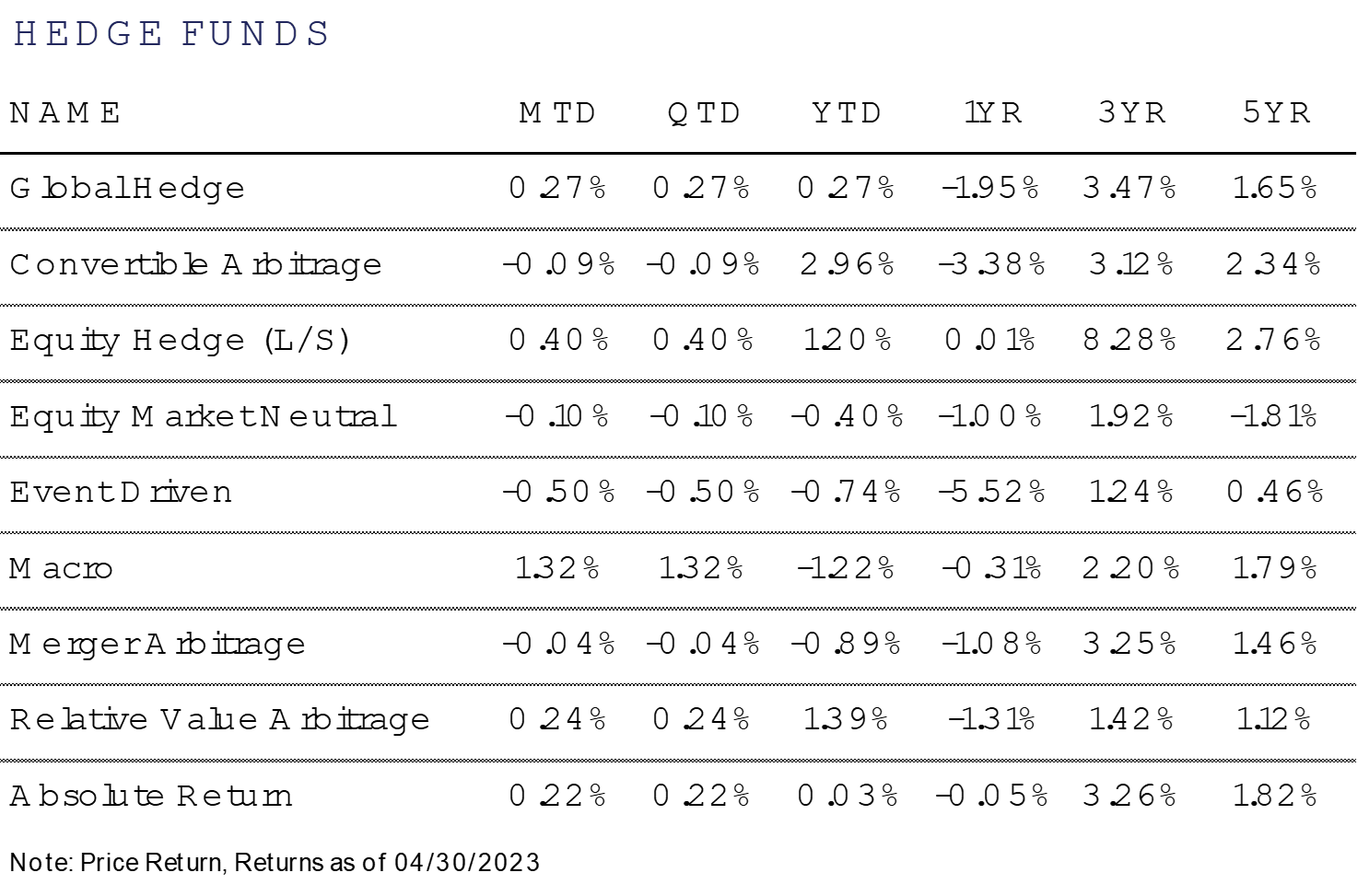

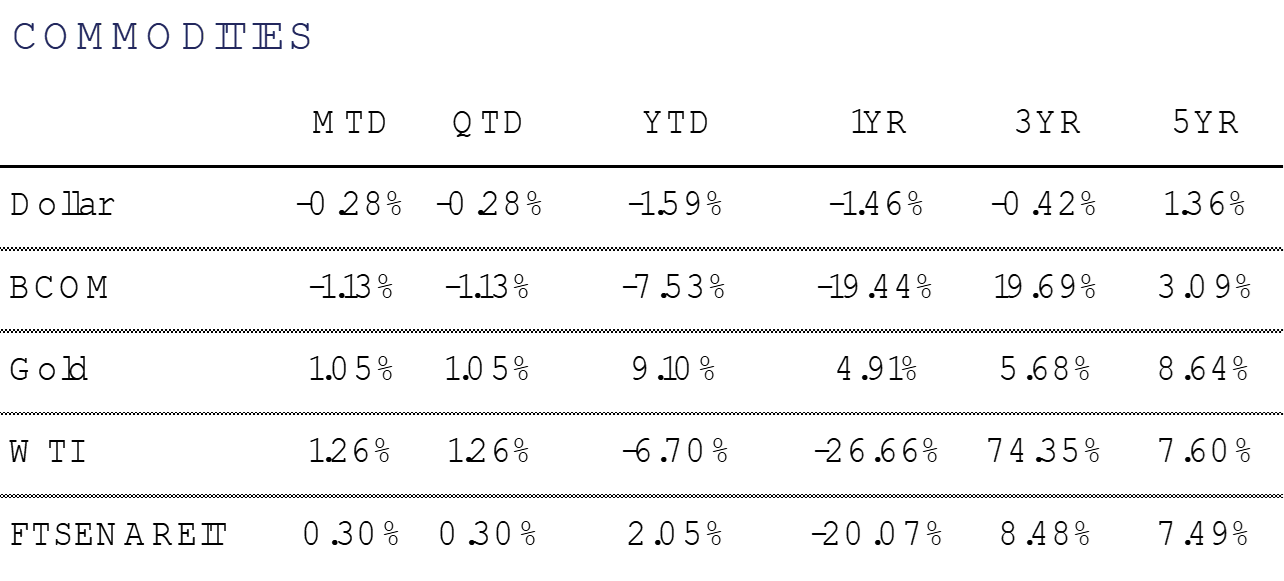

Alternative Investments

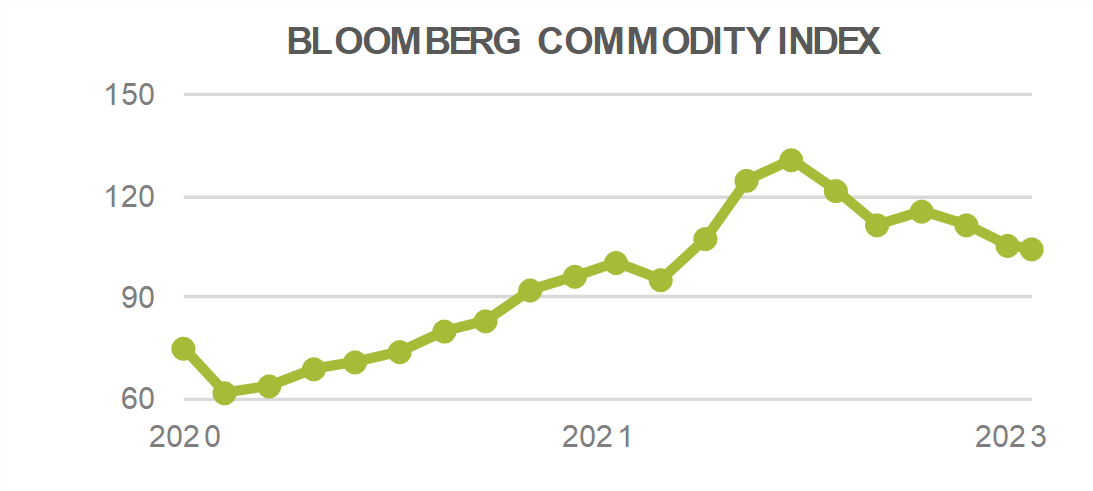

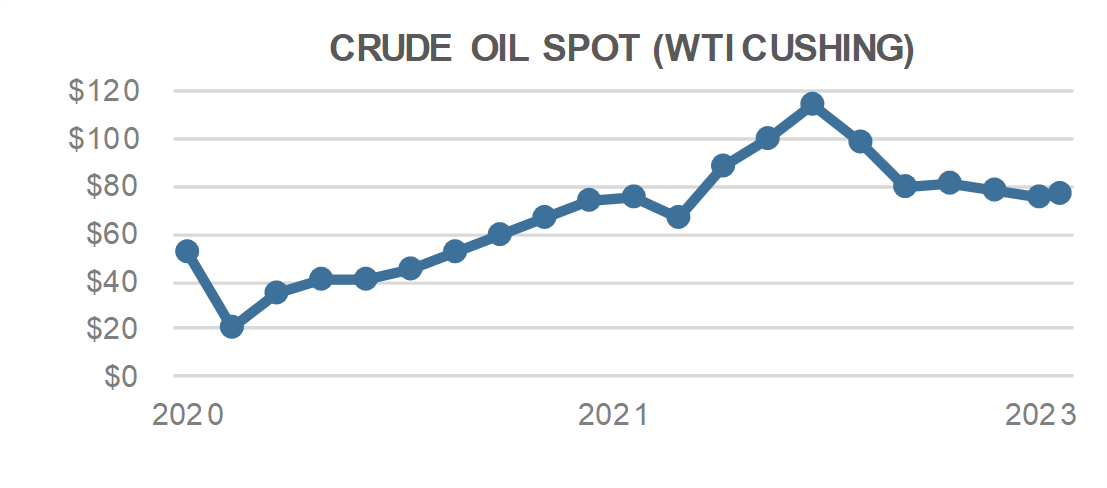

Alternative investments had mixed results for the month of April. Broad commodities, as measured by the Bloomberg Commodity Index, were down -1.1% for the month.

The near term outlook for commodities is muddied by uneven global economic data, especially in the U.S. and China. China had an unexpected contraction in its Manufacturing activity data (ie, China’s Purchasing Manager’s Index) in April after its Q1 GDP growth exceeded expectations. This may be a sign that China’s economy is struggling to regain momentum even as Chinese consumers have been splurging on travel and goods since COVID restrictions were lifted late last year. The contrasting data paints a cloudy picture for the largest importer of commodities and the 2nd largest economy in the world.

