While value- and yield-oriented factors continue to fall out of favor, investors are now turning to quality.

The Invesco S&P 500 Quality ETF (SPHQ) has seen a spike in flows year to date. SPHQ, which has $4.7 billion in assets under management, has seen the third greatest net flows year to date across Invesco’s lineup of ETFs, hauling in $794 million as of April 11. The fund has seen $295 million in net flows over a one-month period.

“Advisors are turning to higher quality investments given the earnings and market uncertainty,” Todd Rosenbluth, head of research at VettaFi, said. “Stocks inside SPHQ have relatively strong financial profiles that should help them grow in most environments.”

According to Rosenbluth, many investors turned to ETFs in the first quarter that invest in higher-quality companies with strong financial profiles such as low debt leverage, consistent earnings, and ample free cash flow generation.

Quality was the top-performing factor in February and the second top-performing factor, lagging only growth, in March across the S&P factor index family. SPHQ is up 8.3% year to date as of April 11, while the S&P 500 has climbed 7.5% during the same period.

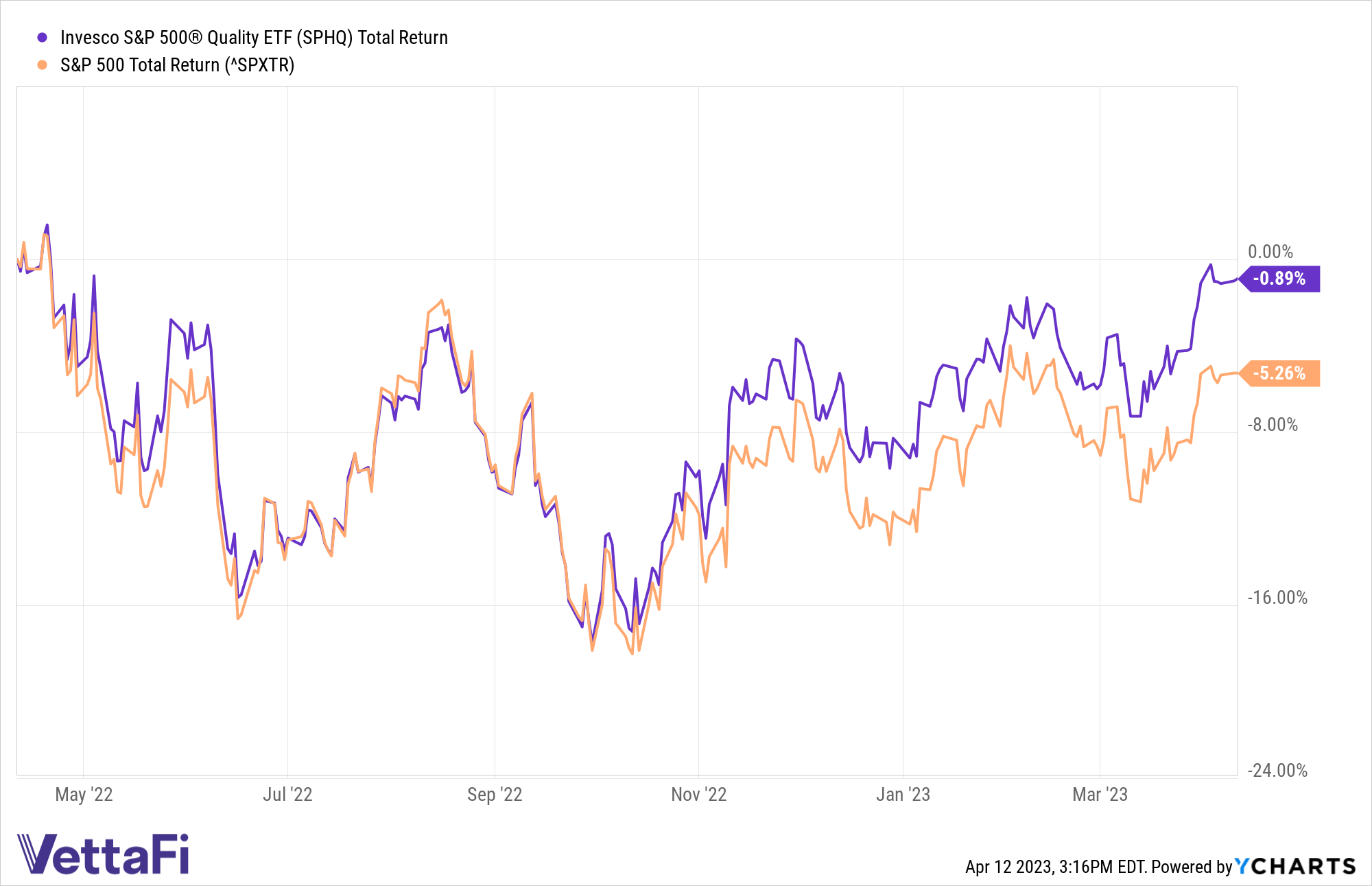

Over a one-year period, SPHQ is down just 0.9% and the S&P 500 is down 5.3%, according to YCharts.

SPHQ tracks the S&P 500 Quality Index, which includes 100 companies from the S&P 500 that have impressive quality scores, which are calculated based on three fundamental measures: return on equity, accruals ratio, and financial leverage ratio.

The sector tilts that quality introduces to a portfolio, as compared to the cap-weighted S&P 500, include overweighting IT, energy, and consumer staples, and underweighting financials, consumer discretionary, and communications, as of December 30.

SPHQ charges 15 basis points.

For more news, information, and analysis, visit the Innovative ETFs Channel.