After more than a decade of very low Treasury rates and a positively sloped yield curve, investors have been accustomed to reaching further out on the risk spectrum and maturity curve for any reasonable level of yield. But with short-term government bonds now yielding 5% and an inverted Treasury curve, the opportunities for returns in fixed income are very different.

In the current economic environment, Elya Schwartzman, co-founder and CIO of BondBloxx Investment Management, said that investors need to relearn how to think about risk versus reward in fixed income.

“Treasuries are once again regarded as a ‘viable’ asset class, and shorter-duration emerging markets look very attractive from a risk/return point of view,” Schwartzman said.

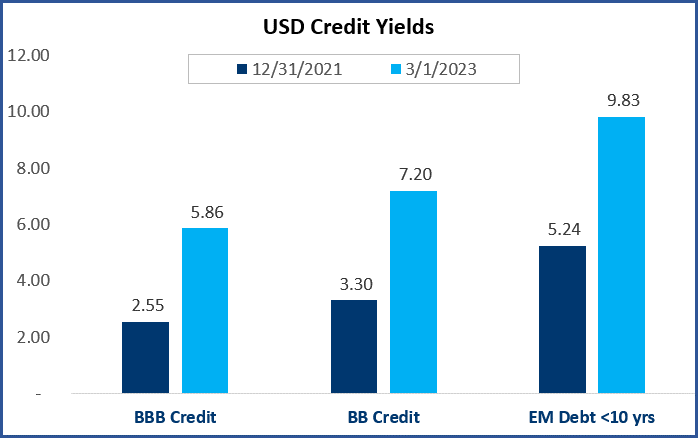

For example, it perhaps made sense to expect 2.5% in investment-grade fixed income when Treasuries were yielding 1% (or less). But when investors can get 5% with no credit and minimal interest rate risk or 5.8% for Treasuries or IG, it becomes a very different risk vs. reward equation, according to the BondBloxx co-founder.

In addition, there’s also an interesting premium for high yield and emerging markets debt, which is yielding 300 to 500 basis points over Treasuries with relatively low interest rate risk.

Source: BondBloxx Investment Management

With short-dated Treasury yields at 5% for the first time in 15 years, investors may want to consider one of the eight duration-specific U.S. Treasury ETFs that BondBloxx offers. The funds track a series of indexes developed by Bloomberg Index Services that include duration-constrained subsets of U.S. Treasury bonds with more than $300 billion outstanding. They track indexes that achieve target durations using U.S. Treasury securities, instead of specific maturities or maturity ranges.

“In today’s rapidly changing interest rate environment, key priorities for portfolio managers and investors are earning higher yields on strategic cash positions, precisely managing duration risk, and having effective collateral tools,” said BondBloxx client portfolio manager JoAnne Bianco. “BondBloxx Target Duration U.S. Treasury ETFs may help investors in all these areas, with the potential benefits of being lower cost, transparent, liquid and tax efficient.”

Meanwhile, the BondBloxx JP Morgan USD Emerging Markets 1-10 Year Bond ETF (XEMD) seeks to track the investment results of an index composed of short- to intermediate-term U.S. dollar-denominated, emerging market bonds by excluding bonds with maturities longer than 10 years.

“XEMD is designed to give fixed income investors the ability to better manage their duration exposure when investing in emerging markets debt,” Bianco said.

BondBloxx was launched in October of 2021 by ETF industry leaders to provide precision ETF exposure for fixed income investors. Since February 2022, the firm has launched 19 fixed income ETFs.

For more news, information, and analysis, visit the Institutional Income Strategies Channel.