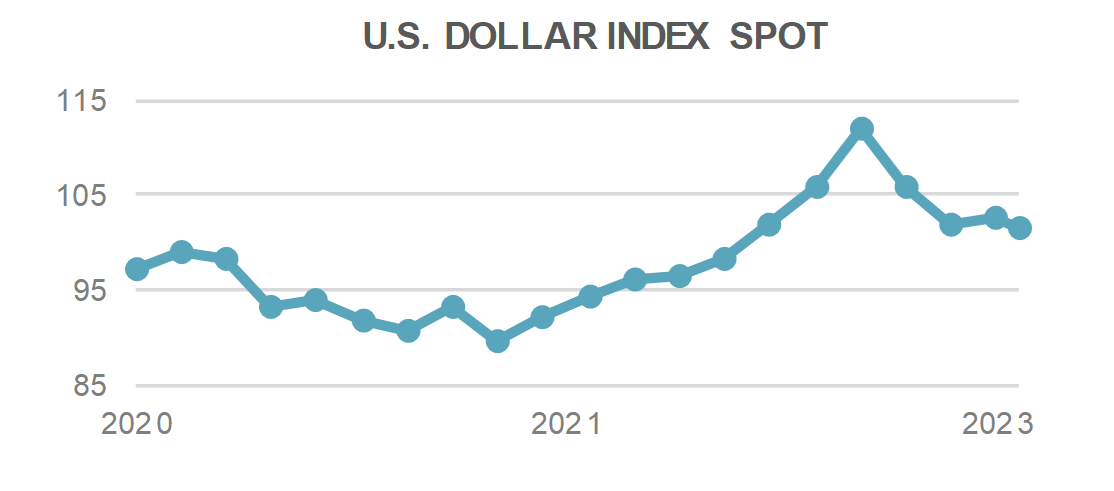

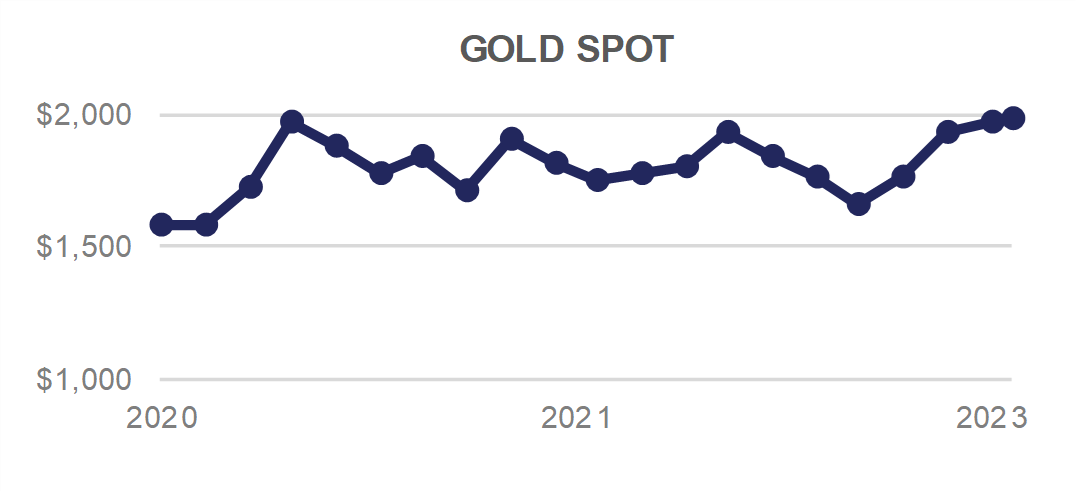

Gold continued to perform well after a very strong March and first quarter, rising +1.1% during April. Gold remains a valuable portfolio hedge given uneasy markets and the potential for a weaker U.S. Dollar. However, gold nearly hit all time highs intra-month and its ability to cross this level bears watching going forward.

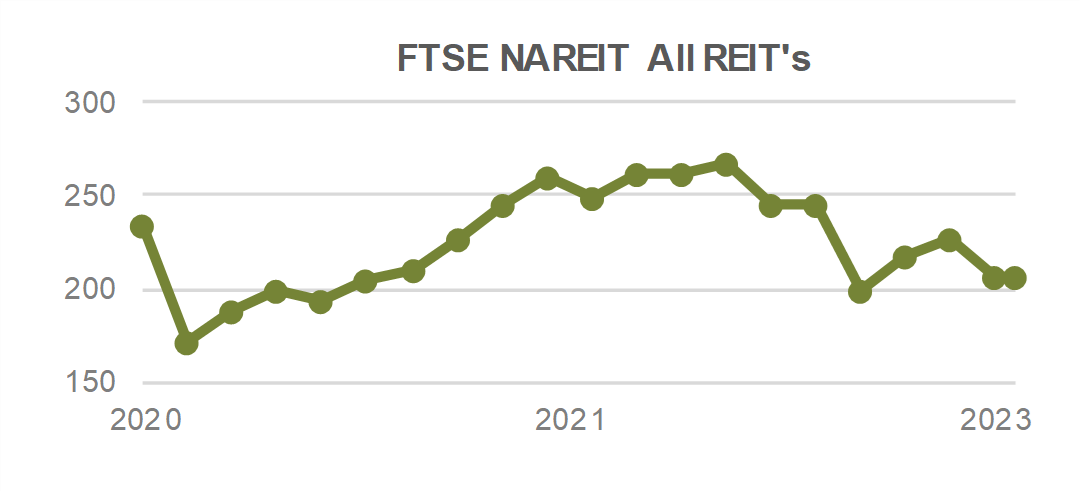

The recent turmoil in the U.S. banking system has brought a renewed focus on potential lending problems for banks with large exposures to Commercial Real Estate. Some market observers are worried about an incoming credit crunch given tighter borrowing conditions and high interest rates. It remains to be seen whether issues may be widespread or concentrated in certain real estate sectors such as Office Real Estate, where vacancies have risen given work from home trends.

For more news, information, and analysis, visit the ETF Strategist Channel.