Markets continue to rise and fall on inflation hopes and fears, but the resounding message emerging is one of recession. For advisors and investors looking to hedge in cash alternatives, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is currently above technical indicators and worth consideration.

The World Bank recently issued its Global Economic Prospects report for January 2023 where it revised it’s previous 3.0% forecast for global growth made just six months ago down to 1.7% currently. Furthermore, it anticipates that GDP for emerging markets and developing economies will be 6% lower by the end of 2024 than what was originally forecast pre-pandemic.

“Global growth is projected to decelerate sharply this year, to its third weakest pace in nearly three decades, overshadowed only by the 2009 and 2020 global recessions. This reflects synchronous policy tightening aimed at containing very high inflation, worsening financial conditions, and continued disruptions from the Russian Federation’s invasion of Ukraine,” according to the World Bank.

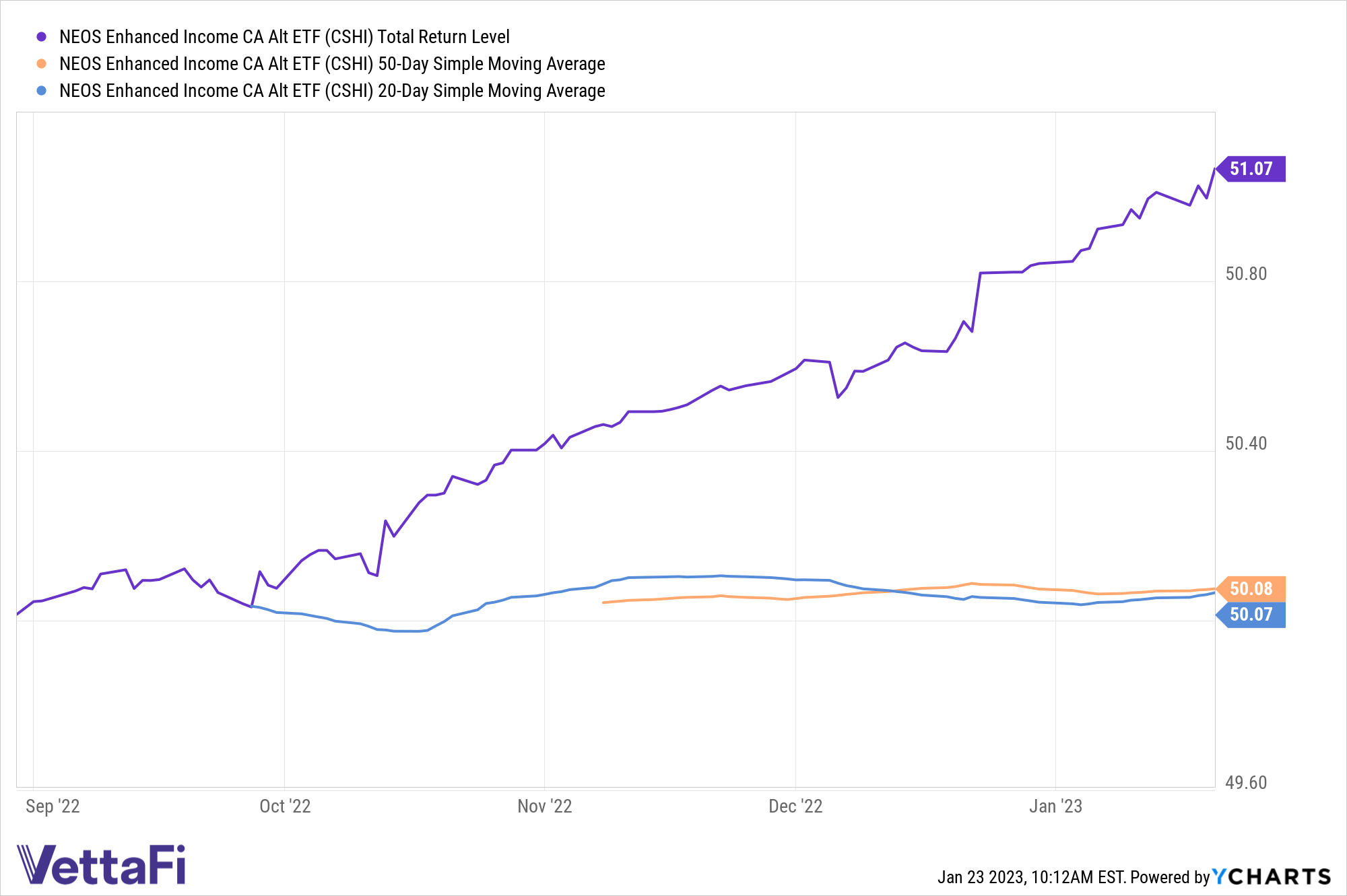

For advisors and investors considering a cash alternative strategy given economic slowing and recession risk, the NEOS Enhanced Income Cash Alternative ETF (CSHI) is well above technical indicators, a strong buy signal for trend followers. The ETF is currently above both it’s 20-day Simple Moving Average as well as its 50-day SMA and has trended upwards since October 2022.

CSHI was launched at the end of August last year and has thus far proven to be a strong contender within the cash alternative arena. It’s an options-based fund that is long 3-month Treasuries and also sells out-of-the-money SPX Index put spreads that roll weekly to account for market changes and volatility. It seeks to deliver 100-150 basis points above what 90-day Treasuries are yielding while also taking advantage of tax loss harvesting opportunities and the tax efficiency of index options.

The put options that the fund uses are S&P 500 index options that are taxed favorably as Section 1256 Contracts under IRS rules. This means that the options held at the end of the year are treated as if they had been sold on the last market day of the year at fair market value, and, most importantly, any capital gains or losses are taxed as 60% long-term and 40% short-term no matter how long the options were held. This can offer noteworthy tax advantages, and the fund’s managers also may engage in tax-loss harvesting opportunities throughout the year on the put options.

CSHI currently has a distribution yield of 5.06% as of 12/30/2022 and an expense ratio of 0.38%.

For more news, information, and analysis, visit the Tax-Efficient Income Channel.