By Natalia Gurushina

Chief Economist, Emerging Markets Fixed Income

China Geopolitical Goals

Headlines about the rising tensions between the U.S. and China continue to flood our Bloomberg screens – fanning debates about China’s long-term geopolitical aspirations and the renminbi’s possible (or is it likely?) ascendance as one of the world’s reserve currencies at the expense of the good old greenback. Many emerging markets (EM) are watching these developments with great interest – a possibility of playing China against the U.S. might look attractive going forward – but for now many seem content with the fact that their economies are arguably more correlated with China’s post-pandemic rebound than with the U.S. Federal Reserve’s rate cycle or developed markets (DM) banking mayhem. This explains why the next batch of China’s activity gauges will be closely watched this evening. The consensus is cautious – both the services and the manufacturing PMIs are expected to stay in expansion zone, but with no further improvement.

EM Inflation Risks

The pace of China’s rebound is an important driver for China’s inflation outlook (very benign right now) and China’s “exported” inflation – including a wider impact on global commodity prices, which can affect the disinflation momentum in EM. The latest communications from various EM central banks sounded hawkish (surprisingly so in some instances), with upside inflation risks being a top concern. And EM hawks continued to dominate the newsflow this morning. Brazil’s quarterly inflation report talked about the need to maintain restrictive policy stance for now, while the South African central bank surprised with a larger than expected +50bps rate hike, raising this year’s inflation forecast. The rate-setting meetings in Mexico and Colombia this afternoon now look even more interesting.

EM Market Performance

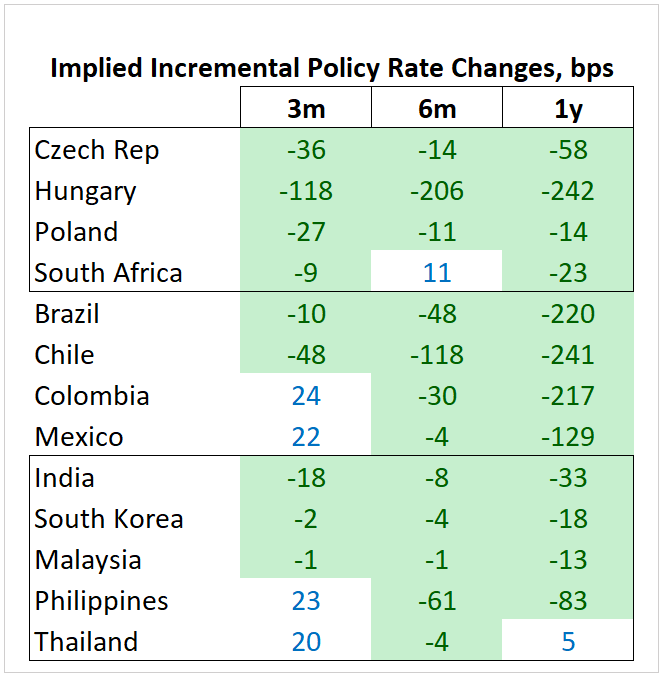

While this is happening, the market continues to price in EM rate cuts in the next six months. These expectations are on the optimistic side, but EMs’ “cautious for longer” policy bias can easily create more room for rate cuts in the fall and beyond. In the meantime, high real interest rates in EM can improve local bonds’ valuations and shelter EM currencies from market turmoil in DM. Stay tuned!

Chart at a Glance: Market Still Sees Rate Cuts in EM

Source: Bloomberg LP.

Originally published 30 March 2023.

For more news, information, and analysis, visit the ETF Strategist Channel.

The information presented does not involve the rendering of personalized investment, financial, legal, or tax advice. This is not an offer to buy or sell, or a solicitation of any offer to buy or sell any of the securities mentioned herein. Certain statements contained herein may constitute projections, forecasts and other forward looking statements, which do not reflect actual results. Certain information may be provided by third-party sources and, although believed to be reliable, it has not been independently verified and its accuracy or completeness cannot be guaranteed. Any opinions, projections, forecasts, and forward-looking statements presented herein are valid as the date of this communication and are subject to change. The information herein represents the opinion of the author(s), but not necessarily those of VanEck.

Investing in international markets carries risks such as currency fluctuation, regulatory risks, economic and political instability. Emerging markets involve heightened risks related to the same factors as well as increased volatility, lower trading volume, and less liquidity. Emerging markets can have greater custodial and operational risks, and less developed legal and accounting systems than developed markets.

All investing is subject to risk, including the possible loss of the money you invest. As with any investment strategy, there is no guarantee that investment objectives will be met and investors may lose money. Diversification does not ensure a profit or protect against a loss in a declining market. Past performance is no guarantee of future performance.