The European Union Parliament approved several tightening reforms last month for the bloc’s carbon market that would bring emissions down more aggressively and create positive price momentum for the cap-and-trade’s carbon allowances. The KraneShares European Carbon Allowance ETF (KEUA) is a fund positioned to capture tightening allowances prices in the EU carbon market and there is an opportunity to gain exposure at attractive prices before tightening measures are finalized.

Under the new reforms awaiting final approval by the European Council, carbon allowances within the cap-and-trade program will be reduced by 4.4% annually beginning in 2028, an increase from 2.2% currently, explained Luke Oliver, managing director, head of climate investments and head of strategy at KraneShares, in a summary on the Climate Market Now blog. To account for allowances brought forward for auction this year to help fund energy recovery in the transition away from Russian fossil fuels, the number of allowances in 2024 and 2026 will fall.

A noteworthy change is the inclusion of the maritime industry in accountability for emissions within the EU. Shipping companies will need to cover 40% of emissions beginning next year and all emissions beginning in 2026 with EUAs. To account for the additional emissions, the cap will increase. Another major change will be the addition of a secondary emissions trading system (ETS) that oversees fossil fuel emissions from the transportation sector and domestic sector.

Investors welcomed the EU Parliament’s approval of a number of tightening measures for the cap-and-trade program, with the EU carbon allowance price rallying briefly before retreating. However, volatility and a challenged macro environment continues to influence most asset classes, even diversified ones such as carbon allowances.

Invest Now in the EU Carbon Market With KEUA

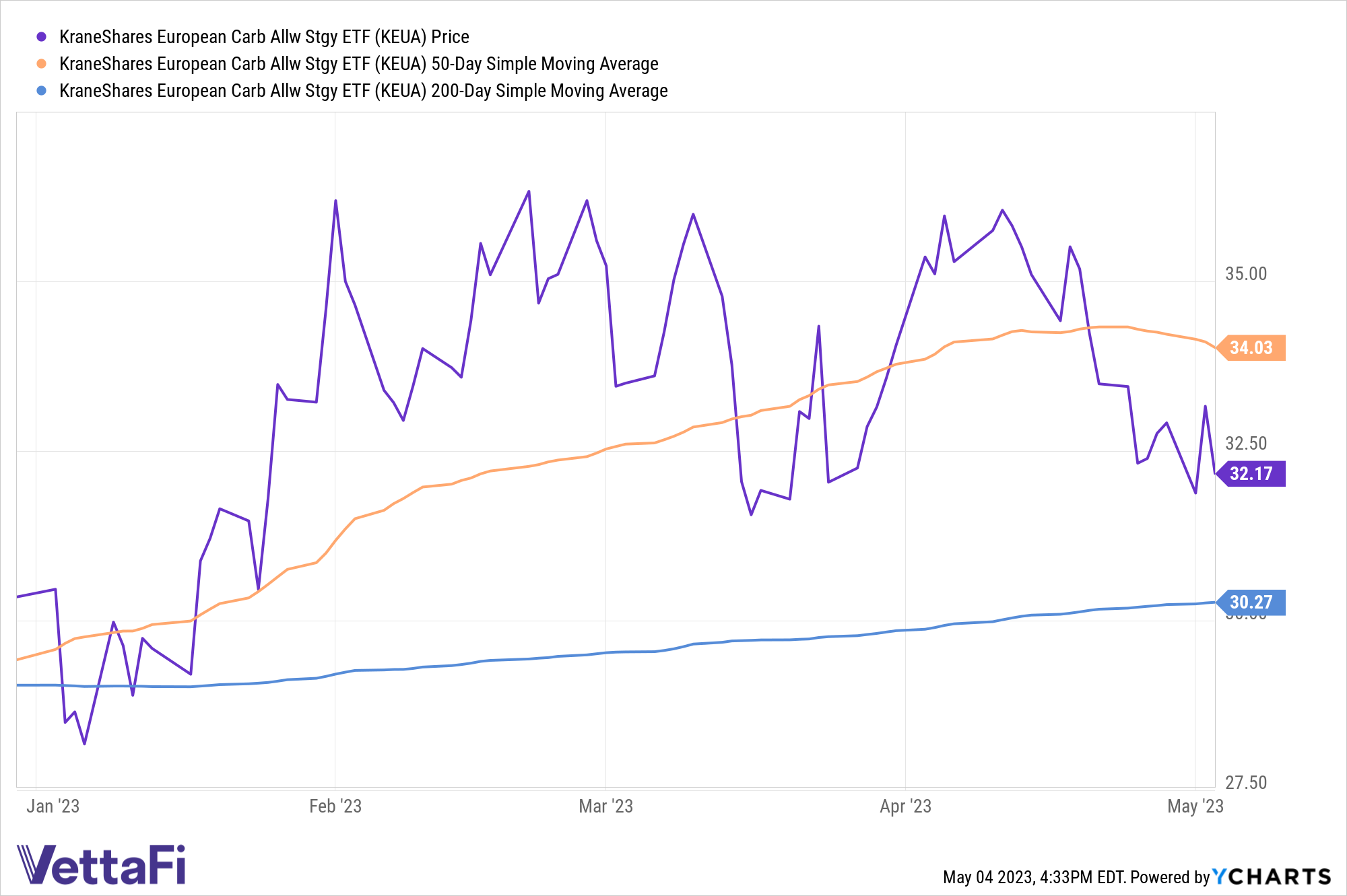

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed. KEUA has fallen below its 50-day simple moving average but has remained above its 200-day SMA for nearly four months.

YTD, KEUA has traded between its 50 day and 200 day moving averages.

The fund’s benchmark is the IHS Markit Carbon EUA Index. This benchmark tracks the most-traded EUA futures contracts, the oldest and most liquid carbon allowances market. Currently, the market covers roughly 40% of all EU emissions, including 27 member states and Norway, Iceland, and Liechtenstein.

The Fit for 55 plan launched in 2021. Its goal: reducing carbon emissions 55% or more by 2030 compared to 1990 levels, with net zero by 2050. This means reducing carbon allowances 4.2% per year compared to the previous 2.2%, tightening price pressures each year for participants.

KEUA has an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.