The investment case for carbon allowances continues to grow as more countries and regulatory bodies enact policies to provide support for emissions trading systems. Understanding how one carbon allowance market works will allow advisors to better understand the roles they will play in the years to come, and the investment opportunity that exists now.

In the transition to net-zero emissions by 2050, allowance markets will play a critical role. While there is strong potential for investors now and looking ahead, advisors still largely remain in the dark about how the regulatory markets work. The easiest way to understand these markets is to take a look at the creation of one such market, California’s cap-and-trade program.

The California cap-and-trade allowances program is the largest emissions trading system in the U.S., the fourth largest in the world, and was launched in 2013. It has since subsequently linked its program with Quebec’s in 2014 into one joint system and is overseen by the California Air Resources Board (CARB) which creates carbon allowances annually equal to the number of carbon emissions allotted each year.

Carbon Allowance Market Mechanisms Explained

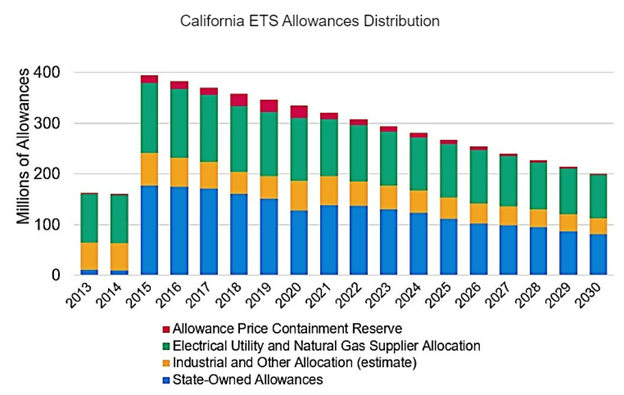

One carbon allowance equates to one metric ton of CO2 (or equivalent emissions) and the cap-and-trade program tightens over time, creating fewer allowances each year and driving up costs, and putting pressure on participants to reduce, mitigate, or eliminate their emissions. Carbon allowances are not inherently reducing emissions as a stand-alone unit — unlike carbon offsets that represent verified emissions removal projects — but when used within a tightening, regulatory framework they are strong drivers of change.

California’s program currently covers roughly 85% of all greenhouse gas emissions in the state, with over 450 entities participating. Every entity is allotted a certain number of free allowances each year, depending on their industry, and at the end of the year allowances must be surrendered to account for that year’s emissions.

Image source: Carbon Credits

Companies that come up short are forced to buy more allowances to account for their overages that are sold at auctions, though these auctioned allowances have a rising, predetermined floor price over time as well. California runs auctions quarterly with a set number of allowances set aside for each auction.

California also has a built-in mechanism, as do all cap-and-trade programs, to mitigate volatility by holding back a set amount of allowances called the cost-containment reserves that it can introduce should prices begin to spike precipitously. Carbon market participants as well as voluntary market participants (those that create, sell, or buy carbon offsets) are allowed to participate in auctions.

Proceeds from California’s allowance auctions all go to the Greenhouse Gas Reduction Fund (valued at nearly $20 billion as of June 2022) which the state then uses to fund emissions reduction projects.

Investing in California’s Cap-and-Trade Program With KCCA

The KraneShares California Carbon Allowance ETF (KCCA) offers targeted exposure to the joint California and Quebec carbon allowance markets and will benefit from California’s aggressive push to reduce emissions as rapidly as possible.

KCCA is a fund that offers exposure to the California cap-and-trade carbon allowance program, one of the fastest-growing carbon allowance programs worldwide, and is benchmarked to the IHS Markit Carbon CCA Index. The CCA includes up to 15% of the cap-and-trade credits from Quebec’s market.

The index measures a portfolio of futures contracts on carbon credits issued by the CCA and only includes futures with a maturity in December in the next year or two while using a wholly-owned subsidiary in the Cayman Islands to prevent investors from needing a K-1 for tax purposes.

KCCA carries an expense ratio of 0.78%.

For more news, information, and analysis, visit the Climate Insights Channel.