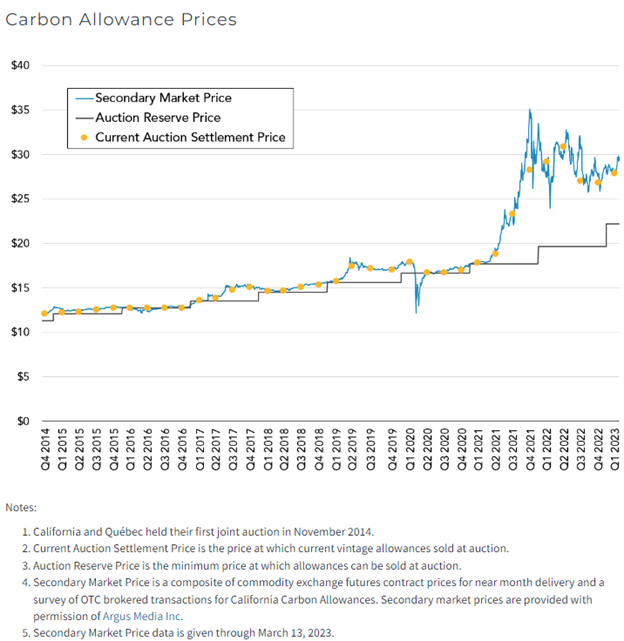

The cap-and-trade program in California continues to tighten and set aggressive emissions targets. This creates potential positive price pressures for carbon allowances, setting up opportunities for investors looking for ETFs flashing with strong buy signals.

Carbon allowances, the units cap-and-trade programs transact in, represent one metric ton of carbon dioxide emissions. Participants within these regulated markets, such as California, are allotted an amount of emissions each year. To cover that, the regulator issues carbon allowances on an annual basis. If the company exceeds those limits, they must buy additional allowances to cover, or pay a hefty fine. As the market tightens and allowance supply contracts, the cost to pollute rises.

California has proposed aggressive net-zero emissions goals to reduce emissions by 2045. At the same time, the state continues to tighten measures for many of its industries. In fact, the state just became the first in the U.S. to set emissions limits for trains. It has also set new goals to accelerate zero-emissions heavy-duty and medium-duty vehicles, and it will limit access to ports and railyards to only zero-emissions vehicles by 2035.

“This locomotive rule is going to have one of the biggest impacts I’d say out of any of California’s clean air regulations,” Yasmine Agelidis, senior associate attorney for the environmental nonprofit Earthjustice, told LA Times. “Locomotives have not been regulated by any entity at the state, federal or local level in the past 15 years, so railroads have been allowed to pollute recklessly.”

The state continues to tighten as it focuses to bring down emissions, and has proposed a number of tightening measures for its carbon allowances market that would create positive underlying price pressures for allowances.

See also: “Don’t Sleep on California’s Carbon Market and KCCA“

Image source: California Air Resources Board

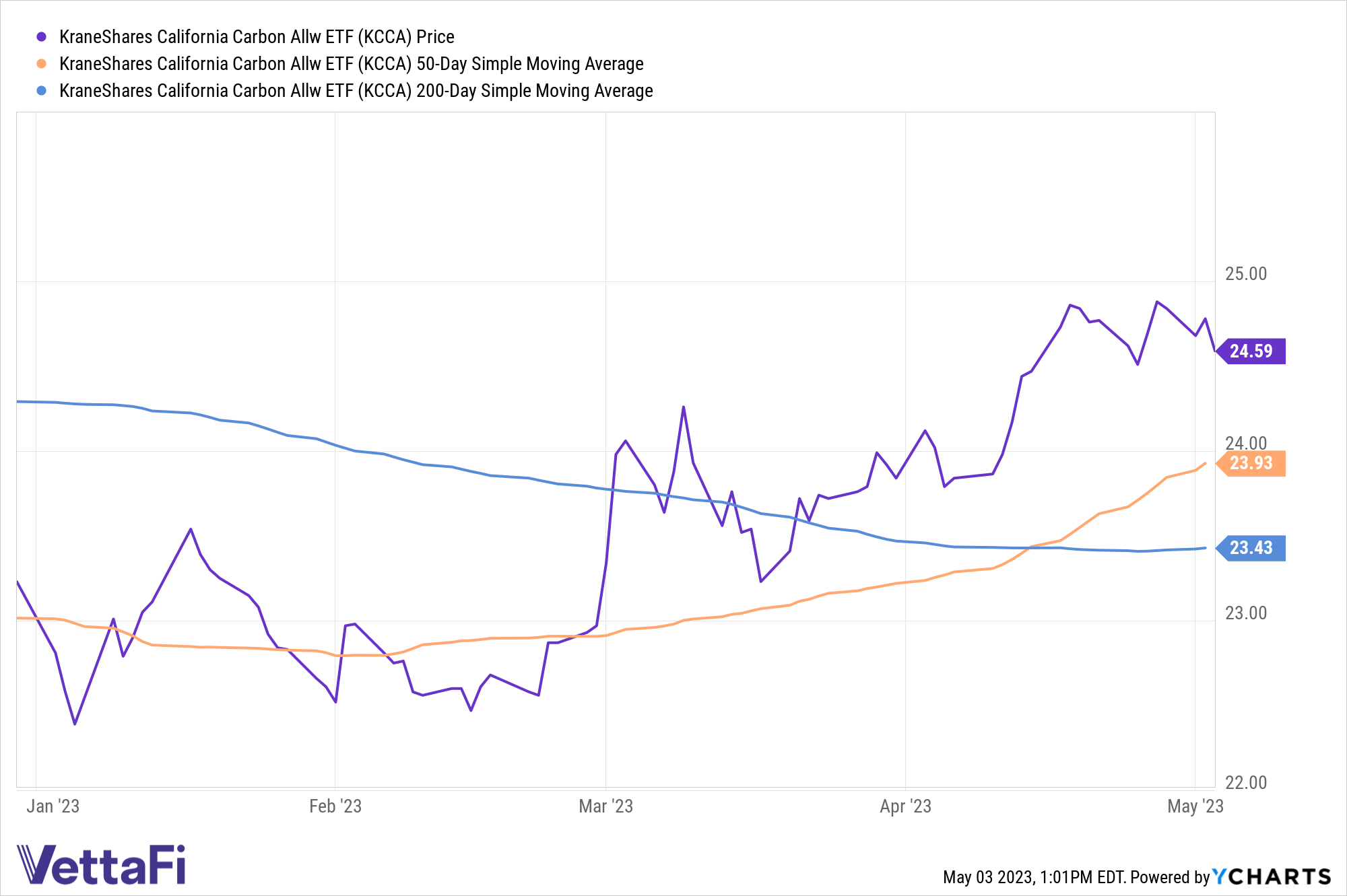

Investing in California Carbon Allowances with KCCA

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance markets and will benefit from California’s aggressive push to reduce emissions alongside the increasing demand for allowances within the market. Carbon allowance investing is worth consideration for the diversification benefits that they can bring portfolios as well as the strong long-term outlook.

KCCA is currently up 5.86% YTD and is above both its 50-day Simple Moving Average as well as its 200-day SMA, strong buy signals for trend followers.

KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs worldwide. Its benchmark is the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA and only includes futures with a maturity in December in the next year or two while using a wholly owned subsidiary in the Cayman Islands to prevent investors from needing a K-1 for tax purposes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.