Preliminary analysis revealed that EU carbon dioxide emissions covered under the carbon cap-and-trade program dropped in 2022 and will likely lead to carbon allowances tightening later this year. Recent trading activity resulted in a rally in EU allowances and investors looking to capture the opportunity in rising EUA prices this year should consider the KraneShares ETFs that offer exposure.

Emissions from EU Emissions Trading System participants dropped by 1.4% in 2022 according to ICIS analysis of 94% of stationary power plants, reported Luke Oliver, managing director, head of climate investments, and head of strategy at KraneShares, in the Carbon Market Now blog. While the full analysis isn’t complete, the drop surprised most analysts and investors who anticipated a moderate increase in emissions due to the energy crisis and heavier reliance on coal.

“If confirmed by final EU data, the decline in total emissions in 2022 would add to the overall surplus in the market and cause the Market Stability Reserve to remove a higher volume of permits from the market in September,” explained Oliver. That official count is pending and the limit for allowances in circulation will be announced in May. A reduction in market surplus would create a tightening in supply and positive price pressure for EUAs.

The decline follows an abnormally warm winter for the EU that prevented the bloc from having to rely too heavily on the winter fuel supply. High energy prices are believed to have kept many industrial companies from purchasing forward energy supply contracts last year and with energy prices leveling this year, that purchasing is likely to resume.

“A resumption of forward buying would lead to renewed demand to hedge fuel and carbon costs, which will likely sustain the market in Q1 and later,” Oliver wrote.

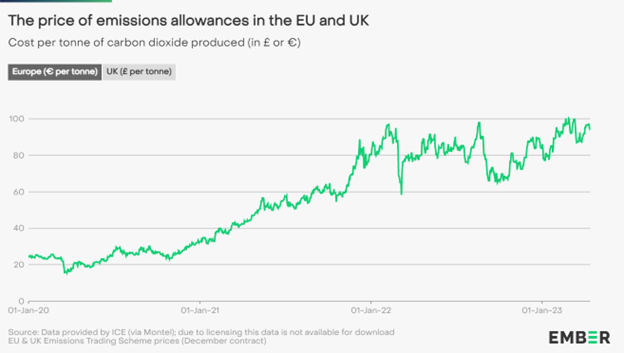

Despite the surprise to the downside for emissions, EUAs have recently rallied 14% to hit €97.44 after falling to €84.75 on March 20. Prices likely declined in March due to the liquidation in net long positions of 20 million EUAs by investors, which in turn triggered a buy signal for traders that analyze investor holdings for directional signals, Oliver explained.

Image source: Ember

EUA futures prices for December 2023 contracts are currently €92.91 as of 04/17/2023.

Investing in EU Carbon Allowances With KraneShares

The KraneShares European Carbon Allowance ETF (KEUA) offers targeted exposure to the EU carbon allowances market and is actively managed.

The fund’s benchmark is the IHS Markit Carbon EUA Index, an index that tracks the most-traded EUA futures contracts, a market that is the oldest and most liquid for carbon allowances. The market currently offers coverage for roughly 40% of all emissions from the EU, including 27 member states and Norway, Iceland, and Liechtenstein. KEUA has an expense ratio of 0.78%.

The KraneShares Global Carbon ETF (NYSE: KRBN) was the first of its kind to offer an investment take on carbon credits trading and provides exposure to major allowance markets worldwide. KRBN tracks the IHS Markit Global Carbon Index, which follows the most liquid carbon credit futures contracts in the world. This includes contracts from the European Union Allowances (EUA), California Carbon Allowances (CCA), Regional Greenhouse Gas Initiative (RGGI) markets, and the United Kingdom Allowances (UKA). KRBN has an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.