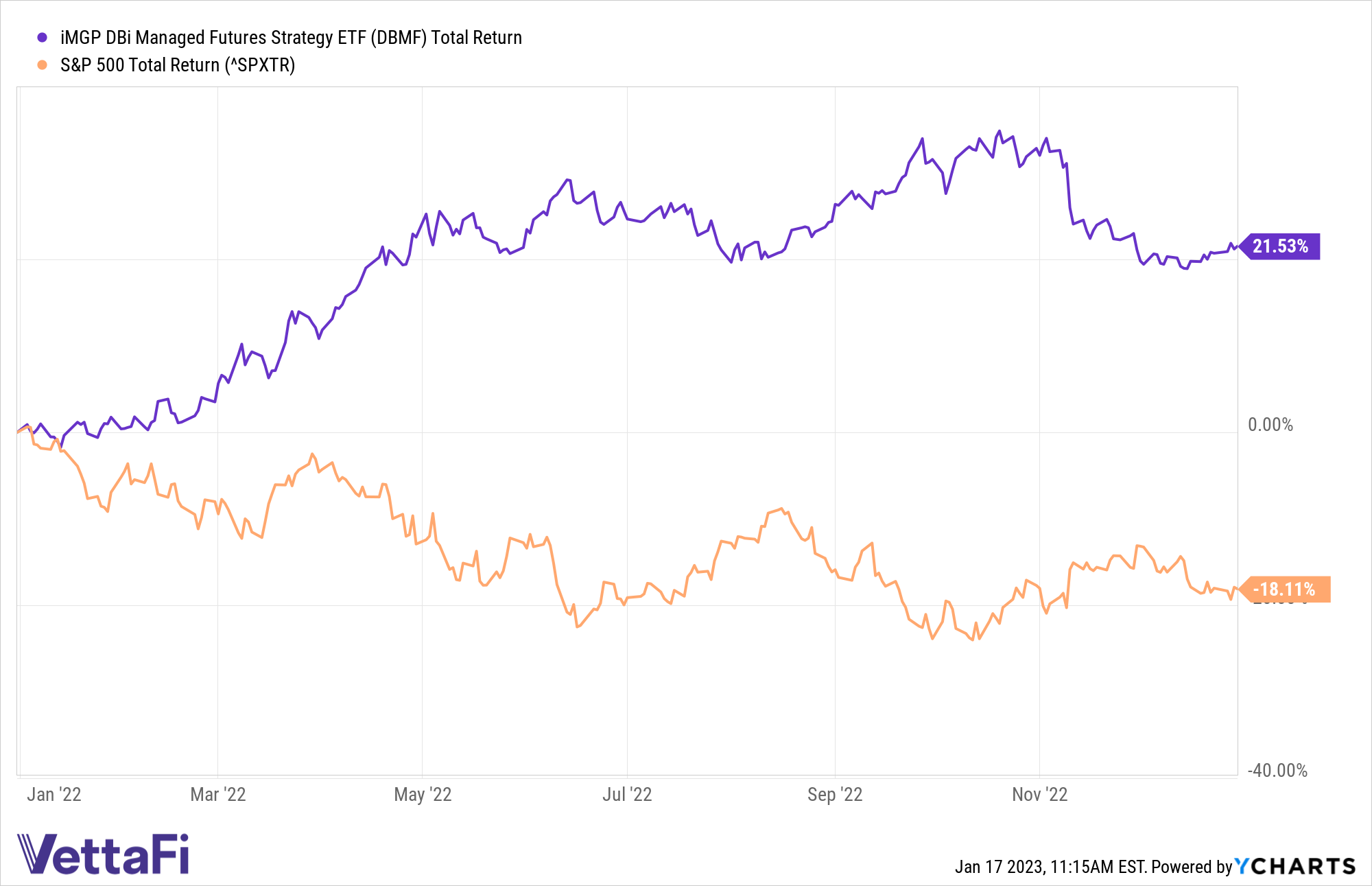

Managed futures proved their mettle in 2022 as one of the few strategies to offer positive performance in a challenged year for equities and bonds. The co-portfolio managers of iMGP DBi Managed Futures Strategy ETF (DBMF), one of the top-performing managed futures ETFs of 2022, recently discussed the fund’s performance last year and what they are anticipating as 2023 unfolds.

The ability of managed futures to short asset classes via the futures market meant that funds such as DBMF were able to capture the underperformance of equities, treasuries, and more for much of 2022.

“The old inflation playbook – buy gold, TIPS, and real estate – simply did not work this time around. Instead, the ‘new’ inflation trade was to short the yen and Treasuries – something out of the reach of most investors,” explained Mathias Mamou-Mani, co-portfolio manager of DBMF and managing member of Dynamic Beta investments, in a communication to VettaFi.

DBMF ended the year up 0.4% in December while the S&P 500 was down 5.8%. For the entirety of 2022, DBMF had a total return of 21.5% compared to the S&P’s -18.11% total return. It was one of the top-performing funds of the year and an all-star for alternatives, bringing in $1 billion in flows in 2022.

“The inflation trade was contrarian for eighteen months. Managed futures funds rode the wave until it started a sharp reversal in November,” explained Mamou-Mani of the fund’s performance last year.

Predictions for 2023

We’re just half a month into 2023 and already market volatility and uncertainty have proven to be a persistent carry-over from last year. Looking ahead to the rest of the year, Andrew Beer, co-portfolio manager of DBMF and managing member of Dynamic Beta investments, hedges against overly optimistic market outlooks.

“The consensus view today is that this will be easy: inflation will gently fall, the economy will slow but not crash, and the Fed will resurrect the put. Just a reminder that the consensus view has been wrong – really, really wrong – for most of the past two years,” Beer cautioned.

Markets have fluctuated strongly in the first few weeks of the year, driven downwards on news and data of a persistently resilient jobs market and fear of Fed response and then upwards on inflation falling 0.1% month-over-month and hopes that the Fed will ease. For now, concerns around Fed policy remain a primary source of uncertainty in the short term. As to how managed futures and DBMF are positioned, Beer and Mamou-Mani are decidedly more optimistic.

“With the recent market volatility, managed futures funds are hunting for the next big moves, whether up or down. No trend looks obvious in the beginning,” explained Mamou-Mani.

“Ten years of monetary easing and fiscal profligacy won’t be cured in a year. Mistakes will be made, things will break, the impossible will keep happening – and managed futures will be there, waiting for the next big trade,” said Beer.

Positioning for Uncertainty With DBMF

The iMGP DBi Managed Futures Strategy ETF (DBMF) allows for the diversification of portfolios across asset classes uncorrelated to traditional equities or bonds. It is an actively managed fund that uses long and short positions within the futures market on several asset classes; domestic equities, fixed income, currencies, and commodities (via its Cayman Islands subsidiary).

The fund’s position within domestically managed futures and forward contracts is determined by the Dynamic Beta Engine, which analyzes the trailing 60-day performance of CTA hedge funds and then determines a portfolio of liquid contracts that would mimic the hedge funds’ averaged performance (not the positions).

“I urge to not try to time managed futures: most people who did this missed a decade of alpha in eighteen months. Managed futures should be a core, strategic allocation in all diversified portfolios,” explained Beer.

DBMF has management fees of 0.85%.

For more news, information, and analysis, visit the Managed Futures Channel.