After back-to-back years of impressive net inflows into U.S.-listed ETFs, many thought that a $1 trillion industry cash haul was possible. However, only $80 billion of net new money flowed in during the first quarter of 2023. Even as the market climbed higher, U.S. equity-focused ETFs had net outflows. While some may think that ETFs are becoming less important, a recent report from iShares indicated otherwise.

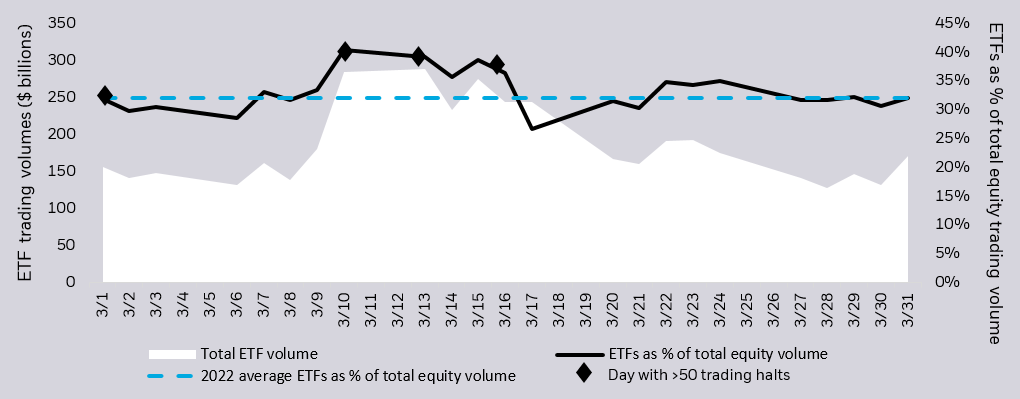

In “Global ETF Market Facts: three things to know from Q1 2023,” Samra Cohen, CIO of ETF and index investments at iShares wrote: “U.S. ETF trading volume as a percentage of total U.S. equity volume reached nearly 40% versus an average of 32% in 2022 when the CBOE Volatility Index (VIX), a common proxy for U.S. equity market volatility, spiked to higher levels in March.” As noted below, when many stocks incurred trading halts due to the banking crisis in mid-March, ETF volume reached some of its highest relative trading levels.

U.S. ETFs as a percentage of total equity trading volume during March 2023:

Source: iShares

Despite this volatility, trading in ETFs remained orderly. Data from iShares suggests that investors increasingly turned to ETFs to access markets, and most ETF trading activity took place in the secondary market with limited impact to underlying securities.

Indeed, the secondary-to-primary ratio for U.S.-listed ETFs was 9:1 in March, consistent with its three-year average, according to Cohen. This trading between buyers and sellers in real time prices does not result directly in new ETF share creation or funds being redeemed through the asset manager and is indicative of the tremendous value that ETFs provide to the market.

High trading volume results in tight bid-ask spreads, which is a cost savings for all investors. Cohen noted that the average spread for a U.S.-listed iShares ETF was 12.4 basis points in the first quarter of 2023, down slightly from 12.5 in the fourth quarter of 2022. Spreads for European- and Asia-Pacific-listed ETFs were higher compared to the U.S. in early 2022 but narrowed sharply from late 2022 levels.

While U.S.-listed U.S.-focused equity ETFs incurred modest net redemptions in the first quarter of 2023, U.S.-listed fixed income funds had net inflows of $52 billion, equal to 65% share of the industry’s cash haul, despite representing just 20% of the assets. “A new interest rate regime and disruptions in the global banking system provided some additional tailwinds for greater use of US Treasury ETFs,” according to Cohen. Global U.S. Treasury ETFs reached record volume in the first quarter of 2023, with $525 billion trading hands.

During the week of March 13, U.S. Treasury funds saw record weekly inflows of $11 billion, with iShares accounting for 60% of this flow. ETFs like the iShares 7-10 Year Treasury Bond ETF (IEF) and the iShares 0-3 Month Treasury Bond ETF (SGOV) were in high demand. Fixed income ETFs benefit from trading on exchanges like equities, which is supportive of enhanced liquidity and price discovery compared to trading a bond over the counter.

For more news, information, and analysis, visit VettaFi | ETF Trends.